Worried about stocks Bonds look worse Jan 4 2015

Post on: 19 Сентябрь, 2015 No Comment

As 2015 kicks off, investors are skittish.

That’s not dotcom bubble levels, but it’s a cautious point, especially when we’re in the midst of the fourth-longest bull market since the 1928. Wall Street experts say we’re in the middle or even late stage of the business cycle.

The world’s problems: On top of that, Europe and Japan are fighting off recessions. and even China looks fragile. The U.S. stands alone in its financial health, but to paraphrase John Donne, No economy is an island, at least not anymore.

We’ll get another check up on the American economy this Friday when the monthly jobs report is released.

There are clear headwinds for stocks. The problem is, where else do you put your money?

Cash in the bank is earning zero interest. Even if the Federal Reserve does raise interest rates later this year as widely expected, cash is unlikely to earn much more than 1% by the end of the year — not enough to keep up with inflation.

Bonds are expensive: Bonds are the obvious alternative. There’s just one problem: If stocks look a little scary, bonds look worse.

Every time you hear someone say we’re at record low yields, what they’re really saying is we’re at record high bond prices, says Burt White, chief investment officer of LPL Financial.

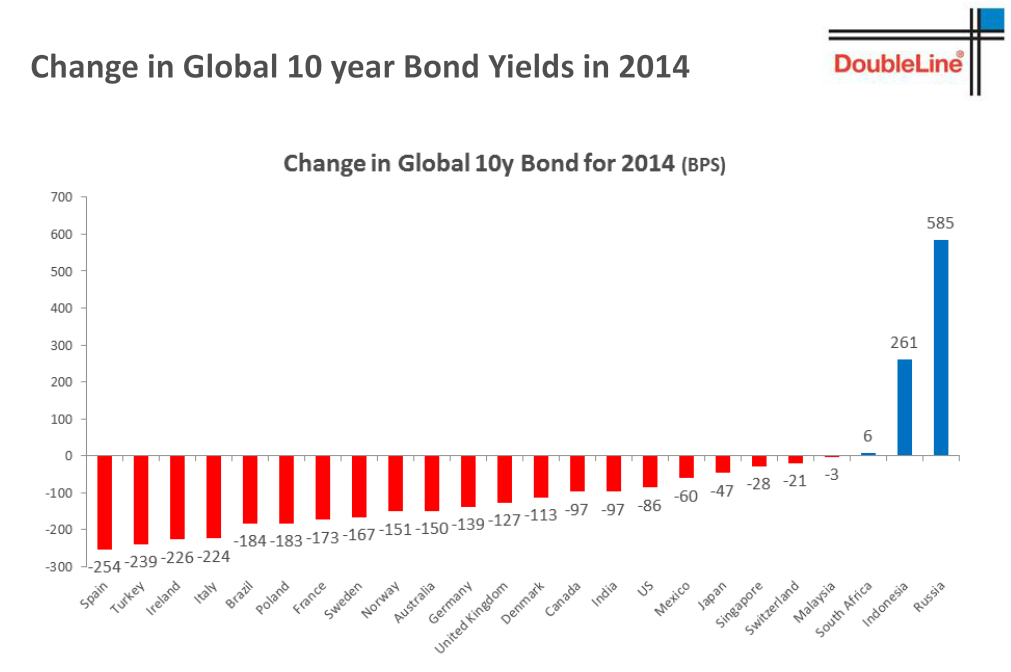

This time a year ago, experts predicted 2014 would be a rough year for bonds. As the Federal Reserve ended its massive bond-buying stimulus program, most thought yields would go up and thus bond prices down.

Instead, the opposite occurred. As the world economy looked gloomier, investors poured money into U.S. bonds — both government and corporate. That means bonds are even more expensive now.

It’s possible that foreign investors will continue to buy up U.S. bonds this year, but even that force could be counterbalanced once the Fed begins to raise interest rates.

How to position your portfolio: The advice for 2015 is to keep your portfolio overweight stocks and underweight bonds.

The average investor is about 60% stocks and 40% bonds. For that kind of client, we’re suggesting fixed income closer to the 32% level, White says.

Famed investor Warren Buffett went as far as to call bonds a terrible investment right now.

Stocks are more expensive than average, notes White. But you look at the bond market and you’ve never had a bond market much worse than today.

Stocks beat bonds: The bigger question investors should be asking is how many bonds belong in their portfolio not just for 2015, but beyond.

Buffett put it bluntly last year when he disclosed his plan for his wife’s portfolio: My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors.

That’s a much smaller percent in bonds than most people have, especially after their 20s and 30s.

As Merrill Lynch reminded investors in its CIO Outlook. stocks have outperformed bonds by a lot over the long term. The compound annual return for stocks since 1925 has been 10.2%, compared with 5.7% for long-term Treasury bonds.

There’s certainly a role for bonds to play in a portfolio. Many people count on bonds to go up when the stock market tanks — and to provide that steady fixed income when they retire.

But investing in bonds means you give up some of the return you likely could have had from investing in stocks.

CNNMoney (New York) January 4, 2015: 9:22 AM ET