Capital Pricing Model

Post on: 21 Сентябрь, 2015 No Comment

By: Frank Armstrong

By: Frank Armstrong, CFP, AIF

The fickle finger of fate

If Bill Sharpes first thesis had been accepted, the world of finance might look a lot different today. Fortunately, after the paper was rejected as so uninteresting that there was absolutely no thesis there, Sharpe was introduced to Harry Markowitz. Under Markowitz guidance, Sharpe set out to solve the critical real-world problem of Modern Portfolio Theory: the math was just too much for the days computers to digest. Before portfolio managers could optimize their holdings, MPT computations had to be simplified. Sharpe, a self-styled computer nerd*, was up to the task.

The Most Important Common Factor

As Markowtiz paper had laid out the problem, each asset included in the portfolio had to have a expected rate of return, standard deviation, and correlation to every other asset in the portfolio. That meant that as assets were added to a portfolio, the possible combinations increased exponentially. Pretty soon, even the toughest computer was brought crashing to its knees. A single run was limited by computer capacity to about 250 stocks, took hours and cost more than a brand new car.

The key to simplifying the process lay in relating each asset to a single common factor. That factor had to be the most important factor that related all of them to each other. By observing that all stocks were correlated, Markowitz had hinted at a solution in his original paper, but never pursued it. Now, acting as Sharpes mentor and collaborator, he suggested that the math was pretty simple and told Sharpe to solve it.

Sharpes elegant answer, A simplified model for portfolio analysis, published in 1961, was to relate each stock to the market as a whole rather than to every other stock. Under Sharpes simplified model it was only necessary to input the expected return of a stock, and its correlation to the market. Fortunately, both were easily determined, and reasonably stable over time.

Now the computer could rip through optimization problems containing over 2000 stocks in just a few seconds with very similar results to a complete Markowitz optimization. MPT became a viable portfolio management tool.

But, wait, theres more

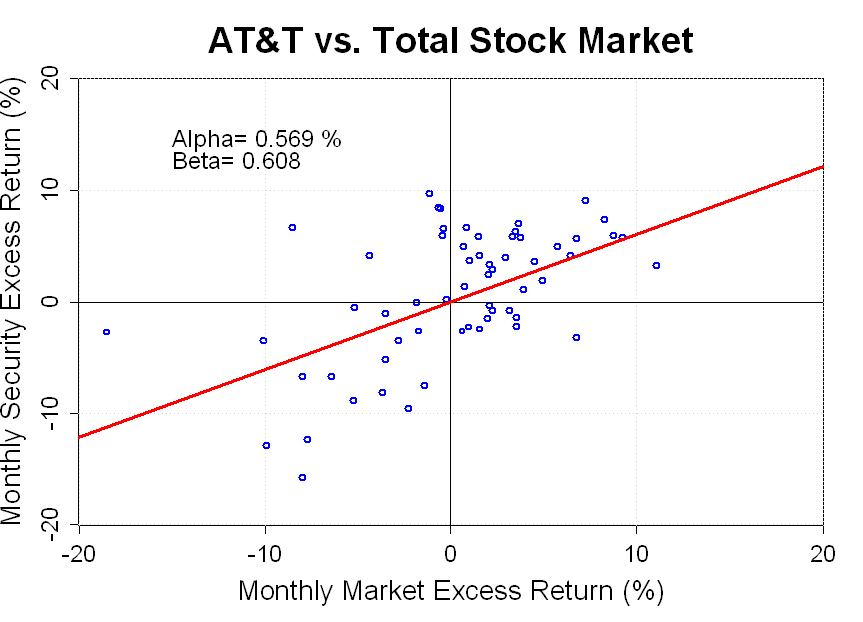

Sharpe wasnt done. He reasoned that if MPT were true, then there must be implications for both stock prices and returns. In his article, Capital Asset Prices: A Theory of Market Equilibrium Under Conditions of Risk Sharpe expands on the insights derived from the simplified model. He breaks stock returns down into risk free return, stock market premium (diversifiable risk), and specific stock premium (non-diversifiable risk). The later he named Beta. Stock returns and prices at equilibrium would then be related to total risk. So, confirming the risk-reward relationship, stocks with higher risk would command lower prices and higher returns than less risky stocks.

Capital Asset Pricing Model (CAP-M) became the dominant pricing model for a generation. The theory, by relating stock returns to a single factor (Beta), was both simple and elegantýjust the kind of thing that academics love.

The super-efficient portfolio rears its beautiful head!

An important by-product of CAP-M is that it neatly solves the question of the superefficient portfolioýthe portfolio of risky assets that dominates all other portfolios and which all investors should want to hold. The most efficient (maximum return per unit of risk) portfolio available to any investor is the entire global market!

At the time, the US so dominated the worlds markets that the S&P 500 was considered a good proxy for the world market. However, the assumption that a simple index would dominate a professionally managed portfolio was considered heretical. Sharpes intuition in CAP-M depended on efficient markets, and led him to be called the godfather of index funds. Sharpe is widely known for his disdain of active managers and their claim to be able to beat the market. See: The Parable of the Money Managers .

The test of time

Unfortunately, the test of a good theory is how much it explains in the real world. CAP-M fails to explain as much as it promised. Still widely taught, and not without its supporters, CAP-M has gradually been replaced by more powerful multi-factor models. Sharpe has long since turned his mind to more interesting new projects and is remarkably unconcerned. When asked about the new models and the fall of CAP-M recently he responded with a laugh: Im glad they cant take the (Nobel) Prize away. I think those boys (Fama and French) are on to something, but I think CAP-M was a pretty good first cut at the problem!

Whats in it for you?

Sharpes work made MPT a practical reality. We can now design and test portfolios in a split second. The implication for all of us is that portfolio risk can be far better managed and controlled while we pursue optimum returns.

While CAP-M may have been tweaked a little, the insight that there is a risk-reward line holds true, and the global market portfolio stands as a pretty good starting point for your risky asset portfolio. Ignore Sharpes support for efficient markets and indexing at your peril.

William F. Sharpe won the 1990 Nobel Prize in Economics for his contributions to the theory of price formation for financial assets, the Capital Asset Pricing Model (CAP-M).

Are stock prices predictable, or are they a random walk?

www.stanford.edu/

viking.som.yale.edu/will/finman540/classnotes/class4.html