The Key Differences between Mutual Funds and ETFs

Post on: 20 Октябрь, 2015 No Comment

With all the jargon commonly used in the financial industry, it can be difficult to parse out the differences between similar investing concepts. Take mutual funds and exchange traded funds (“ETFs”), for example. Both are “funds” (collections of stocks, bonds, and other investments that make it easy to achieve diversified exposure to a segment of the market). So are there differences between them that could affect your portfolio?

There are, although they are small and subtle: all other things being the same, whether a fund is a mutual fund or an ETF generally won’t have a dramatic effect on your portfolio’s performance. But there are a few key differences to pay attention to when deciding which is right for a specific situation.

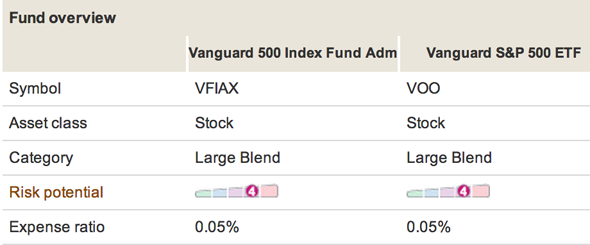

The main difference between mutual funds and ETFs is that they tend to represent very different investment philosophies and therefore contain different underlying investments. Most mutual funds are actively managed, meaning that the people who manage the fund select which specific investments the fund should hold. Most ETFs, by contrast, are passively managed and simply try to track the performance of an index of stocks or bonds (although many ETFs track customized indices that aim to achieve higher returns than conventional indices and therefore could be considered actively managed). There is plenty of overlap, however: there is a large number of both mutual funds and ETFs that are passively managed and try to track the performance of the S&P 500 index, for example.

In those cases where the aims of the mutual funds and ETFs are similar, the differences are even more subtle. There can be differences in the fees that you pay when buying or selling a fund: typically you have to pay a small commission when trading an ETF (just like when buying or selling individual stocks), whereas there can be a slew of fees associated with mutual funds (such as “front-end load fees”, “back-end load fees”, or “redemption fees”). These fees can vary dramatically depending on the fund and the situation: some brokerage companies offer free trades for specific ETFs, and many mutual funds have none of these extra fees.

Lastly, there can be differences in taxes. Whenever a mutual fund sells one of its underlying investments for a profit, it is considered a capital gain for the fund’s investors and can be taxed. Investors may therefore need to pay some capital gains taxes throughout the time that they hold the mutual fund in their portfolios. With ETFs, by contrast, investors usually don’t need to pay any capital gains taxes until they actually sell the ETF. ETFs are therefore generally considered to be more “tax efficient” than mutual funds, although this difference wouldn’t have any effect in tax-exempt accounts such as IRAs.

Share CircleBlack with your networks: