Frontier Markets The New Emerging Emerging Market

Post on: 15 Март, 2017 No Comment

F rontier markets and the mutual funds and ETFs that invest in them are quickly becoming a separate and distinct asset class from emerging markets. If youve never heard of frontier markets, youre not alone. Theyve only recently become the hot new investment. The WSJ described them as next years darlings in emerging-market investing. Recent developments suggest that at a minimum, frontier markets are worth keeping an eye on. Ill briefly describe what frontier markets are, some recent developments in the creation of indexes to track frontier markets, and how you can invest in this risky asset class.

What are frontier markets?

Frontier markets describe the smallest, less developed, less liquid countries that make up emerging markets. As the WSJ described them, frontier markets are generally understood to be the less liquid, small emerging emerging markets. Examples of frontier markets include Bulgaria, Croatia, Kazakhstan, Nigeria, Sri Lanka and Vietnam.

Do any indexes track frontier markets?

Yes. In October 2007 S&P launced its Select Frontier Index, which tracks 30 companies. Presently, the index is updated monthly, although S&P intends to begin updating it daily. Gathering data from companies in frontier markets proves to be extremely challenging, regardless of how flat one may view the world. S&P also offers the IFC Global Frontier Markets which tracks 270 companies. Year to date the index is up 28%; last year it was up 36%. To view more details about S&Ps Select Frontier Index, you can check out the S&P Select Frontier Fact Sheet (pdf). Heres a breakdown of the index from the fact sheet:

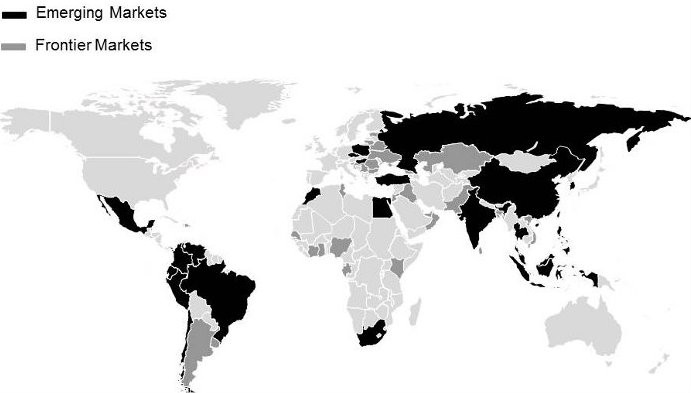

MSCI Barra also has plans to launch a frontier markets index called the MSCI Frontier Markets Indices. The index will cover 19 countries. These 19 countriesshown to the rightcover Africa, Middle East, Asia and Central & Eastern Europe. You can find more information about the MSCI Barra Frontier Index here.

How can you invest in frontier markets?

The mutual funds that invest in frontier markets are still very limited. With the creation of the indexes, you can expect ETFs and eventually mutual funds to begin offering new investing alternatives. Here are two funds that currently offer exposure to frontier markets:

T. Rowe Price Africa & Middle East (TRAMX)

- Ave. Market Cap. $4.5 billion

- Expense Ratio. 1.75

- Initial Investment. $2,500 ($1,000 for IRAs)

- Fund Assets. $128 million

Eaton Vance Tax-Managed Emerging Markets (EITEX)

Eaton Vance has had impressive returns. From 2003 its annual returns have been 62.7, 31.6, 33.8, 38.0 and 38.6. On a risk adjusted basis, however, the returns are less impressive, but 30+% is still 30+%. Of course, it wont keep up this pace and the strong returns have to make you wonder whether the fund is in for some difficult years. In addition to these funds, many emerging market funds have some exposure to the frontier markets.

What are the risks of investing in frontier markets?

There are many risks associated with investing in frontier markets. Political instability in emerging countries present many risks to an investment. In these smaller frontier markets, liquidity is also a risk. The simple fact is that for periods of time, there may be no market for a stock in a frontier market company. The regulatory scheme within these countries varies and often provides far less oversight than in more developed countries. On a more positive note, some believe that frontier markets are less influenced by global conditions such as the current credit crunch. Regardless, frontier market funds are risky. If the Eaton Vance fund can rise more than 60% in one year, it can surely fall just as fast.

Am I buying a frontier market fund?

At this point, no. The options are just too few and too expensive. If Vanguard or Fidelity eventually offers a frontier fund, Ill certainly consider moving a potion of my portfolio currently invested in emerging markets over to frontier markets. But for now, Im on the sidelines watching.