What is Price Earnings Ratio(PE)

Post on: 11 Октябрь, 2016 No Comment

When it comes to investing, the one advice that gets often repeated is: Invest in blue chip companies. Certainly better than shorting and investing in penny stocks! But how valid is this advice?

Lets take a company thats solid, profitable, pays dividends and has seen multiple depressions and recessions and is still going strong. AT&T. The company is so old that the last T is now obsolete! But AT&T, being a bellweather company, is regarded as a good, stable bluechip company. How could anyone go wrong investing in the big T?

Lets say in 1999 at the peak of the stock market frenzy you bought into AT&T while your paranoid friend decided to stash his cash under his mattress. Guess who wouldve come out smiling? Not you! You wouldve lost more than 40% of your investment! Your only consolation would be, had you invested in a technology stock, you probably wouldve lost more or everything!

But then thats not the point of investing. What went wrong? AT&T was a profitable company back then and it is a profitable company now. The answer is you simply paid too much for T back in 1999.

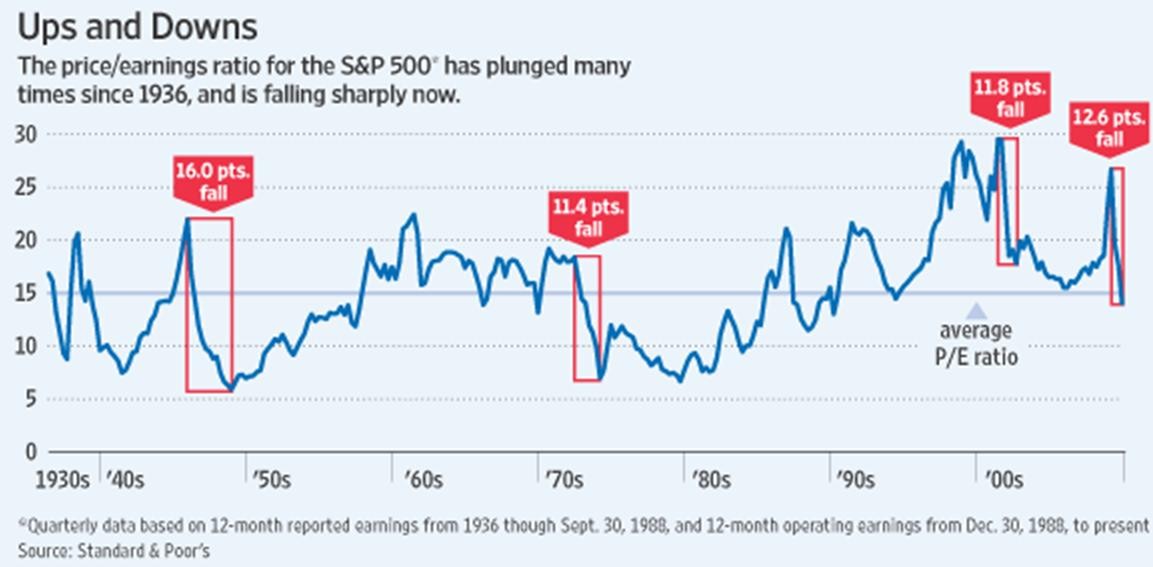

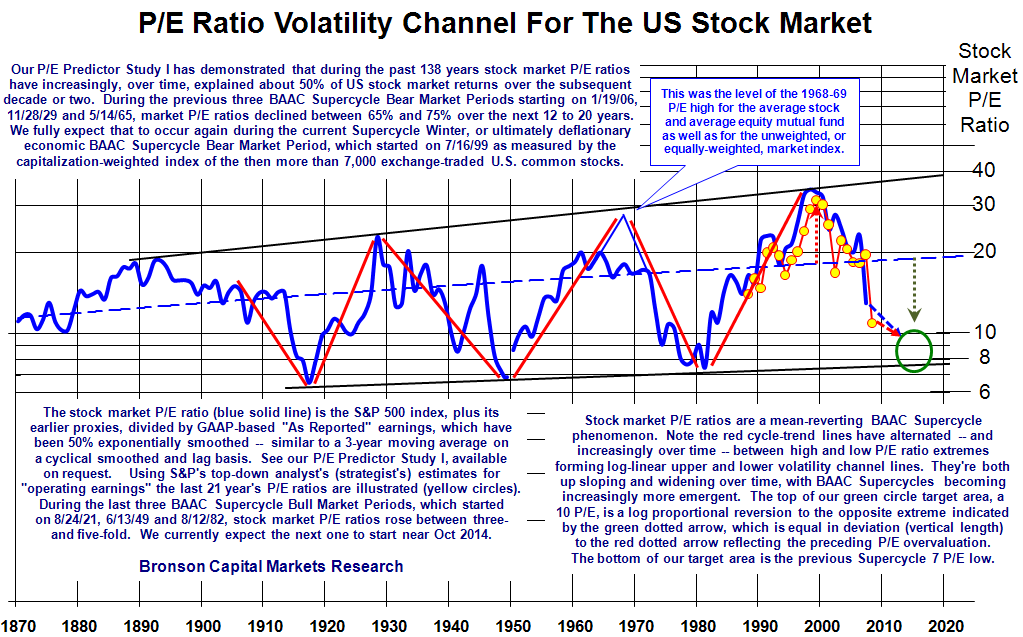

How can you tell if you are overpaying for a stock? Many consider the PE ratio to be a good indicator of value.

What is Price-Earnings Ratio?

PE is the ratio of current price of a share of a company to its earnings per share.

Heres Apples PE ratio from Yahoo Finance.

In laymans terms, PE tells you the price you are paying relative to the companys performance. The higher the PE, the more expensive a stock is.

Whats a good PE ratio?

Benjamin Graham, regarded as the father of value investing, in his book Security Analysis says:

We would suggest that about sixteen times average earnings is as high a price as can be paid in an investment purchase in common stock.

Today 15 or 16 is considered a fair price. But then finding good companies isnt that simple. PE ratios differ based on the competition, sector and time period.

For instance you would be hard pressed to find a high-growth technology company trading at a low PE.

Is a stock with a low PE necessarily a bargain?

Not necessarily. A low PE could be due to the sector the company is in (utility companies historically have low PE ratios), low investor confidence in future earnings, ongoing SEC investigations and various other factors. Always research thoroughly. If somethings too good to be true, it usually is!

Back to our story. AT&T back in 1999 was trading at a PE of over 25! Even with its outrageous long distance plans, AT&T simply couldnt live up to investors expectations.

Today AT&T trades at a PE of a little over 7. Is it a bargain? Only time will tell. Verizon on the other hand, is trading at a PE of 39!

Calculating PE

Heres Apples PE ratio from three different sites: