The Most Accurate Way To Gauge Returns The Compound Annual Growth Rate

Post on: 17 Март, 2016 No Comment

Experienced investors understand the benefits of knowing the growth rate of their investment portfolios in percentage terms. Calculating portfolio growth rate allows you to measure the success of your investments. An investor who fails to estimate the growth of his portfolio is unable to recognize if he is making effective and profitable investment decisions.

You may also measure the growth of a particular stock index, such as the S&P 500. Two popular ways exist to calculate portfolio growth rate. A common and effective method for estimating the growth rate of an investment portfolio requires calculating the compound annual growth rate. A less commonly used method involves calculating the average annual growth rate. Each method has its advantages and disadvantages, and investors should understand both methods to determine the best one to use.

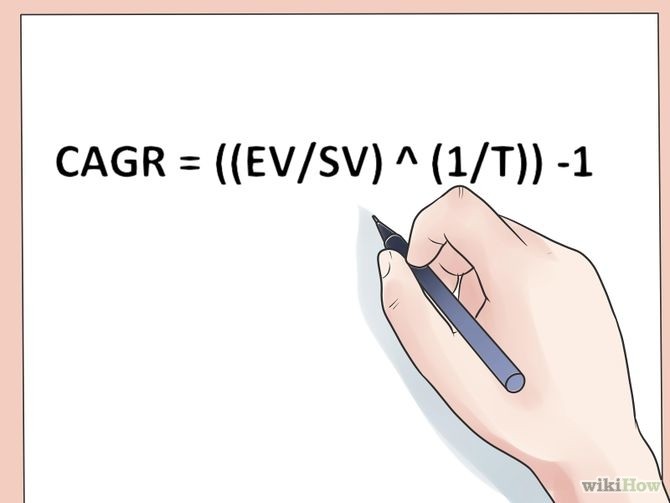

Calculating CAGR

The formula to calculate compound annual growth rate is (Ending Value / Beginning Value) ^ (1 / n) – 1. The character ^ represents a number raised to the power of and n represents the number of years of the investment portfolio. For example, suppose you invested $1,000 in 2007 that grew to $2,500 in 2011. CAGR for the investment portfolio equals 25.74 percent: ($2,500 / $1,000) ^ (1/4) – 1. An investment that grows by 25 percent is seen favorable by most investors.

Pros and Cons of CAGR

The advantage of using CAGR is that it is the most accurate method for calculating portfolio growth rate over multiple years. Investors may use CAGR to determine how well a stock performed against similar stocks or a particular stock market index. The disadvantage of using CAGR is that the method does not take volatility into account. CAGR assumes that investments are growing annually at a steady rate, when in reality yearly returns may fluctuate greatly. Volatility is an important element when making an investment decision, so investors should use CAGR with caution.

Calculating AAGR

The average annual growth rate method calculates the average increase of the investments within a portfolio over a one year period. The formula to calculate AAGR is (Ending Value — Beginning Value) / Beginning Value. For example, the initial investment in a portfolio was $1,000 in 2010 and grew to $1,500 in 2011. The AAGR from 2010 to 2011 is 33.3 percent ($1,500 — $1,000) / $1,500, which means that the portfolio grew approximately 33 percent in one year.

Pros and Cons of AAGR

The advantage of using AARG to calculate portfolio growth is the simplicity of the method. Investors can easily and quickly estimate a portfolio’s growth rate using AARG by calculating the arithmetic mean over the number of investment periods. AARG can also help investors determine growth trends for a particular investment portfolio. The disadvantage of using AARG is that it simply calculates the average of a series of growth rates, which can lead to an inaccurate measurement of growth rates in some cases. Many investors choose to use CAGR to calculate portfolio growth because it is more accurate in calculating growth over multiple years.