VIX Futures—Crystal Ball or Insurance Policy Six Figure Investing

Post on: 30 Апрель, 2015 No Comment

VIX Futures—Crystal Ball or Insurance Policy?

Many people seem to believe that the CBOEs VIX Futures market is attempting to predict upcoming CBOE VIX® values. I think they are mistaken. Most futures prices have very little to do with predicting the future.

Futures contracts were invented to allow producers/consumer of commodities to limit their business risk by locking in future prices. In exchange for eliminating price risk they give up the potential for increased profits if markets later moved in their favor. Traders wasted no time using futures for speculation, not because they somehow foretell the future, but rather because the low margin requirements for futures allows them to heavily leverage their bets.

Prices for futures contracts are constrained by arbitrage. For example, if an arbitrager sees the premium for Dec 2013 E-mini S&P 500 futures rise above a certain point they will short E-mini contracts and buy the appropriate amount of stocks in the S&P 500 (or just short SPY). From this point on they don’t care what direction the market moves—they are perfectly hedged—a risk free position. The transaction is triggered when there is sufficient difference between the current S&P prices (the “spot” price) and the December contract bid price to compensate for their cost of capital to buy the stocks, account for dividends, and deliver the target profit. Alternatively, if they think the futures price is too low, they reverse the transaction, buying the future and shorting the S&P 500. Companies will differ in how much premium they require between the spot price and the futures price but the net effect is that E-mini prices trade between these boundaries—they aren’t a divination of the S&P 500’s value in December 2013.

For physical commodities like corn or natural gas the cost of storage is included in the futures pricing and in some cases seasonality. For example, prices for corn might be depressed during harvest time because some producers want to move the product directly to market so they don’t have to store it.

Arbitrage for VIX futures is a much trickier thing. You can’t buy volatility on the spot market and store it in your garage for a few months. The best you can do is buy or sell the appropriate set of S&P 500 (SPX) options—the ones that expire 30 days after the settlement date, and eventually subject yourself to the settlement process. Settlement is via the tweaky Special Opening Quotation (SOQ) process, which can’t even tell you ahead of time the full set of options that will be used for the settlement and in the last year has differed from the VIX opening price by as much as +4.27% / -3.8% on the morning that VIX Futures settle.

Contiguous SPX options are only available for the next 4 or 5 months, so the options associated with further out VIX futures expirations (up to 9 months out) are sometimes not even available. Clearly market makers in VIX Futures must have other ways to hedge their positions (e.g. VIX futures spreads, VIX options, calendar spreads of SPX options). In fact with the recent CBOE announcement of plans to start VIX futures trading 5 hours earlier than the current 8:15 ET, to coincide with European trading hours it appears they don’t even need the S&P 500, SPX options, or the VIX to operate their market—at least for a few hours.

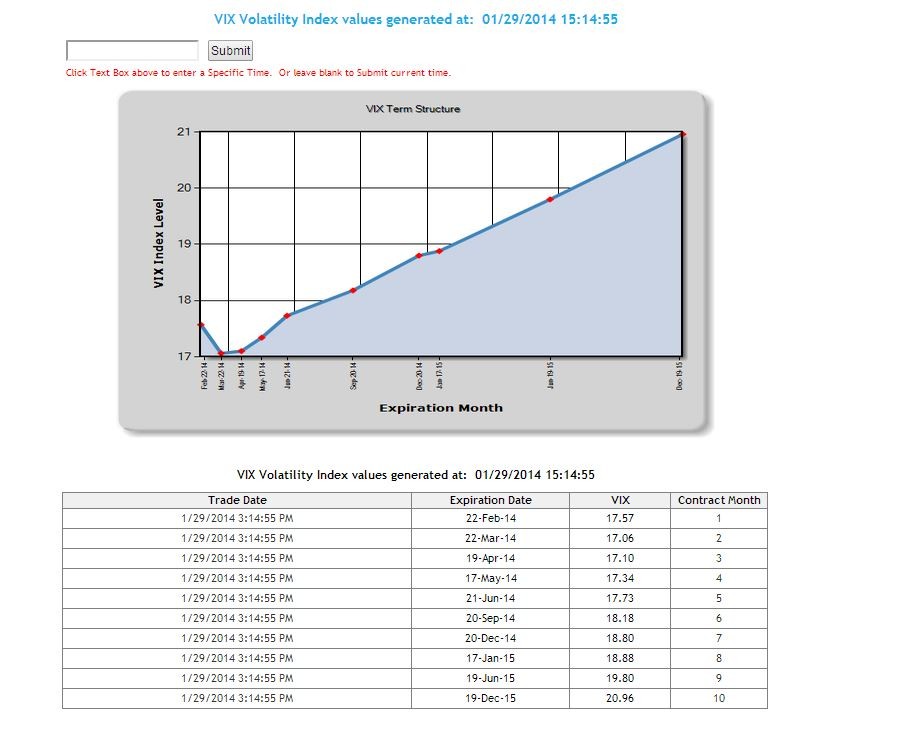

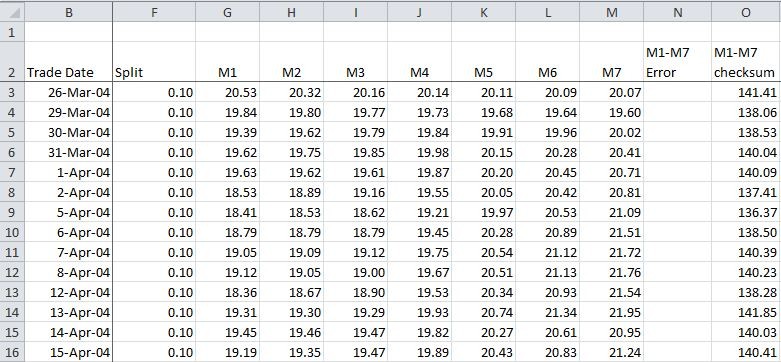

A quick look at historical data suggests that VIX futures tend to trade at a 3% to 9% premium to the VIX level of their associated SPX options. A chart with April 10, 2012 and April 11, 2013 data is shown below: