The Financial Risk Manager (FRM®)

Post on: 16 Март, 2015 No Comment

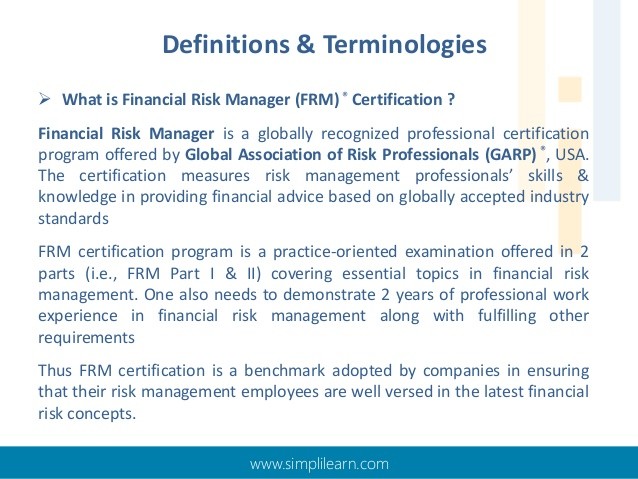

PIK aims to highlight the Importants of FRM Course in today’s business scenario. The Financial Risk Manager (FRM) is the certification recognized among financial risk professionals worldwide, with17,673 FRM holders in 90 countries across the globe.

Financial risk management is one of the inevitable skill sets to have in the financial services industry today that offers excellent visibility and outstanding earnings potential. The profession has seen considerable growth over the past 15 years fueled by the complexity of financial products, increased regulation and recent notable failures.

Like other careers in finance,having an advanced degree and certification helps to increaseyour career potential in financial risk management. FRM holders occupy positions such as Chief Risk Officer,Senior Risk Analyst,Head of Operational Risk,and Director,Investment Risk Management, to name a few.If you are infinancial risk management, or considering a career in it,then earning your FRM is the next natural step.

Performance Inc Kuwait Consulting serves its valuable customers here in Kuwait providing this training course through a mutual cooperation with our golden partner IFA (Institute for financial Analysts, Lebanon).

Objectives and benefits of the programs

· Candidatewillberecognizedacrosstheglobeasaleaderinfinancialr iskmanagement.

· Youwillbemoredesirabletoexecutiverecruitersandhiringmanagers sincetheyarenow seeking FRM holders for senior riskmanagement jobsmorethan everbefore. The FRM professional certification differentiates youfromyourpeers.

· Studying the broad concepts underlyingrisk managementin today’s dynamicmarket environment will give you aholisticview and appreciationfor theroleriskmanagementplaysin anenterprise.

· Providesyouwiththefeelingofpersonalachievement andthesatisfactionofconquering anexamdevelopedbythebestriskmanagementpractitionersintheworl d.

· Objectivelybenchmarksyourknowledgeofthemajorstrategicdiscipl inesoffinancialrisk management:

1. MarketRisk

2. CreditRisk

3. OperationalRisk

4. RiskManagementinInvestmentManagement

· Allows you to join an elite group of 17,673 FRMs across the globe with the only risk managementcertificationrecognizedworldwide.

· Expandsyourpersonalandprofessionalopportunitieswithintheworl doffinance.

· Provides youwiththeabilitytonetwork withsomeoftheworld’ s leading financial riskmanagementprofessionals.

Why Performance Inc Kuwait?

As the best of our knowledge, we- Performance INC Kuwait is the only Training Institute that provides such a certified program in Kuwait at present.

· We prepare the candidate with A 10 day’s integral program for FRM® exam that is of an international certification.

· We register our candidates for FRM Exams at GARP (GlobalAssociationofRiskProfessionals) .

· Our FRM program consist of Schweser essential study package

Certificate requirements

InordertobecertifiedasaFinancialRiskManager( FRM®)andbeabletousetheFRMacronym afteryourname,thefollowingisrequired:

· ApassingscoreontheFRMExamination( oneachofthetwolevelsofthecertificate) .

· ActivemembershipintheGlobalAssociationofRiskProfessionals.

· Aminimumoftwoyearsexperience intheareaoffinancialriskmanagement oranother related field including, but not limited to, trading, portfolio management, academic or industryresearch,economics,auditing,riskconsulting,and/ orrisktechnology.

Conclusion

The FRM designation creates opportunities for a diverse set of candidates to accelerate their careers, no matter what their backgrounds. The FRM certification, as the globally recognized professional designation for financial risk managers, clearly differentiates you from your peers, providing you with a competitive advantage with colleagues, clients and prospective employers. Whether you manage risk, money, or investments, achieving the FRM certification is a career enhancer.

Other certification courses PIK provides:

1) CFA (Chartered Financial Analyst)

2) JIA (Junior Investment Analyst)

3) CIPA (Certified Islamic Professional Accountant)

4) CDCS (Certified Documentary Credit Specialist)

5) CMA (Certified Management Accountant)

6) Bank Lawyer Certificate

7) Credit Certificate

8) The Professional Office Manager Certificate

9) Training For Employment Principles Of Banking Certificate

10) SME Banking Certificate Etc…….

AboutPerformance Inc Kuwait Consulting W.L.L

Performance Inc. Kuwait caters to our clientele in finding innovative and creative ways to operate and achieve strategic solutions. This enables organizations to execute their business strategy flawlessly, enabling our clients to achieve significant breakthroughs in professional and personal performance. We are distinguished from others by our capabilities in solving our clients’ most complex business issues, delivering sustainable solutions to ensure business success for our clients, turning Potential into Performance.

We achieve success through offering the following excellent services, including organizational consulting, marketing consulting, HR consulting, economic consulting, project management, training, organizational reengineering, restructuring, financial restructuring, management consulting, performance management, communication consulting, customer relationship management (CRM), strategic marketing plans, market research, feasibility studies, financial analysis, return on investment (ROI) analysis, competitive analysis, market analysis, risk management, time management, human resource management, custom training and training needs analysis etc.

For more information visit our website: www.performanceinckw.com