The DIVNet The Importance of Diversification Part 1

Post on: 16 Октябрь, 2015 No Comment

The Importance of Diversification — Part 1

Risk can be either Unique or Systemic . As most investors know, investing in a company comes with a risk of the company either going under or just losing value, which results in the investor losing part or whole of his/her capital. This is called Unique risk. While investors can preserve their capital and investment by picking better companies, it is almost impossible to find a good investment without any inherent risk; as the old adge goes Without risk, there is no reward. As illustrated in the graph above, studies have shown that risk can be mitigated by investing in as little as 12 companies, and close to elimination with approximately 50 companies.

My Thoughts

When I consider diversification for my investments, I consider it on three different levels: diversification based on asset class; diversification by sector of the economy; and geographical diversification. Another old adage that investors should remember: Never put all eggs in one basket.

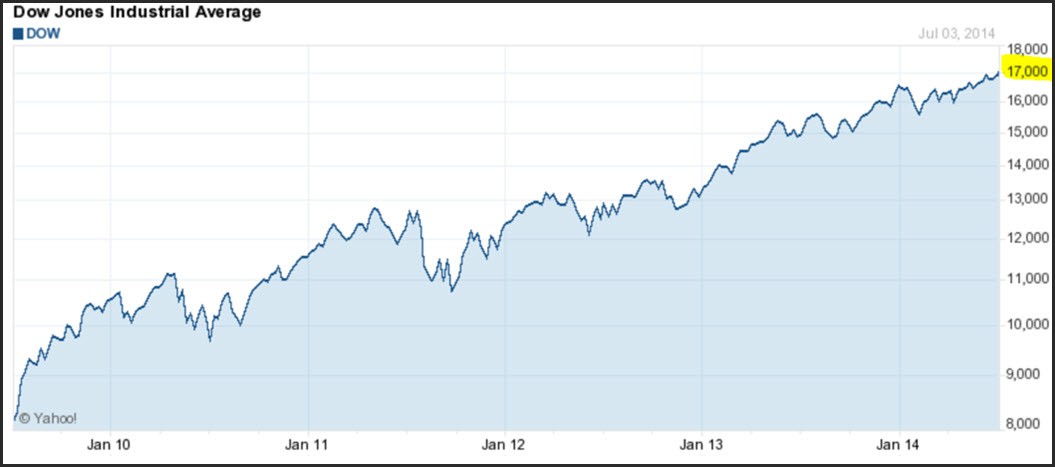

- Asset class diversification is important for investors as relying on one asset class such as stocks, bonds, real estate or commodities exposes risk immensely. Stock market crashes of the yesteryears remind us how investor’s fortunes were gained and lost.

- Sector allocation. Investors should try to mitigate risk by investing in all sectors of the economy. I current own 20 individual stocks and 5 funds, which provides me with pretty good diversification. However, I still do not consider my portfolio completely balanced as it is lacking in certain sectors of the economy and it is an ongoing project on getting that balance right. Once I get it to a state I want it in, I will be cycling through my holdings and investing additional capital in the relatively undervalued stock/fund.

- Geographical diversification. The type of diversification often overlooked by investors is the geographical diversification. A lot of investors believe in the mantra invest in what you know. This, I find is a double edged sword. Yes, it is good to invest in companies that you know well if you are familiar with the business model and know how the company actually runs and turns profits and if the company has good future prospects. However, it is important to not depend only on your local businesses, but invest globally — esp now that we have all the tools available at our fingertips making trades available and affordable. This way, any local disturbances such as recessions, wars, natural disasters will not take a toll on your investments and the risk is mitigated.

Our Portfolio

As things stand, our portfolio is not so bad on the sector-wise asset allocation, but geographical diversification is very skewed to our home country (Canada). This big skew occurred after my wife and I merged our portfolios and all of her investments were focused on the Canadian markets. As part of my 2014 goals. we intend to rebalance our portfolios with better diversification.