Earnings per share

Post on: 14 Апрель, 2015 No Comment

Stock swap transactions are one of the popular ways in which mergers can be financed. Stock swap refers to the situation when an acquiring company exchanges its common stock shares for common stock shares of the target company at the agreed upon ratio.

The ratio, which is called ratio of exchange. is determined during merger negotiations. The acquiring company often needs to repurchase shares in the market place to obtain an adequate amount of shares to be able to complete the stock swap transaction.

To find the ratio of exchange, the dollar amount required to be paid per share of the target company must be divided by the market value of the shares of the acquiring company.

Ratio of exchange = amount required to be paid per share of the target company/market value of the shares of the acquiring company

Test yourself:

ABC Company would like to acquire company BCD by using a stock swap transaction to finance the merger. ABC’s shares currently trade for $60 per share. BCD’s shares are traded for $55. However, in merger negotiations, it was agreed that BCD’s shares should be valued at $90 per share. What is the ratio of exchange in this merger stock swap transaction?

The ratio of exchange is 1.5 (90/60). ABC will need to exchange 1.5 shares of common stock to obtain 1 common stock share of BCD.

Test yourself:

ABC (acquiring company) is acquiring BCD (target company) with the use of a stock swap transaction where it will exchange 1.5 shares of common stock for each common stock share of BCD. ABC’s shares trade at $60 per share. It was agreed during merger negotiations that BCD’s shares will be valued at $90 each. The real market price of BCD’s shares is $55 per share. Find out how many shares does ABC need to exchange in the stock swap transaction if BCD needs to obtain 15,000 shares?

ABC needs 22,500 (15,000*1.5) to complete stock swap transaction with BCD at a ratio of exchange of 1.5:1.

Test yourself:

ABC (acquiring company) is acquiring BCD (target company) with the use of a stock swap transaction. ABC’s earnings before the merger were $400,000 per year and it has 110,000 of shares of common stock outstanding. ABC will have to issue 22,500 shares of additional common stock to complete the stock swap transaction with BCD. BCD’s earnings before the merger are $65,000 and it has 15,000 shares of common stock outstanding. The ratio of exchange is 1.5 of ABC’s shares for 1 share of BCD.

What are current earnings per share (EPS) of ABC and BCD and what will be the initial earnings per share of ABC after the merger, if earnings are assumed to stay unchanged?

Current (before the merger) earnings per share (EPS) of ABC is $3.6 (400,000/110,000).

Current (before the merger) earnings per share (EPS) of BCD is $4.3 (65,000/15,000).

Initial earnings per share of ABC after the merger is:

= ((400,000+65,000)/(110,000+22,500))

=485,000/132,500

= $3.5

It is common for earnings per share of acquiring company to initially decrease. This happens because acquiring company pays a large premium above the target company’s market price. In the long run, however, earning per share will likely be higher than it would be without the merger.

If the price/earnings ratio (P/E ratio) paid for the target firm by the acquiring firm is greater than the P/E of acquiring firm then, the EPS of the acquiring firm will initially decrease and vice versa. However, in the long term, the EPS of acquiring firm should increase. The P/E Ratio is found by dividing the market price per share by earnings per share (EPS).

Test yourself:

ABC (acquiring company) is acquiring BCD (Target Company) with the use of a stock swap transaction. ABC’s market price is $60 and its earnings per share are $3.6. BCD’s market price is $55 and its earnings per share are $4.3. However, during merger negotiations ABC agreed to a 1.5 ratio of exchange where it value BCD’s shares at $90.

A. Explain how ratio of exchange was determined.

B. Calculate the P/E ratio for ABC and BCD before the merger at market prices per share.

C. Calculate the P/E ratio of BCD at the agreed upon price per share for the merger.

Solution:

The ratio of exchange of 1.5 is calculated by dividing $90 (the agreed upon price of BCD’s share) by $60 (the market price of ABC’s share). ABC will need to exchange 1.5 shares of common stock to obtain 1 common stock share of BCD.

P/E ratio of ABC before the merger is $60/$3.6=16.6

P/E ratio of BCD before the merger is $55/$4.3=12.7

Stock repurchases is a form of dividends. If stock repurchases are made instead of cash payment, it increases the earnings per share of current shareholders and it increases the market price per share.

Market price per share increases because earnings available for distribution to shareholders are now divided among fewer shareholders. Share price also increases because when a firm is buying back its shares it sends a positive signal to the market that management considers shares undervalued. Of course, repurchasing stock is especially beneficial for firm to undertake if the share price is really perceived by management to be undervalued.

Repurchase of stock also discourages unfriendly takeovers. This happens firstly because takeover can be attractive due to a company’s liquidity position. If a company has a lot of cash, it can be used to cover the debt undertaken to finance the acquisition. By using available cash to repurchase stock, a firm decreases its attractiveness as a takeover target. Moreover, repurchase of shares increases the price per share which makes takeover more expensive.

Another benefit of repurchase of stock is that it delays the tax liability of the shareholders. If cash dividends are paid out to the shareholders, then shareholders will have to pay part of it to the government as taxes. Repurchase of stock delays taxes that shareholders will be liable for until capital gain is realized, which occurs when shareholder sells stock.

Agency problem also have something to do with managements’ incentive to repurchase stock. Executive’s rewards are often tied to performance measures such as earnings per share. If firms have fewer shares outstanding and earnings stay the same than its earnings per share will inevitably increase.

Therefore, a part of the agency cost that firm has to incur is due to a necessity to monitor management actions to ensure that stock is not repurchased because an executive’s compensation is tied to EPS measure.

Repurchase of stock also allows a firm to have shares available for employee stock option plans. Buying back shares also temporarily provides a higher floor for the stock price .

Shares repurchase methods

The most common share repurchase method is purchasing shares on the open market. A second option is to negotiate with major stockholders to purchase a large bulk of shares. Another option is a formal fixed price tender offer that can be made to purchase shares at above market price.

Dutch auction tender offer , which originated in 1981, is another option to repurchase stock. This option entails invitation to shareholders to tender their shares at prices within ranges established by the firm. The firm will try to purchase shares at the lowest possible prices. Thus, if more than enough shares are tendered then shares will be purchased up to a certain price at which an adequate amount of shares will be available. If not enough of shares are tendered then firm can either cancel the offer or buy back all the shares tendered.

Under every method of shares repurchase the reasons behind repurchase of shares must be clearly stated to the shareholders. The intention as to how repurchased shares are intended to be used should also be communicated. For example, it can be used for executive compensation or for trading it in exchange for shares of another firm.

In conclusion, companies need to maintain a target payout ratio which is suitable for the company’s needs. Organizations must also try not to neglect acceptable projects (with NPV higher than zero and IRR greater than weighted marginal cost of capital ) to pay out large dividends. The main objective, as always, should be owner’s wealth maximization.

Also it is important to remember that whereas it is important to try not to decrease dividends to ensure that no negative signals are sent to the market, it is also important to maintain a healthy liquidity position. Organizations certainly should not borrow to be able to pay out large dividends.

Financial leverage is the relationship between operating profit and EPS (earnings per share). In short, it measures the level of debt. It is a measure of how the potential use of fixed financial costs (e.g. interest on debt) can enlarge the effect that change in operating profit (EBIT) has on EPS (earnings per share).

When does a firm have financial leverage?

If a firm has mixed financial costs, it has financial leverage. Due to financial leverage (existence of fixed financial costs), any increase in EBIT will result in even larger increases in EPS and any decrease in EBIT will result in even larger decreases in EPS.

How to calculate degree of financial leverage (DFL) of the firm?

To calculate degree of financial leverage, which is just a way to measure financial leverage of the firm, we can follow the following formula:

DFL =% change in EPS /% change in EBIT

Therefore, if the degree of financial leverage is greater than 1, then financial leverage exists (which is the case as long as the company has fixed financial costs). Also, any increase in financial leverage results in an increase in risk and any decrease in financial leverage results in a decrease in risk.

Related Articles:

In finance, leverage (which is also called gearing or levering) refers to the use of debt rather than equity as a source of capital to finance investments and reinvestments. The more debt the business uses the more leverage it has.

As leverage increases, the risks also increase and so does the return on investment. However, as leverage decreases, the risks also decrease as well as the return on investment. Management have almost total control over the risk introduced by increased leverage.

- Operating leverage – refers to the relationship between sales revenue and operating profit (which is also called EBIT (earnings before interest and taxes))

- Financial leverage – refers to the relationship between operating profit and EPS (earnings per share)

- Combined or total leverage – refers to the relationship between sales revenue and EPS

Related Articles:

The EBIT-EPS capital structure approach focuses on finding a capital structure with the highest EPS (earnings per share) over the expected range of EBIT (earnings before interest and taxes).

The reason why we are interested in finding a capital structure which will permit maximization of the EPS over the expected range of EBIT is because it partially helps us to achieve the ultimate objective of the enterprise. The ultimate objective of the enterprise is to maximize shareholders’ wealth by maximizing its stock price. Two key variables that affect stock price are return (earnings attributed to owners of the enterprise) and risk (which can be measured by required return (rs)). This approach explicitly considers maximization of returns (EPS). However, it is important to note that this approach ignores risk (does not explicitly consider risk).

The fact that this approach fails to explicitly consider risk is the major shortcoming of this method. As firm obtains more debt (its financial leverage increases), the risk also increases and shareholders will require higher returns to compensate for the increased financial risk. Therefore, this approach is not completely appropriate because it does not consider one of the key variables (risk), which is necessary for maximization of shareholders’ wealth.

As per above, the approach does not explicitly consider financial risk. However, when utilizing the approach, financial risk can be considered in two ways:

1) The approach measures financial risk by the financial breakeven point. The higher the breakeven point the greater the financial risk.

2) The approach also measures the financial risk by the slope of the capital structure line. The steeper the capital structure line the greater the financial risk.

It is a graphical approach. EPS is plotted on the vertical axis (x-axis) and EBIT on the horizontal axis (y-axis). By connecting the coordinates for different capital structures (different variations of equity versus debt), capital structure lines for each capital structure are graphed.

We will need to represent EBIT-EPS coordinates (capital structure lines) for different capital structures to ascertain at which levels of EBIT which capital structure is preferred. This will allow us to find a capital structure with the highest EPS over the expected range of EBIT.

For the purposes of this article it is sufficient to mention that to find EBIT-EPS coordinates we can assume particular EBIT values (and associated earnings available for common stockholders values) and calculate EPS in line with such values for different capital structures.

The formula to calculate EPS is as follows:

EPS = Earnings Available for Common Stockholders/ Number of Shares of Common Stock Outstanding Another easy way to find one of the EBIT-EPS coordinates is to use the financial breakeven point calculation. Financial break-even point occurs at the level of EBIT (earnings before interest and taxes) at which EPS (earnings per share) equals zero. At this level of EBIT all fixed financial costs are covered. The formula for calculation of the financial break-even point is as follows:

Financial break-even point = I + PSD/1-T

Where:

I – interest charges

PSD – preferred stock dividends

T – tax rate

***

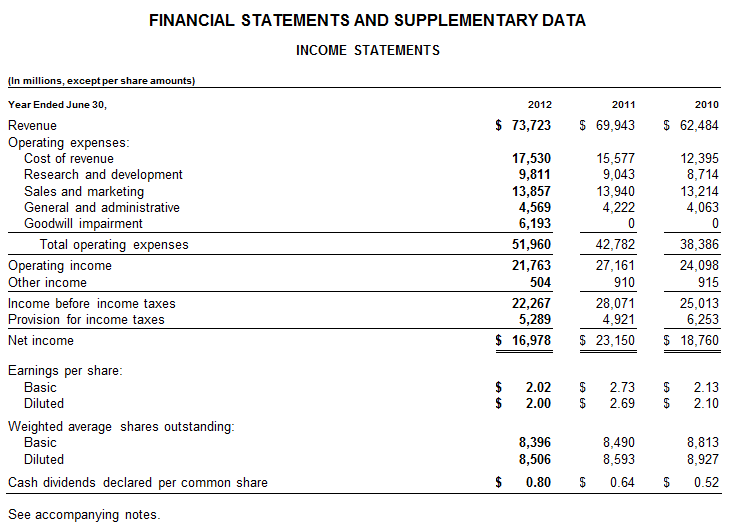

Calculating earnings per share (EPS) allows us to understand how much dollars were earned on each outstanding share of common stock.

In summary, in order to find earnings per share (EPS), we need to take earnings available for common stockholders (the bottom line of the income statement ) and divide it by number of shares of common stock outstanding.

Earnings per Share (EPS) = Earnings Available for Common Stockholders/ Number of Shares of Common Stock Outstanding

Therefore, in order to determine EPS (earnings per share), we need to know earnings available for common stockholders. Earnings available for common stockholders are calculated as follows:

Sales revenue

LESS: Cost of goods sold

= Gross profit

LESS: Operating expenses

= EBIT (earnings before interest and tax/operating profit)