What is Short Selling

Post on: 31 Август, 2015 No Comment

The Basics

When an investor goes long on an investment, it means she has bought a stock believing its price will rise in the future. Conversely, when an investor goes short, he is anticipating a decrease in share price.

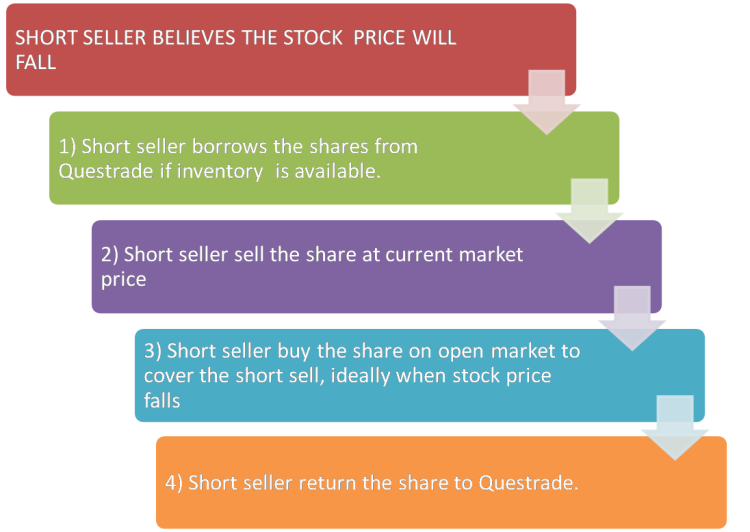

Short selling is the selling of a stock that the seller doesn’t own. More specifically, a short sale is the sale of a security that isn’t owned by the seller, but that is promised to be delivered. That may sound confusing, but it’s actually a simple concept. Here’s the idea: when you short sell a stock, your broker will lend it to you. The stock will come from the brokerage’s own inventory, from another one of the firm’s customers, or from another brokerage firm. The shares are sold and the proceeds are credited to your account. Sooner or later you must close the short by buying back the same number of shares (called covering) and returning them to your broker. If the price drops, you can buy back the stock at the lower price and make a profit on the difference. If the price of the stock rises, you have to buy it back at the higher price, and you lose money.

Most of the time, you can hold a short for as long as you want. However, you can be forced to cover if the lender wants back the stock you borrowed. Brokerages can’t sell what they don’t have, and so yours will either have to come up with new shares to borrow, or you’ll have to cover. This is known as being called away. It doesn’t happen often, but is possible if many investors are selling a particular security short.

Since you don’t own the stock (you borrowed and then sold it), you must pay the lender of the stock any dividends or rights declared during the course of the loan. If the stock splits during the course of your short, you’ll owe twice the number of shares at half the price.

There are two main motivations to short:

The most obvious reason to short is to profit from an overpriced stock or market. Probably the most famous example of this was when George Soros broke the Bank of England in 1992. He risked $10 billion that the British pound would fall and he was right. The following night, Soros made $1 billion from the trade. His profit eventually reached almost $2 billion.

For reasons we’ll discuss later, very few sophisticated money managers short as an active investing strategy (unlike Soros). The majority of investors use shorts to hedge. This means they are protecting other long positions with offsetting short positions.

There are many restrictions on the size, price and types of stocks you are able to short sell. For example, you can’t short sell penny stocks and most short sales need to be done in round lots.

Short selling also requires that you put up margin. As with a margin buy (long) transaction, the percentage required varies depending on the eligibility of individual securities.

Click here to see Desjardins Online Brokerage’s short selling margin requirements. Note that the percentages listed include proceeds originally received from the short sale, so that 150% actually represents 100% of the short sale proceeds plus 50% of account margin.

In addition, the TSX, SEC, NYSE and NASD have rules preventing short selling unless the last trade of the stock is at the same or higher price (known as an uptick or zero plus tick). These rules exist so that investors can’t sell short in a declining market. Continuous short selling on a falling stock will keep forcing it down, damaging the market further.