Recessionproofing retirement

Post on: 16 Март, 2017 No Comment

(Linda Stern is a freelance writer. Any opinions in the column are solely those of Ms. Stern. You can e-mail her at lindastern@aol.com.)

By Linda Stern

WASHINGTON (Reuters) — There are about four billion retirement calculators out there, and they all agree on one thing: It’s bad when you have to retire into a recession. Folks who start out their non-working years by losing money in the market can fall irretrievably behind.

If the date comes around and you’re in a bear market, and you were planning to retire, just don’t retire, says T. Rowe Price’s Christine Fahlund. Hold on until you come out of it.

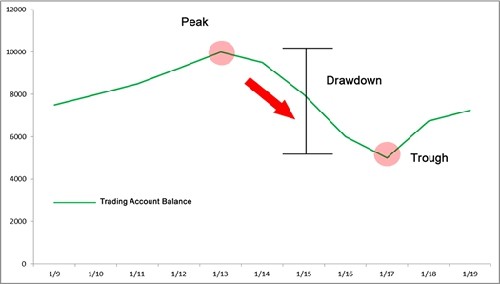

Her strict advice is based on a new study from her company, which found that the first five years of retirement are critical: Starting to make those retirement withdrawals from an IRA or 401(k) at a time when the balances are falling anyway can be devastating.

Poor market performance or outright losses in the first five years significantly increase the chances of a retired person outliving his money during a 30-year retirement, the study said.

Retiring into a rising market would give a typical T. Rowe Price planning customer an 89 percent chance of getting 30 years of rising retirement income. But if the first five years of a retirement were marked with an average annual decline of portfolio value of just 1 percent or less, it would cut the retiree’s chances of having the money last to 51 percent.

That’s not very reassuring to anyone who may have hung up their spurs at the end of 2007. Since then the stock market has dropped by about 9 percent. And it’s not much consolation either for anyone who is being forced into retirement by the current economic downturn.

But there are ways to recover.

The T. Rowe Price analysis, and much of the company’s retirement advice, is based on the idea that retirees will take 4 percent of their account’s value in withdrawals during their first year of retirement and then increase their withdrawals by 3 percent a year to cover the rising cost of retirement living. That’s a fairly conservative formula. It aims to give retirees 30 years of rising income and doesn’t count on any other financial relief, like income from selling a home or decreased spending in later years of retirement.

That gives you some room to maneuver, and there are strategies that can help. Here are some effective ways — and one very ineffective one — for new retirees to deal with the market drop.

— Don’t panic. It’s rare for the market to lose money over 5-year periods, and it’s rarer still for retirees to have all of their money in stocks. If you have a balanced portfolio now, it’s unlikely that your portfolio will lose 1 percent or more a year over the next five years.

— Cut your withdrawals. If you’re already taking 4 percent a year from your retirement account, and it’s fallen 9 percent or more since January 1, see if you can’t cut your withdrawals. You might be able to tighten the belt for just a few months, or take on a part-time job or freelance assignment.

— Don’t take the inflation adjustment until you absolutely, positively must. T. Rowe Price tells clients to increase their withdrawals by 3 percent a year to cover inflation. But if you can get by next year on the same dollar amounts as you’re getting this year, do that. You might even be able to hang on for three or four years before you have to give yourself a cost-of-living increase, says Fahlund.

— Keep balancing your portfolio. If your stocks have tanked and your cash account is stable, it’s likely your portfolio isn’t in the same proportions you intended it to be. Take more money out of your accounts that have done well and less out of your accounts that have fallen in value. Don’t do this beyond the point of rebalancing back to your intended mix, says Fahlund.

— Don’t sell all of your stocks and put the money into bonds. That was the retirement plan embraced by a previous generation, but money doesn’t grow for 20 or 30 years if it is invested only in bonds. According to the T. Rowe Price analysis, this was the worst scenario: An investor who switched to a 100 percent bond portfolio on January 1, 2003 (after the bear market which ended in September 2002) had just a 5 percent chance of succeeding with 30 years of withdrawals.

— Make little changes, not big ones. If you’ve just retired, chances are you’ve already got some idea of what you’ll live on going forward. If you feel like you’re running out of money too fast, make adjustments around the edges, but don’t dramatically alter your plan. Time and time again, the market rewards those who stick with their investment plans and avoid the urge to take drastic action.