What Is the Difference Between Large Cap and Small Cap

Post on: 13 Октябрь, 2015 No Comment

These 10 animal facts will amaze you.

Adorable animal families that will make you aww.

These 10 facts about space will blow your mind.

The main difference between large cap and small cap companies are the amounts of capitalization. Large cap stocks or funds are invested in large, well-established companies, whereas small cap ones are for small companies with the potential to grow. Another difference between these stocks is that they involve different levels of risk. Investors should evaluate the objectives and risks included in the prospectuses for large cap and small cap stocks and funds prior to investing.

Large cap, or large capitalization, companies generally have a capitalization of greater than $10 billion US Dollars (USD). These companies, sometimes called blue-chip companies, have large amounts of outstanding stock shares and are well-established and financially stable. They are also included on the Dow Jones and S&P 500 Index. Examples of large cap companies are Exxon Mobil, Microsoft and General Motors.

Small cap, or small capitalization, typically refers to companies that have a capitalization of less than $5 billion USD. The dollar limit is arbitrary, however, so it can vary by investment. These small companies are ones that are generally not well-known. Some companies start out as small cap but eventually grow to mid cap or large cap status, while others might ultimately dissolve or go out of business.

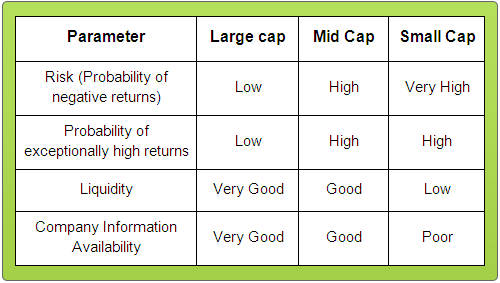

Both large cap and small cap investments involve risks, but the levels associated with each are different. Large cap stocks and funds are typically low risk since the companies tend to maintain their financial stability. These companies do not have as much potential to grow as small cap companies, so their stocks might not yield as high of returns. In general, low risk investments do not fluctuate with the ups and downs of the stock market as much as aggressive ones, so they are regarded as less volatile investments.

By contrast, small cap companies are not well-established, and investments with their stocks are considered to be high risk and aggressive. Although with high risk comes the possibility of greater growth and returns than with low risk investments, there is also the potential for the companies to go out of business. Small cap companies might be particularly risky during periods of economic decline since they might not have the financial means to stay afloat.

The state of the economy often benefits one size of capitalization over the others. For example, small cap funds might be thriving at a time when large cap funds are not, or vice versa. Some studies have shown that small cap investments will outperform large cap ones over the long term.

Investors wishing to invest in large cap and small cap stocks or funds should thoroughly read the prospectuses prior to investing. The prospectuses will include pertinent information such as the objectives, expenses, historical rates of return, and risks. For large cap and small cap mutual funds. the prospectuses will also list what companies they are invested in.