How to Collect Hundreds in Income From LowYield Stocks

Post on: 3 Январь, 2017 No Comment

By Amber Hestla on November 6, 2013

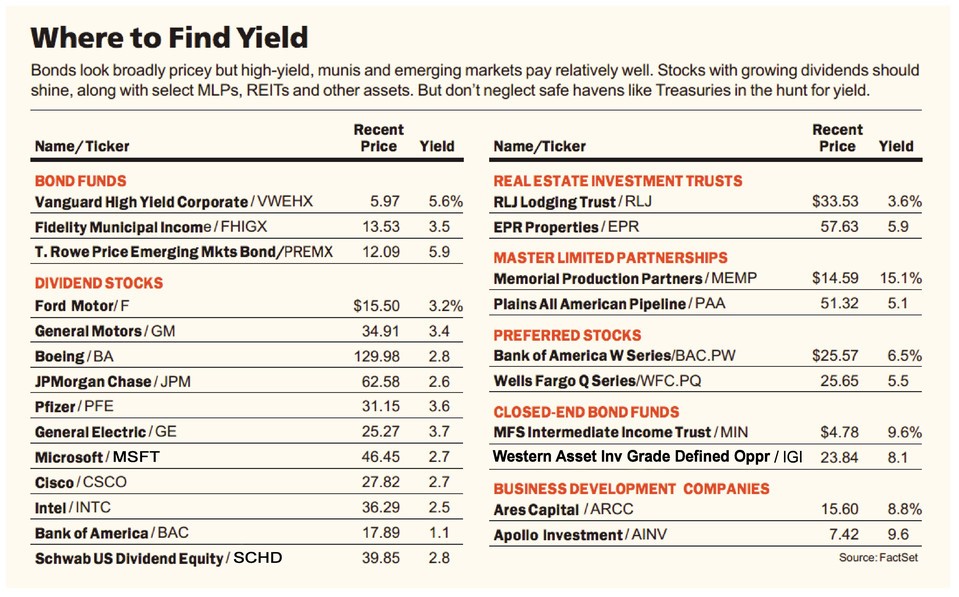

Income investors often set a minimum dividend yield as a requirement for their buy decisions. That eliminates a number of stocks from consideration. This requirement could also increase market risk since it tends to limit investments to just a few sectors.

A diversified portfolio should hold more than large drug companies and big-name tech stocks that are no longer growing rapidly but are paying large dividends. Covered calls can increase the number of stocks income investors can select from and help them diversify their portfolio without sacrificing income.

A covered call strategy involves selling call options on a stock you own. Selling calls generates instant income known as a premium .

A covered call allows you to participate in the upside of the stock, while the income will help offset any downside. This is an excellent strategy for income investors to consider, and I want to use an example of a trade I like right now to illustrate the amount of income that is possible.

Arkansas Best (NASDAQ: ABFS ) is a trucking company that has been around since 1935. It operates approximately 3,700 tractors and 20,000 trailers in long-haul and local pickup delivery operations. ABFS also provides logistics support to its customers, using its IT systems to help companies manage inventory and schedule deliveries and pickups. Additionally, it leverages its internal processes and infrastructure to provide emergency roadside assistance to other trucking companies.

Revenue grew 25% last year and increased 45% in the first quarter of 2013. For the full year, analysts expect 9.4% revenue growth.

The company is stable but has been unprofitable for several years. Analysts expect a return to profitability this year with earnings per share (EPS) of $0.21 and a significant jump in profits to $1.70 a share in 2014. If they are right, now would be an ideal time to invest in ABFS.

Income investors, however, might not like the low dividend of $0.12 a year, a yield of just 0.4%. But the company has demonstrated its commitment to rewarding shareholders by paying a dividend every year since 1992. As profits grow, it is reasonable to believe that ABFS is likely to increase its dividend.

While waiting for this to happen, investors can use covered calls to generate more income. To do this, you will need to buy at least 100 shares of the stock, because each call contract covers 100 shares. With ABFS trading at about $26.50 at the time of this writing, 100 shares will cost about $2,650.

A call option with a strike price of $29 expiring in December is trading at about $1.05. Selling one call generates instant income of $105 since each contract covers 100 shares.

When the call expires in December, if ABFS is below $29 you will keep the shares and the income from the options sale. You could then sell another call option as long as you continue to own the stock. Selling a call for $100 in income every two months would generate annual income of $600 a year on a $2,650 investment for a 22.6% yield. This dwarfs the dividend that would be collected on the stock.

If ABFS is trading above $29 when the option expires, you will have to sell the stock at $29. The call income would add to your total gain and you would make $355 on 100 shares in this example (a $250 gain on the stock plus $105 in income from the call). This would be a return of 13.4% in less than two months. You would then have $3,005 to invest in another trade.

Covered calls can create high-yielding income opportunities on many stocks, even those without dividends. This strategy is a low-risk way for investors to increase their income.

Note: My Income Trader subscribers have been earning an average return of 8.6% every 48 days by selling options. To learn more and to see my track record, follow this link .