Why Darvas Boxes Work

Post on: 30 Сентябрь, 2015 No Comment

by Darrin Donnelly on February 16, 2011

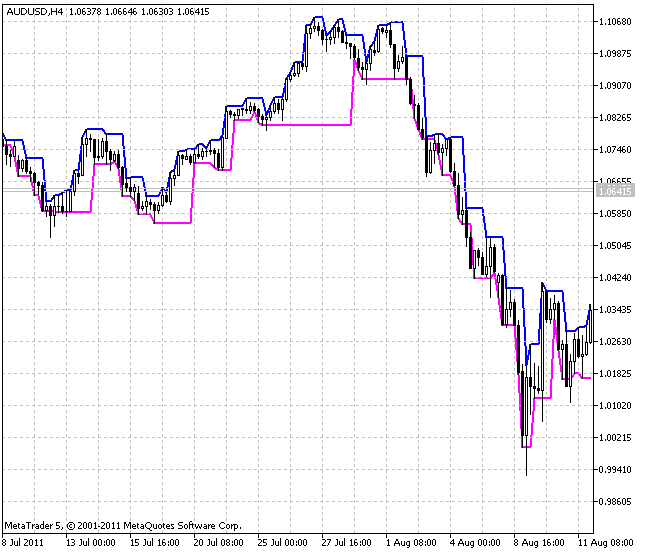

Click on chart to enlarge.

Nicolas Darvas developed his famous method for identifying stock trends using “Darvas Boxes” in the late 1950s.

His goal was to create a trading system that allowed him to ride a powerful stock’s rising trend for as long as it remained in that rising trend.

This is obviously a simple and logical concept, but extremely difficult to implement. The difficulty lies in deciphering what is a “normal” correction within a rising trend and what is an “abnormal” correction, which breaks the rising trend.

There are numerous methods used for determining stock and commodity trends. There’s the original Dow Theory, Jesse Livermore’s “Pivotal Points,” Richard Donchian’s moving averages, the famous Turtle breakout system, classic chart patterns, and on and on this list could stretch. All of these methods work to a certain extent and a successful trend trader usually implements portions of each.

Like the trend trading strategies listed above, the Darvas Box System stands the test of time.

Why is that so? Why do Darvas Boxes continue to properly identify trends more than 50 years after Nicolas Darvas first discovered their validity?

The quick answer is to quote Jesse Livermore, who famously stated, “The game does not change and neither does human nature.”

In other words, trend trading will always work because human psychology, judgment, and emotion will always drive the stock market – or any marketplace where fear and greed fuels speculation. (This will remain true even in this era of “program trading” because humans are doing the programing.)

Before we get into why Darvas Boxes still work, let’s make sure we properly define what they are.

The most specific definition Nicolas Darvas provided was as follows: “The top of the box is established when the stock does not touch or penetrate a previously set new high for three consecutive days. This is true – in reverse – for the bottom of the box.”

As these boxes are formed, trends can be identified. As long as a stock remains in its top Darvas Box, it remains in a rising trend.

The question most often asked about Darvas Boxes is, “Why three days? Why not four or five or 10?”

Nicolas Darvas essentially formed his Box Theory around what many day traders and swing traders know as “The Three-Day Rule.”

This rule of thumb recognizes that big stock moves usually occur over a three-day period: Day One is the beginning of a move, Day Two is a follow-through where traders who missed Day One jump on board, and Day Three is often the day where those late to the party try to join in.

Day traders and swing traders keep this rule in mind because they usually want to avoid buying on the third day of a stock’s strong move.

Some swing traders even utilize the Three Day Rule as the main component of their entire trading strategy. They simply buy breakouts on Day One and sell on Day Three.

For three years, Nicolas Darvas spent eight hours almost every single day vigorously studying the stock market in his attempt to develop a winning system. His studies led him to this Three Day pattern and he utilized it to implement his Darvas Box Method.

Darvas Boxes recognize that if a new high or new low isn’t penetrated for more than three days, it is a significant message from the market. Thus, Nicolas Darvas established support and resistance levels based on this recurring tendency.

This Three Day pattern isn’t random. It’s based on human psychological tendencies that will never change. That is why Darvas Boxes continue to work in our modern world of stock market speculation.

There are some techniques that have been added to improve the performance of Darvas Box trading in today’s more volatile market conditions. The three most important new techniques are probably:

1) Applying the “Undercut Sell Rule” to Darvas Boxes in order to set new stops and establish more valid support levels.

2) Recognizing when a Darvas Box should be disregarded because it is actually part of a larger, more reliable, chart pattern.

3) Evaluating volume to confirm the validity of a Darvas Box breakout or breakdown.

These three techniques will be explained more thoroughly in future articles at this site, but the point of this article is to simply explain why, after all these decades, the Darvas Box Method – in its purest form – continues to be a powerful and successful trend trading system.

For more on the Darvas Trading System, including our current portfolio of stocks, everything on our watchlist with EXACT buy points and sell points, and full-page chart analysis on all the most powerful stocks on the market, check out Darvas Trader PRO . the newsletter for Darvas System traders .