Thomson Reuters Gives Elite Traders Early Advantage

Post on: 27 Сентябрь, 2015 No Comment

Getty Images

The Thomson Reuters building in New York.

A closely watched consumer confidence number that routinely moves markets upon release is accessed by an elite group of traders, for a fee, a full two seconds before its official release, according to a document obtained by CNBC.

A contract signed by Thomson Reuters. the news agency and data provider, and the University of Michigan, which produces the widely cited economic statistic, stipulates that the data will be posted on the web for the general public at 10 a.m. on the days it is released.

Five minutes before that, at 9:55 a.m. the data is distributed on a conference call for Thomson Reuters’ paying clients, who are given certain headline numbers.

But the contract carves out an even more elite group of clients, who subscribe to the ultra-low latency distribution platform, or high-speed data feed, offered by Thomson Reuters. Those most elite clients receive the information in a specialized format tailor-made for computer-driven algorithmic trading at 9:54:58.000, according to the terms of the contract. On occasion, they could get the data even earlier—the contract allows for a plus or minus 500 milliseconds margin of error.

In the ultra-fast world of high-speed computerized markets, 500 milliseconds is more than enough time to execute trades in stocks and futures that would be affected by the soon-to-be-public news. Two seconds, the amount promised to low latency customers, is an eternity.

For exclusive access to the data, Thomson Reuters pays the University of Michigan $1 million per year, according to the contract, in addition to a contingent fee based on the revenue generated by Thomson Reuters. The contract reviewed by CNBC was signed in September 2009. It expired a year later. Thomson Reuters and the University Michigan confirmed that the relationship still exists.

In a statement, Thomson Reuters said, Through an agreement with University of Michigan, Thomson Reuters is the exclusive distributor of the Thomson Reuters/University of Michigan Surveys of Consumers to its clients through various subscription services as well as to the general public via a press release. Details of the tiered release of this data are provided openly to Thomson Reuters customers and the wider public and anyone wishing to trade on this data can pay for the service that best meets their data needs.

Many market participants are not aware that some traders get a head start on market-moving data with plenty of time to execute trades before the general public receives the same information. And the existence of an elite group that receives early information is likely to attract criticism that it doesn’t square with the principle that market-moving information should be released to all market participants equally.

I worry that there’s both a fairness and a disclosure issue, said former Securities and Exchange Commission Chairman Harvey Pitt. If I’m paying a lot of money, I should know whether I have the best deal possible. If there was no disclosure of the tiered structure, that would be a serious problem.

To demonstrate that it disclosed the existence of a two-second lead time, Thomson Reuters sent CNBC a link to a Webpage of marketing material detailing the system. There, the firm cited a major market move on Aug. 12, 2011, in which U.S. stocks slipped after consumer sentiment data was released. Thomson Reuters News Feed Direct customers benefited from the 2-second advance and the fastest delivery in the market, the site said. The firm explained that this disclosure can be found on the Machine Readable News product page of its Website, under a drop-down menu for suite components.

Thomson Reuters declined to reveal how much it charges for access to each tier of data it sells. Thomson Reuters distributes a wide range of data on economic indicators to its customers.

The consumer confidence number is a measure of household opinion about the state of the economy that has been conducted since the 1940s. Surveyors conduct telephone interviews to gauge consumer sentiment. It is looked to by market professionals as a guide to where the economy might be heading, or how well consumers are dealing with adverse economic events.

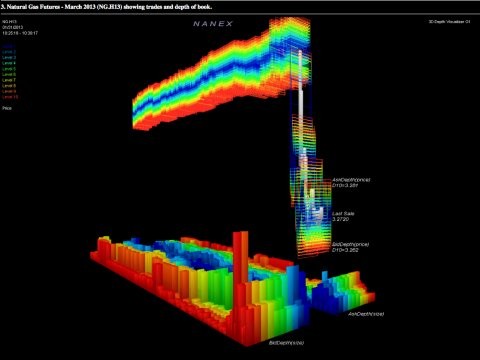

Within milliseconds, the new data causes market reaction—a move that can come the instant Thomson Reuters transmits the data to its elite group of traders. On May 17, for example, trading volume exploded in the Spider ETF at exactly 9:54:57.975. More than 100,000 shares traded hands in the first 10 milliseconds of the burst of activity, reports the analysis firm Nanex, LLC. Within 100 milliseconds, the price of SPY jumped from $165.90 to more than $166.06.

In the first half second of the trading burst, Nanex calculates that more than $40 million changed hands, just in the Spider ETF.

By 10 seconds into the event, more than $100 million had changed hands.

It takes a human being between 300 and 400 milliseconds to blink an eye.

Several economists contacted by CNBC said they were unaware that the data are released to the elite group two seconds before the 9:55 conference call. One called the release disingenuous, another called it unfair.

Thomson Reuters did not respond to a request for comment on those economists’ remarks.

But Pitt pointed out that private entities are usually free to distribute their own work product however they see fit, as long as they disclose what their arrangements are. A nongovernmental and noncorporate individual’s generic data analysis can be market moving, but if so that is merely a reflection solely of the work product of that individual, Pitt said. The insider trading laws can’t—and shouldn’t—be read to deprive the progenitor of personal analyses of the potential market uses that person can make of the data.

In marketing material on its Website, Thomson Reuters touts the virtue to traders of its economic data. Be The First To React, says the site, explaining that the service offers Data Your Algorithms Can Interpret.

The University of Michigan’s arrangement with Thomson Reuters dates to 2007, said a university spokesman. This is something that’s been reviewed carefully, said university spokesman Rick Fitzgerald. It’s been in place for a number of years, and we think it complies with all the regulations. Fitzgerald said the total amount received by the university under the deal has been very close to a million dollars each year.

Asked why a taxpayer-financed university should sell data to Wall Street before it releases it to the taxpayers, Fitzgerald said: Most of our research funding comes from private sources.

Richard Curtin, director of the Thomson Reuters/University of Michigan Surveys of Consumers at the Survey Research Center of the University of Michigan, defended the arrangement. This research project is privately financed, he said. Without the support from Thomson Reuters, no data would be collected, the project would no longer exist and the public benefit would disappear.

As for the university’s role, former SEC chairman Pitt said, I think public colleges should set a higher standard, but they need to get their money wherever they can, I suppose.

Within the past week, there have been two incidents involving trading ahead of the official release of market-moving data.

On June 3, Thomson Reuters inadvertently sent market-moving ISM manufacturing data early to its paying clients, many of whom immediately traded on the information before it was available to the wider market.

The manufacturing data, which that day came in disappointingly low and sent traders scrambling to sell shares, was set to be released at precisely 10 a.m. by the Institute for Supply Management, a private entity that puts out the data each month. Nanex showed a spike in the trading volume of the ETF SPY 15 milliseconds before 10 a.m. and a corresponding move down in the price ahead of the official release time of the information as computer trading algorithms processed the data and executed trades. Thomson Reuters said the accidental release was due to a minor clock synchronization issue. The firm said it would take steps to fix the problem.

Separately, on Friday, Nanex spotted a burst of trading about a half second before release of the Department of Labor’s highly scrutinized monthly jobs data, which often set the tone for market trading all day. It remains unclear what caused that spike in trading. There is no evidence that Thomson Reuters or the University of Michigan were involved with this early release of data.

Asked about the event, a Department of Labor spokesman said officials there saw nothing unusual during the lock-up in which members of the media are given the number in advance and asked to hold it for a precise 8:30 a.m. release time.

I am not aware of any information slippage, said Labor Department spokesman Carl Fillichio. There was nothing evidentially unusual during [the] lock up.

However, Fillichio did not discount the possibility of a mistake. You should remember that even if there was human error on our part and even if the switch was hit milliseconds early, everyone in the lockup would have been affected, so it would have still been a level playing field, Fillichio said.

_By CNBC’s Eamon Javers. Follow him on Twitter at @EamonJavers. CNBC’s Steve Liesman contributed to this report.