Using AAII Portfolios

Post on: 31 Март, 2015 No Comment

AAIIs purpose is to provide investment education and information. Our ongoing goal is to prepare individual investors to effectively manage their investments and to provide the necessary education, data and support to help them in that effort.

Over the years, however, we became increasingly aware that many of our members wanted more specific help. In talks with members, we found that there is a need for an intermediate level of supportnot a complete advisory letter, but some specific guidance for individuals in developing an effective investment programa real-world example of how to take an investment approach and construct and monitor an actual portfolio. AAII addresses this need by offering our members access to two model portfolios:

- AAII Model Fund Portfolio

- AAII Model Shadow Stock Portfolio

This brief guide is offered as a starting point for those members interested in following the investment direction and education we offer through the AAII model portfolios. The performance of these real-world portfolios has been impressive, but please be advised that a bit of study and commitment is required of members seeking to follow our portfolios.

AAII Model Fund Portfolio

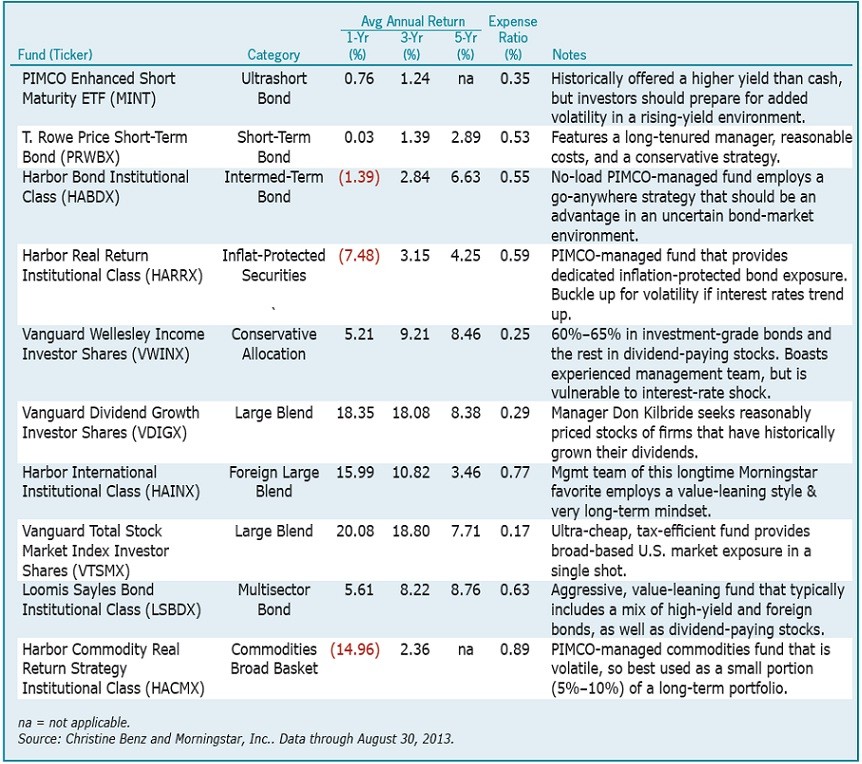

First Methodology

The fund selection rationale consists of two distinct approaches. The first approach is to select actively managed funds where the managers have shown a long-term ability to outperform the market after allowing for additional portfolio risk, regardless of the sector invested in. A fund must have the following characteristics to be considered for the Model Fund Portfolio:

- It must be a pure no-load fund. Short-term holding penalties are allowed if paid to the fund and not the manager.

- It must have been active for 10 years. However, exceptions are possible.

- It must have outperformed the S&P 500 index over the past five-year and 10-year periods.

- In its worst three-year (calendar) period it must not have had a loss; or, in particularly difficult market periods, its loss must have been substantially less than that of the S&P 500 index.

- Its expense ratio must not be above 1.25%. Lower rates will increase desirability.

- Fund assets must not be over $10 billion. Some exceptions are permitted, depending on fund objectives.

- It must currently be open to individual investors, with a minimum investment of $25,000 or less.

The above rules apply to new fund selections. Funds will not automatically be eliminated if they later violate the rules without considering other factors.

Second Methodology

The second methodology selects investment approaches that have provided excess returns or reduced portfolio risk to investors over the long term and then searches for the best traditional fund or exchange-traded fund (ETF) in that area. Factors to be considered are:

- The liquidity of the fund.

- The resources of the management company, in the case of ETFs.

- The investment returns and risk over as long a term as possible, given the newness of so many ETFs.

- Selection of areas with demonstrated long-term excess returns: value stocks, small-capitalization stocks, real estate, and special areas where individuals cannot easily invest. An example of a fund in a special area would be Fidelity Capital & Income fund (FAGIX), which invests in distressed securities.

Portfolio Management Notes

- The Model Fund Portfolio is meant to be a portfolio, and we suggest you invest in the entire portfolio on an equal investment basis—that is, invest equal dollar amounts in each fund initially.

- If a fund is closed, create your portfolio from the remaining funds.

- You may make adjustments based on your non-fund holdings. For example, if you have partnership or individual holdings in investment real estate (not personal housing), you may reduce or eliminate any REIT funds.

- There is no need to rebalance on a regular basis. Rebalancing can be accomplished when there are portfolio changes or if one holding gets way out of line. We will notify you of any rebalancing in the Model Fund Portfolio.

Getting Started: AAII Model Fund Portfolio

AAII communicates information about our Model Fund Portfolio to our membership via both print and online methods. Our ongoing print coverage is provided through James Cloonans AAII Model Portfolios column in the AAII Journal. Performance information and commentary are always posted and kept up-to-date at www.aaii.com/fundportfolio .

We encourage members to study this guide, read the Journal articles and visit the Model Fund Portfolio area of AAII.com prior to investing in any funds.

AAII Model Shadow Stock Portfolio

The Model Shadow Stock Portfolio provides guidance for investing in the promising micro-cap value sector of the market. The portfolio was initially conceived to show the membership of AAII how to capitalize on the most promising academic research to manage a stock portfolio without having to commit a great deal of time and effort to day-to-day monitoring. In fact, AAII manages this real-money stock portfolio (it is not a hypothetical portfolio) by simply reviewing holdings on a quarterly basis.

The Model Shadow Stock Portfolio reflects the following beliefs:

- The best stocks for individual investors are not the same stocks that are best for institutions.

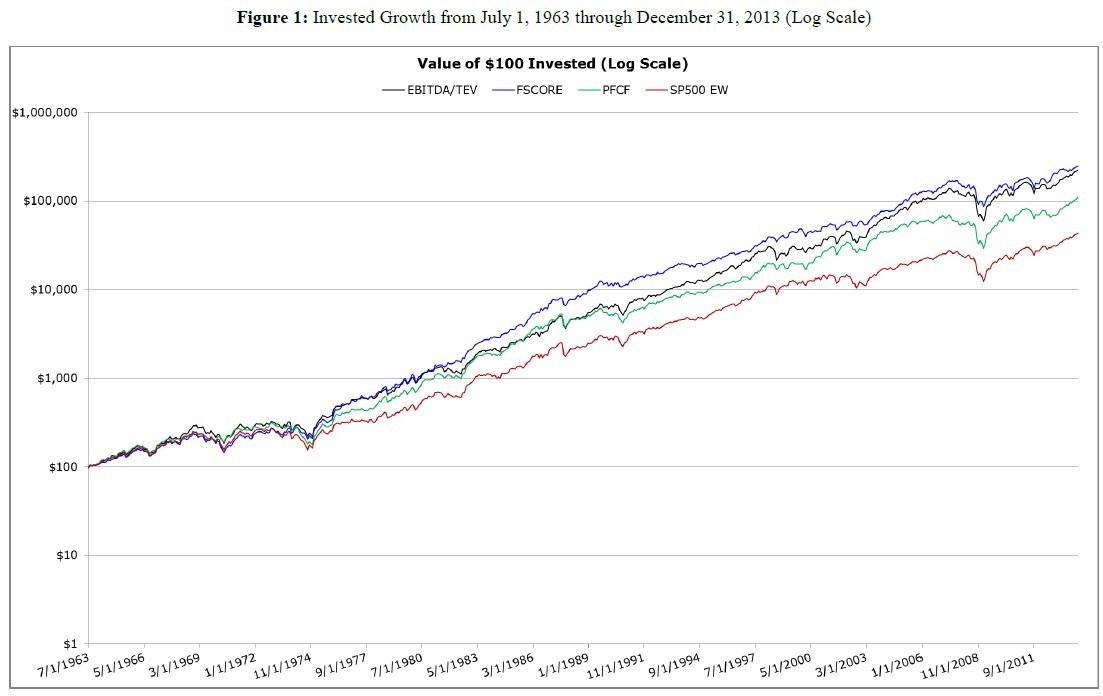

- Over the long run, research indicates that value stocks outpace the market, as do small (and micro-cap) stocks.

- Excessive trading of small-cap stocks hurts your bottom line; you can achieve solid returns by simply adjusting your portfolio quarterly.

- Ultimately, the best returns come from giving major consideration to risk. Success comes more from concern for the overall portfolio than for individual stocks.

A True Do-It-Yourself Model

To pick the right stocks for AAII’s Model Shadow Stock Portfolio, we focus primarily on portfolio formation and risk reduction. The stocks in the AAII Model Shadow Stock Portfolio are largely risky stocks when evaluated separately. But when taken together as a portfolio, most of that individual stock risk has been diversified away. In fact, the average risk of the individual stocks has been reduced by about 70%. The central point of our Model Shadow Stock Portfolio is that the risk of any individual stock is not important if your portfolio is well diversified. What is important is how the addition of that stock affects the risk of your overall portfolio. If you are not following our full portfolio but instead use our list of stocks as a tool to generate investment ideas, we suggest that you adhere to our overall strategy by selecting and monitoring a portfolio that consists of at least 10 stocks. Choosing stocks in different sectors will provide added diversification and protect your portfolio from some sector volatility. Furthermore, be sure to consider fees when making your investments. While there is no recommended minimum, investments should be large enough so that fees are insignificant.

While the Model Shadow Stock Portfolio minimizes risk, it is still prudent to take into account your personal risk tolerance. Investors are rightly worried about the amount they invest in a micro-cap strategy. Even a properly diversified micro-cap portfolio will be more volatile than the total market because these stocks are inherently more risky. The worst time to sell a stock is at the bottom, so be sure not to put so much weight into your micro-cap portfolio that you cannot stomach the losses. Keep in mind that due to the nature of the Model Shadow Stock Portfolio, it will offer very little income in the form of dividends.

Two Ways to Build Your Own Shadow Stock Portfolio

Follow the guidance provided here and issued in the AAII Model Portfolios columns in the January, April, July and October AAII Journalsremember, this portfolio was designed to require only simple modifications on a quarterly basis when company fundamentals change.

Utilize the resources we offer at www.aaii.com/stockportfolio where we provide monthly updates on the Passing Companies. The Passing Companies list shows the companies that meet the criteria for the Shadow Stock screen on the data as of date. This list is not to be confused with the Actual Portfolio list, which shows the companies that AAII currently holds in our Model Shadow Stock Portfolio. We run this screen monthly, so please click here for the most current list of stocks.

Ongoing Management of Your Stock Portfolio

AAIIs Model Shadow Stock Portfolio is not intended to be an advisory service in the usual sense of that termit is not intended to be a list of individual stock recommendations. Instead, the model portfolio serves to show you how to use a value-oriented approach to select micro-cap stocks in an effort to build your own Shadow Stock Portfolio. Profitable micro-cap investing requires extra care. The portfolio construction and monitoring rules were developed over the years to minimize real-world costs and maximize profits.

In the pages of the AAII Journal, we provide quarterly commentary on the Model Shadow Stock Portfolio (ours has been running for 20 years) and provide suggestions on how you can vary our approach to build a portfolio suitable for your own specific needs. At www.aaii.com/stockportfolio. we present the detailed rules for building and managing a Shadow Stock Portfolio as well as a monthly list of stocks that meet the criteria for inclusion.

Ongoing performance of AAIIs Model Shadow Stock Portfolio is tracked online, but keep in mind that a portfolio can be built by simply following the investment moves outlined in the AAII Model Shadow Stock Portfolio columns found quarterly in the AAII Journal.

Stock Portfolio Management Criteria

It is our belief that a quarterly review of the following purchase, sale and management criteria is all that is needed to build your own Shadow Stock Portfolio. Simply review your holdings on a quarterly basis to see if any fundamental changes make them candidates for sale (see sell rules below). If you have new investment funds available or cash from sales, you can look at the list of Passing Companies (www.aaii.com/stockportfolio ) to see if any companies meet your needs for inclusion in your Shadow Stock Portfolio.

Stock purchases must meet these criteria:

- Price-to-book-value ratio must be less than 0.80. If the price-to-book-value ratio moved up a bit since the stock was included in the portfolio, it is OK to purchase the stock unless this ratio goes above 0.90.*

- Market capitalization must be between $17 million and $300 million.*

- Price-to-sales ratio must be less than 1.2.*

- The firms last quarter and last 12 months earnings from continuing operations must be positive.

- The share price must be greater than $4.

- No bulletin board or pink sheet stocks will be purchased.

- No financial stocks or limited partnerships will be purchased.

- No foreign stocks will be purchased because of different accounting and/or withholding tax on dividends.

- Any stock that was sold within two years will not be rebought.

- Note second item under stock order guidance (below) concerning spreads when buying shares.

- Eliminate any company that failed to file a 10-Q (quarterly) report in the last six months.

*These figures will change gradually as market values change. Any changes will be noted in the AAII Journal and online.

Stocks are sold if any of the following occur:

- The stock reports a string of negative earnings:

If last 12 months earnings from continuing operations are negative, the stock is put on probation; if a subsequent quarter has negative earnings prior to 12-month earnings from continuing operations becoming positive, the stock is sold.

The stocks price-to-book-value ratio goes above three times the initial criterion.

Market capitalization goes above three times the initial maximum criterion.

In summary, we sell when the market recognizes the value of one of our holdings, thus driving up the price so that it no longer remains in the shadows of Wall Street.

Stock order guidance:

- These rules are for general guidance. Your own experience, market conditions and size of position will impact decisions.

- Market orders are not used. Instead, if the quoted bid/ask spread is less than 2% (ask price minus bid price, divided by ask price), place a limit order at the ask price for a buy and at the bid price for a sell. If the bid/ask spread is more than 2%, try to place a limit order between the bid and ask prices to keep transaction costs low. If necessary, build a position gradually. With low commissions, it is often better to place partial orders than to try to establish a large position all at once. Be patient.

- The average daily dollar volume should be at least four times the amount needed for your position. This will ensure liquidity to get in and out of the position, even if you need to grow the position gradually and sell gradually. This will result in a varying number of qualifying stocks for each investor.

- For NASDAQ stocks, it appears to be better to use day orders. If the order is not filled, it is placed again with a slight adjustment. For NYSE and Amex stocks, good-till-canceled (GTC) orders are used to keep a place in line in the specialists books. If the market isnt close to the desired price, the price is adjusted in a few days with a new GTC order.

- If price changes cause a stock to become ineligible (due to changes in the price-to-book-value ratio or market capitalization) when only part of the order has been filled, shares already purchased are kept but the balance of the order is canceled.

Management rules:

- Equal dollar amounts are invested in each stock initially.

- Decisions are made only at the end of each quarter. In order to react to the majority of earnings reports as soon as possible, quarterly reviews are made in February, May, August, and November.

- Best judgment is used for tenders or mergers, but all criteria must be obeyed.

- At the end of a quarter, if receipts from stocks sold exceed requirements for new purchases, the excess receiptsup to 5% of the portfolios valueare kept in cash until the next quarter. If the excess receipts are greater than 5% of the total portfolio value, the amount above 5% is distributed to smaller holdings that still qualify as buys. Efficient quantities are purchased: If over 10% of the portfolio is in cash, the price-to-book-value ratio can be moved up, but never over 0.90.

- At the end of a quarter, if receipts from stock sales are insufficient to buy all newly qualifying stocks, purchases are made in order of lowest bid/ask spreads.

- Note that if you are managing your own portfolio, it should consist of at least 10 stocks. If you are developing the portfolio gradually you can do it stock by stock, but dont put more than 10% of your funds in each additional stock. More than 20 stocks are not needed until the portfolio exceeds $1 million.

Getting Started: AAII Model Shadow Stock Portfolio

AAII communicates information about our Shadow Stock Portfolio to our membership via both print and online methods. Our ongoing print coverage is provided through James Cloonans AAII Model Portfolios column in the AAII Journal. Performance information and commentary are always posted and kept up-to-date at www.aaii.com/stockportfolio .

We encourage members to study this guide, read the Journal articles and to visit the Model Shadow Stock Portfolio area of AAII.com prior to investing in any stocks.