Will Obama Be Reelected The Stock Market Has The Answer

Post on: 6 Январь, 2016 No Comment

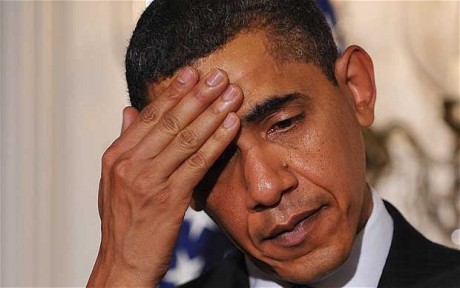

Image via Wikipedia

Not many people realize that the stock market is one of the best predictors of the outcome of a Presidential election. So the best way for investors to determine whether President Barack Obama will win another four years in the White House is to watch what the market does.

The stock market over the years has been one of the most consistent forecasters of the results of the presidential polls. Since 1948, the Standard & Poor’s 500-stock index has proved to be a reliable prognosticator of whether or not an incumbent President gets to be reelected, says Sam Stovall, Chief Equity Strategist at Standard & Poor’s Capital IQ.

“The S&P 500 did an excellent job as an election-prognosticator technique” in the past 62 years, with an accuracy rate of 88%, notes Stovall, who is also chairman of the S&P investment policy commmittee.

Here’s what the record shows: The S&P 500-stock index price performance in the three months leading to a presidential election has been a good predictor of whether a sitting President would be reelected or replaced. Specifically, when the S&P 500 index rises from July 31 through October 31, the incumbent President ends up being reelected. But when the S&P posts a loss during that three-month period, the incumbent gets booted out of the White House.

“So pay close attention to the market’s performance in the three months from July to October leading up to the Novvember presidential election,” advises Stovall. “It will probably do a better job than the plethora of political pundits prognosticating on the presidency,” he argues.

The S&P 500 has also been a good guide for investors in several other important ways. One of them involves the so-called January Effect, which proclaims that how the stock market does in the month of January indicates how stocks will do during the year. The January barometer has been proved right in forecasting positive calendar-year performances almost 100%, says Stovall.

Then there’s the frequency with which the S&P 500 has risen during the presidential election years — which has been proved to be right 75% of the time. Add that to the fact that the index has been successful in predicting 88% of the time the fate of the incumbent President and they all make up for whatever the S&P 500 doesn’t provide in absolute return, says Stovall.

Another relevant question for investors is what stock groups perform the best during a presidential election year. The answer would surprise many: Since 1972, the S&P 500 Energy sector posted the strongest results during the presidential election year, gaining an average 15.6% — beating the market 80% of the time — vs. the S&P 500′s average 5.9% advance. Consumer staple stocks came in second with the sector gaining an average of 10.2%. Industrial stocks also outperformed.

Be cautious, however, about the information-technology stocks, as well as the materials and telecom services groups. Some of the individual stocks in the sector may perform well but as a group they recorded the weakest performance during presidential election years, notes Stovall.

So which stocks will do well in this presidential election year? Here are 10 strong-performing stocks that some savvy pros expect will outperform the market in 2012: