Archive for Stocks

Lockheed Martin An Analysis Using The Capital Asset Pricing Model Lockheed Martin (NYSE LMT)

Lockheed Martin An Analysis Using The Capital Asset Pricing Model Lockheed Martin (NYSE LMT)

Summary I use the Capital Asset Pricing Model to illustrate the risk-return characteristics of Lockheed Martin (LMT) during a period of market upturn and

22 Сентябрь, 2015 No Comment Read More

Portfolio Theory CAPM has its methodological foundations in William Sharpe’s portfolio theory. This theory introduced the concepts of systemic risks and unsystemic risks in

22 Сентябрь, 2015 No Comment Read More

Chapter 11 Optimal Portfolio Choice and the Capital Asset Pricing Model

Chapter 11 Optimal Portfolio Choice and the Capital Asset Pricing Model

The portfolio weight is the initial fraction xi of an investor’s money invested in each asset. Portfolio weights add up to 1. The expected

22 Сентябрь, 2015 No Comment Read More

By: Frank Armstrong By: Frank Armstrong, CFP, AIF The fickle finger of fate If Bill Sharpes first thesis had been accepted, the world of

21 Сентябрь, 2015 No Comment Read More

Capital Asset Definition A capital asset is defined in the financial world as any asset used in the course of making money. For this

21 Сентябрь, 2015 No Comment Read More

CHAPTER ONE: Introduction Introduction The Capital Asset pricing model, almost always known as CAPM. It is a set of prediction of the risk and

21 Сентябрь, 2015 No Comment Read More

ASSET PRICING MODELS (Finance)

ASSET PRICING MODELS (Finance)

Abstract The asset pricing models of financial economics describe the prices and expected rates of return of securities based on arbitrage or equilibrium theories.

21 Сентябрь, 2015 No Comment Read More

Application of Capital Asset Pricing (CAPM) and Arbitrage Pricing

Application of Capital Asset Pricing (CAPM) and Arbitrage Pricing

CONTENTS Appendix 4 Appendix 5 Abstract This paper examines the estimating and forecasting performance of the different and various Generalized Autoregressive Conditional Heteroscedasticity-GARCH’s models

21 Сентябрь, 2015 No Comment Read More

Capital Asset Pricing Model with Missing Data MATLAB Simulink Example

Capital Asset Pricing Model with Missing Data MATLAB Simulink Example

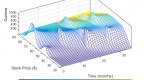

Capital Asset Pricing Model with Missing Data This example illustrates implementation of the Capital Asset Pricing Model (CAPM) in the presence of missing data.

21 Сентябрь, 2015 No Comment Read More

Capital Asset Pricing Model (CAPM)

Capital Asset Pricing Model (CAPM)

Photo by: leungchopan The capital asset pricing model (CAPM) is a mathematical model that seeks to explain the relationship between risk and return in

21 Сентябрь, 2015 No Comment Read More

Follow Us

Sidebar Post

- Most Popular

- Recent Comments

-

Bollinger Bands Strategy With 20 Period ...

-

Pay Off Your Mortgage Prior To Retiremen...

-

You Say You Want A Dissolution An Overvi...

-

Pay Down the Mortgage Before Retirement ...

-

Volume indicator

-

Uncover Value Opportunities Using the Pr...

-

The Strategic Sourceror Top Tips for Rec...

-

How to pay off debt

-

Recessionproofing retirement

-

Frontier Markets The New Emerging Emergi...