Tutorial Benjamin Graham and Serenity Stocks

Post on: 19 Октябрь, 2015 No Comment

Contents

Introduction

Successful investing is the key to financial stability and building wealth. But when starting out, the prospect can be daunting. The field of finance is surrounded by fears and misconceptions — investing is complicated, one must know advanced math, building wealth requires taking risks, stock markets are dangerous etc. Let’s try to debunk some of these myths, and see what you really need to know to invest safely and successfully.

Warren Buffett is possibly the world’s most successful investor, and invests in stocks. Stocks have many advantages over other investments. They have more liquidity, they are naturally hedged (protected) against inflation, and most importantly, they have historically beaten all other forms of investment.

Benjamin Graham was Warren Buffett’s professor and mentor at Columbia Business School. In fact, Buffett even named his son after Graham, and describes Graham’s book — The Intelligent Investor — as by far the best book about investing ever written. In this tutorial, we’ll look at how Graham’s methods can be applied — as faithfully as possible — to today’s stock markets using modern technology.

What Are Stocks and How Do They Grow

Owning a stock is the legal equivalent of owning a share of a company. For ease of investing, stocks are traded on stock markets. The price quoted for a stock on the market changes every day, and there are often large differences between the underlying worth of a stock and the price quoted for it. Highly underpriced and overpriced stocks tend to correct themselves over time, as do highly underpriced and overpriced markets as a whole.

If a stock is chosen correctly, one’s investment will grow as the stock price corrects itself, and also as the company grows. This is where Graham’s teachings come into play — finding the right companies at the right price. Companies and their accountants are constantly trying to make their stocks look better. The challenge for investors is to uncover the facts behind the financial statements and annual reports.

Evaluating Stocks — The Quantitative Measures

The first numbers to look at when evaluating a stock are its Earnings Per Share (EPS) and Book Value Per Share (BVPS). If you were buying groceries, EPS and BVPS are similar to weight or quantity. They tell you how much of something you’re getting for your money.

Earnings Per Share:

EPS tells you how much profit that company makes per share.

EPS combined with price gives you a rough idea of what rate of return you can expect on your investment. EPS and Price are usually mentioned together as the PE ratio, or Price-to-Earnings ratio.

Book Value Per Share:

BVPS is the theoretical liquidation value of the stock. That is, if the company were to close tomorrow, BVPS tells you how much you would be paid per share after all the company’s assets are sold at their depreciated prices, and all liabilities are paid.

However, most companies also include things like Goodwill and other intangibles — which have no real resale value — in their balance sheets. It’s important to use only tangible book values when calculating the liquidation value.

Evaluating Stocks — The Qualitative Measures

When buying something, we also need to look at how good it is, and not just how much we’re getting.

Graham recommended three different qualitative categories of stocks, and different quantitative requirements for each of them. Just as with buying anything else, the fewer qualitative measures a stock meets, the more quantity (EPS and BVPS) it will be required to provide per Dollar.

First Category — Defensive:

The safest category of stocks recommended by Graham were for Defensive investors. The criteria that Graham specified for identifying them are as follows:

Summarized from Chapter 14 of The Intelligent Investor — Stock Selection for the Defensive Investor:

1. Not less than $100 million of annual sales.

2-A. Current assets should be at least twice current liabilities.

2-B. Long-term debt should not exceed the net current assets.

3. Some earnings for the common stock in each of the past 10 years.

4. Uninterrupted [dividend] payments for at least the past 20 years.

5. A minimum increase of at least one-third in per-share earnings in the past 10 years.

6. Current price should not be more than 15 times average earnings of the past three years.

7. Current price should not be more than 1-1⁄2 times the book value.

As a rule of thumb, we suggest that the product of the multiplier times the ratio of price to book value should not exceed 22.5.

Graham’s recommended price for Defensive quality stocks can be calculated from criteria #6 and #7. This price is popularly known as the Graham Number.

Note that the Graham Number is designed to quantitatively assess any stock, regardless of sector or industry. For example, a public utility company that is typically low on Earnings will need a higher asset figure to justify its price. Similarly, a Financial Services company that is typically low on assets will need a higher Earnings figure to be an acceptable investment.

Graham recommended a minimum portfolio size of 10 for Defensive quality stocks, or in other words, not more than 10% of total investment per stock.

Second Category — Enterprising:

For Enterprising investors who are looking for greater profits — and are willing to put in more effort into the maintenance of their portfolio — Graham then recommended the following criteria for identifying Enterprising quality stocks:

Summarized from Chapter 15 of The Intelligent Investor — Stock Selection for the Enterprising Investor:

1-A. Current assets at least 1 1⁄2 times current liabilities.

1-B. Debt not more than 110% of net current assets.

2. Earnings stability: No deficit in the last five years covered in the Stock Guide.

3. Dividend record: Some current dividend.

4. Earnings growth: Last year’s earnings more than those of 1966.

5. Price: Less than 120% net tangible assets.

Thus, the price limit for a stock meeting Enterprising quality requirements is the lower of 120% net tangible assets, or 10 times current earnings. We can combine the two — as Graham did for the Defensive Price — to yield a quantitative price calculation similar to the Graham Number. We’ll call this the Serenity Number.

Just like the Graham Number, the Serenity Number too applies to any stock — regardless of sector or industry — because it’s a combination of both Assets and Earnings. A lower value in one will have to be compensated for by a higher value in the other.

Serenity’s recommendation is for a minimum portfolio size of 20 for Enterprising quality stocks; or in other words, not more than 5% of total investment per stock.

Third Category — NCAV:

For investors who were willing to put in the most effort into the maintenance of their portfolio, Graham finally recommended NCAV quality stocks, which he defined as:

Summarized from Chapter 15 of The Intelligent Investor — Stock Selection for the Enterprising Investor:

Bargain Issues, or Net-Current-Asset Stocks

. price less than the applicable net current assets alone — after deducting all prior claims, and counting as zero the fixed and other assets.

. eliminated those which had reported net losses in the last 12-month period.

These criteria give us stocks selling for less than the value of their cash worth alone, and with positive earnings in the last one year.

Since NCAV stocks are the least established of all stocks, they also require the most diversification. A portfolio of NCAV stocks will require at least 30 NCAV stocks, or not more than 3.3% of total investment per NCAV stock.

Finding Graham Stocks Today — Classic Graham Screening

The good news is that today’s technology makes it easy to find stocks that meet even such advanced criteria. Serenity’s data-mining algorithms apply all 17 rules in Graham’s stock selection framework, to a data warehouse of all 5000+ NYSE and NASDAQ stocks.

Shown below on the Classic Graham Screener is list of stocks that meet all of Graham’s Defensive criteria, as well as those that meet all the qualitative Defensive criteria and part of the quantitative Defensive criteria.

Similar searches can also be done to find stocks that — both completely and partially — meet Graham’s Enterprising and NCAV criteria.

Thus, one can build a sizable Graham stock portfolio today using just the Classic Graham Screener .

Finding Graham Stocks Today — Advanced Graham Screening

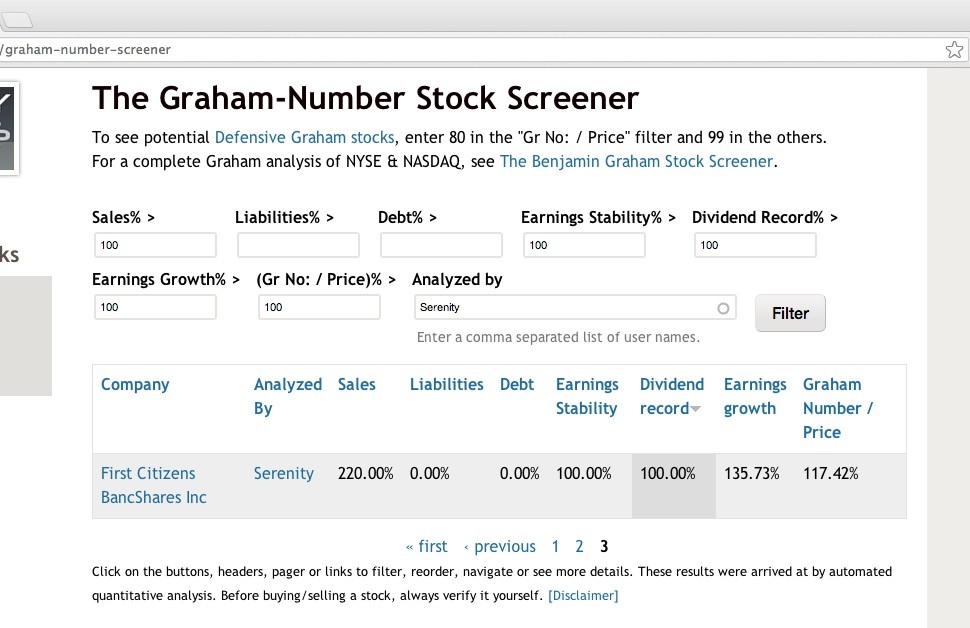

Using the more customizable Advanced Graham Screener. we can also find stocks that meet different combinations of qualitative and quantitative criteria.

For example, here is a partial list of stocks that completely meet Graham’s NCAV criteria, as well have $250 Million in Sales and 5 years of uninterrupted positive Earnings.

The Advanced Graham Screener can also be used to find stocks meeting very unique requirements. For example, here is a stock that completely meets Graham NCAV criteria, and has also been paying uninterrupted dividends for the last 20 years.

Note that the Graham Number is 137% of the Serenity Number.

Essentially, for a given EPS and BVPS, we pay 137% more for a Defensive quality stock since it is of higher quality than an Enterprising quality stock. Thus, the criteria for Enterprising quality stocks can be approximately replicated on the Advanced Graham Screener using the values — CA/2CL. 75%, NCA/LTD. 90%, EPS Stability: 50%, Div Record: 5% and GN/PC: 137%.

Of course, this is assuming that the Reported BVPS has no intangibles. If it does, the GN/PC would need to be higher than 137%. Enterprising quality stocks also need to have an EPS higher than that of 5 years ago.

Shown below is a partial list of stocks that completely meet Graham NCAV criteria, and additionally clear almost all of the above Enterprising criteria.

Note that every one of these stocks already clears Graham’s NCAV criteria completely, apart from the additional criteria. Thus, the Advanced Graham Screener can be used to select stocks of both higher and lower compliance with Graham’s specifications.

Lastly, the Advanced Graham Screener can also be used to compare all Graham ratings — and other data — for any set of stocks of your choice, as shown below.

This comparison can also be done on the Classic Graham Screener. but with fewer fields available for comparison across stocks.

A Sample Graham Analysis — Universal Corporation

To understand how a full Graham analysis works, let’s take the example of Universal Corporation. In the Financial Condition tab for UVV on Serenity, we see the sales and balance sheet figures that were used in the qualitative analysis.

Annual Sales: $2,540.00 Million

Current Assets: $1,673.20 Million

Goodwill: $0.00 Million

Intangibles: $99.50 Million

Total Assets: $2,270.90 Million

Current Liabilities: $455.00 Million

Long Term Debt: $240.00 Million

Total Liabilities: $892.70 Million

Preferred Stock: $213.00 Million

Shares Outstanding: 23.22 Million

This data is used to calculate ratings like Assets/Liabilities, Assets/Debt etc. and the NCAV price. But most importantly, this data is used to calculate the Tangible Book Value. UVV has reported a Book Value of $50.19. But after deducting Goodwill and Intangibles from the Total Assets, we get a lesser Book Value of $45.90.

This change affects both the Enterprising Price, as well as the final Quantitative Result for Enterprising quality stocks. So every stock on Serenity has both the Reported BVPS and Tangible BVPS displayed on it in the Per Share Values tab. as shown below. Only the Tangible Book Value is used for evaluating Enterprising quality stocks.

Combining all the above data with UVV’s dividend history, we get the following ratings for UVV for each of Graham’s Defensive criteria:

Sales | Size (100% ⇒ $500 Million): 508.00%

Current Assets ÷ [2 x Current Liabilities]: 183.87%

Net Current Assets ÷ Long Term Debt: 507.58%

Earnings Stability (100% ⇒ 10 Years): 100.00%

Dividend Record (100% ⇒ 20 Years): 100.00%

Earnings Growth (100% ⇒ 30% Growth): 142.00%

Graham Number ÷ Previous Close: 132.07%

Shown below is the Final Graham Assessment tab for UVV which gives a summary of the entire analysis.

We see that UVV has a Defensive Price (Graham Number) of $67.52, an Enterprising Price (Serenity Number) of $53.77 and an NCAV Price of $24.44. We also see that the qualitative result for UVV is Defensive and thus, the Defensive Price (Graham Number) is also the Intrinsic Value.

Finally, we see the last closing price of the stock ($43.46), and that UVV has a quantitative result of 100% (since the Intrinsic Value is more than the last closing price). Quantitative Results on Serenity are capped at a maximum of 100% to avoid differentiating between stocks that pass the quantitative criteria to different degrees.

Thus, not only do we get a meticulous Graham analysis for UVV, but we also get to see all the data used for the analysis. So once a list of potential stocks for investment is shortlisted using Serenity’s stock screeners. the figures used for analysis can (and should) be verified against the annual reports of the individual companies before investment.

To Conclude

In The Intelligent Investor, Graham says Confronted with a [like] challenge to distill the secret of sound investment into three words, we venture the motto — Margin of Safety. Almost everyone in the financial world will tell you that for better returns, you need to take greater risks. But Graham taught that in the long run, an investor’s overall returns depend on the amount of intelligent effort he was willing to put into his investments, and that increased risk actually reduces returns.

There are those who will say that Graham’s principles are outdated, citing Globalization and Technology. But stocks like IBM have existed since Graham’s time, and institutions like the World Bank and IMF were established early in the 19th century to regulate international trade. Stock markets have existed for nearly 400 years now; NYSE for 150 years. The proliferation of technology may have made stock markets more competitive, but the fundamental ways in which they function remain the same.

Warren Buffett once wrote an article explaining how Benjamin Graham’s principles are everlasting, their results irrefutable, and his students consistently exceptional. It’s called the called The Superinvestors of Graham-and-Doddsville. A reading of both Buffett’s article and The Intelligent Investor is strongly recommended for any aspiring investor.

The Classic Graham Screener and the Advanced Graham Screener let you assess 5000+ NYSE and NASDAQ stocks today against all the above 17 Graham rules.

Appendix I — The Misquoted Benjamin Graham Formula

Most of what Graham actually taught has been forgotten today, and things he warned against are often attributed to him instead. Even when Graham’s actual methods are used, they are often modified to clear the stocks rather than having stocks clear them.

The below formula is a great example of a Graham misquote:

Intrinsic Value = EPS x (8.5 + 2xGrowth)

Benjamin Graham actually gave several warnings about this formula and only used it to show why such oversimplified growth estimates are unreliable. But due to a printing omission in recent editions of The Intelligent Investor. this formula is often recommended as the Benjamin Graham Formula today.

Appendix II — Some General Graham Principles

A detailed study of all of Graham’s principles is beyond the scope of this tutorial. But given below is a summarized list of general Dos and Don’ts based on Graham’s teachings and The Intelligent Investor .