Uncover Value Opportunities Using the PricetoBook Ratio

Post on: 18 Март, 2017 No Comment

Uncover Value Opportunities Using the Price-to-Book Ratio

Start your Free Tomorrow In Review Preview — Sign Up Here: />

What if you could buy a company for less than it was worth? The price-to-book ratio could be just the metric to tell you everything you need to know…

As we’ve been talking about lately, stock screens are one of the best ways to narrow down the thousands of small-cap stocks out there into a manageable watchlist. Today, we will slim down that list even more…

Last week we went over the P/E ratio and added it to our screen. Setting the P/E ratio to greater than 8 and less than 20 allowed us to focus on companies with value and have capital to support their share price. I noted, however, that you should never use this metric alone because it can be subject to accounting manipulation and many different interpretations.

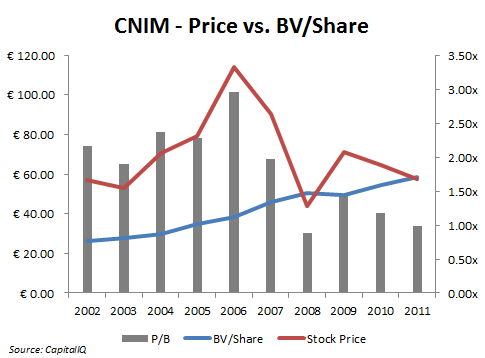

Today I would like to introduce you to the price-to-book ratio or P/B ratio. As with the P/E ratio, this metric should never be used by itself, but it is an important tool to finding value in investments.

You can find the P/B ratio by taking the company’s share price and dividing it by the latest book value per share.

Book value is found by taking the value of the company’s assets and subtracting its liabilities. Essentially, it’s the value of all of a company’s stuff, after taking out any obligations – in other words, it’s a conservative measure of a stock’s liquidation value per share.

The P/B ratio is often used by investors to find companies selling at deep value prices. Like the P/E ratio, there are many ways to interpret this metric.

When calculating the P/B ratio, the book value of a company’s assets is a huge factor. That’s why it’s so important to understand what is included within a company’s book value.

Book value is simply the value of a company’s net assets expressed on their balance sheet (which can be found on Google Finance ). This includes a company’s stocks, bonds, inventory, manufacturing equipment, and real estate, and subtracts any debt. It gives a rough idea of what the stock would hypothetically be worth if it was broken up and sold off tomorrow.

The most important thing to know is that it excludes intangible assets such as brand name, patents, and intellectual property. Companies that rely heavily on intellectual property, like Microsoft ( NASDAQ: MSFT ). do not always have significant tangible assets on their balance sheet; that can cause the P/B ratio to be higher, which makes the company look like less of a deal.

Also, book value may not represent the real market value of a company’s assets. That’s because the book value of an asset typically reflects the original cost, and doesn’t account for value increases in property, or for the markup that inventory gets before being sold.

Because of the variables going into book value (and what is being left out), certain industries consistently have higher P/B ratio then others. Companies with a lot of tangible assets (machinery, real estate, etc.) will have a lower P/B ratio than companies that rely heavily on human capital.

A higher P/B ratio may mean that investors expect management to create more value from a given set of assets. It can also mean that the company is overvalued. The only way to tell the difference is through tried and true experience.

Newer companies with high expectations tend to have higher P/B ratios. When looking at newer companies it is important to compare the P/B ratio to the industry average. If the P/B ratio is higher then the industry average it may be wise to stay away.

A lower P/B ratio means that share price is less then the value of assets. Sometimes, this means that the company is undervalued, but just like with low P/E ratio, it can also mean that the company is in trouble.

That said, a low P/B ratio can indicate that if the company got into trouble, investors could still walk away with a profit on their investment. Lower P/B ratio gives investors a fundamental cushion if the company has difficulties.

The P/B ratio is a staple metric for value investors, and lower P/B ratios tend to show better small-cap value. Because of this we will set our P/B ratio to less than 2.

Here is a look at our stock screen as it currently stands:

That leaves us with about 100 different small-cap companies, eliminating companies that aren’t obvious value plays.

Just like with P/E ratio, P/B ratio should never be used by alone. But it is an important metric when evaluating a company’s assets. By just adding two metrics, P/E and P/B ratios, to our screens, we have cut the original list of 200 small-cap companies in half.

Next week we will take a look at the next value to add to our screen…

Sincerely,

Associate Editor, Penny Sleuth