Treasury Stock Cost Method » Accounting Simplified

Post on: 16 Март, 2015 No Comment

There are mainly two methods of accounting for treasury stock: the cost method and the par value method. This section discusses the cost method.

The Cost Method

The cost method of accounting for treasury shares is the most common method of accounting for treasury shares because of its simplicity, and is the only method allowed by the IFRS. The main difference between the two methods is when a gain or loss is recognized on treasury stock transactions.

When companies use the cost method, the purchase of treasury stock is viewed as a temporary reduction in shareholders equity. The reason for this is that the company expects to reissue the shares instead of retiring them. When the company reissues the treasury shares, the temporary account is eliminated. The cost of treasury stock reacquired is charged to a contra account, in this case a contra equity account that reduces the stockholder equity balance. The purchase of treasury shares leaves the common stock and contributed balances intact.

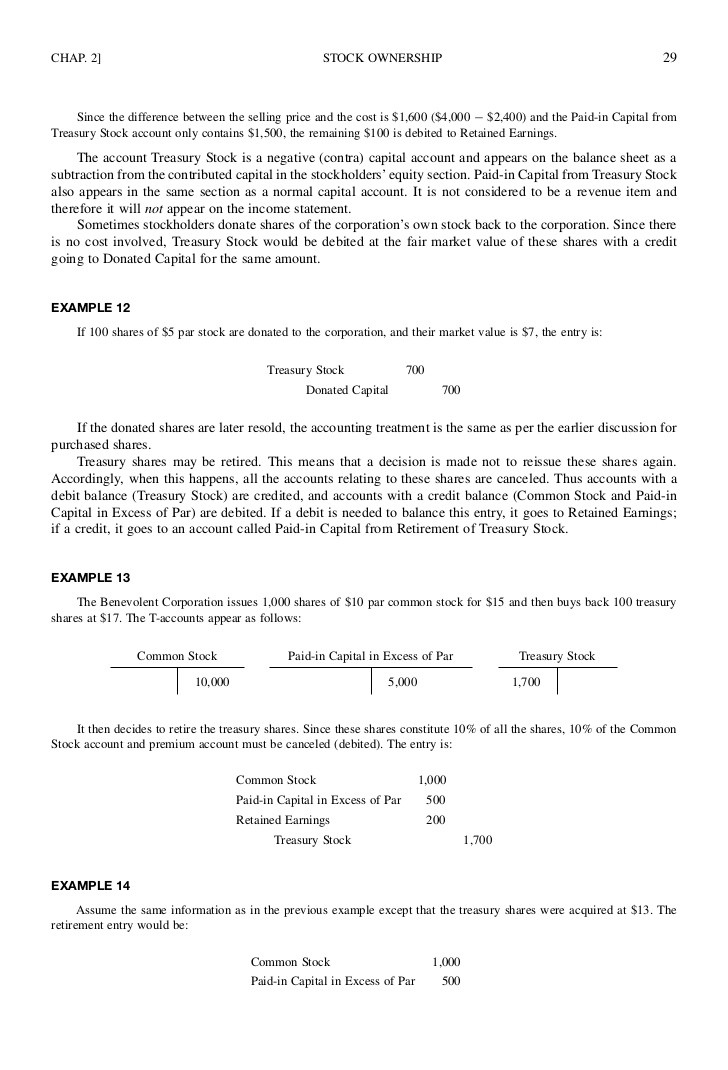

Sunny Sunglasses Shop Shareholders Equity

Accounting for Treasury Stock Using the Cost Method

Total Stockholders Equity

The stockholders equity section has decreased by $5,000. The capital accounts remain intact as originally reported, since the cost method treats the purchase of treasury share stock as a temporary reduction in stockholders equity.

In this example, Sunny issued 25,000 shares. Treasury stock is stock taken off the market and not yet retired, thereby reducing the number of shares outstanding. The amount of stock issued does not change, since the portion of the stock issued is now treasury stock held by the company, reducing only the amount outstanding by the amount of the treasury share stock.

Most states restrict earnings distributions and dividends to the balance of retained earnings less the cost of treasury shares held. GAAP therefore requires a disclosure in the form of a footnote or parenthetically which would be included with the balance sheet to signify the reduction of retained earnings from the acquisition of treasury stock. This is important since a company can only pay dividends to the extent of its available retained earnings less any treasury stock held, in this case $10,283 ($15,283 $5,000). The amount of shareholder equity that cannot be distributed to shareholders is often referred to as legal capital .

When the shares are reissued, treasury stock is credited for the cost of the reissued shares. If the treasury stock is reissued at a price greater than the original cost, the company credits a separate contributed capital from treasury stock account. If the company reissues the treasury shares at less than cost, the difference is first taken out of the contributed capital account for treasury shares. If the difference remains after reducing the contributed capital account to zero, retained earnings is then reduced.

Treasury Stock Transactions can only Decrease Retained Earnings

Companies cannot create earnings through buying or selling their own capital stock. Treasury stock transactions generally increase and decrease contributed capital. Occasionally treasury stock transactions may decrease retained earnings, but a company cannot increase retained earnings through treasury stock transactions.