Stock Trading Psychology Investment U

Post on: 1 Июнь, 2015 No Comment

Stock Trading Psychology

The Trader’s U E-Letter: Issue # 178

Wednesday, March 8, 2006

Stock Trading Psychology: Following a Few Simple Lessons Can Make Youand Save You More Money

by D.R. Barton, Jr. Chairman, Trader’s U

This morning, I had a trade in which I messed up.

I’ve been using a new strategy that has me trade lower volume stocks than I normally use. I scaled into a fairly large position (scaling in means to start with a smaller amount and then add at pre-determined points during the trade). And my new strategy (in which the stock happened to be a short sale) was moving nicely in my direction.

That’s when I made my mistake.

Moving my stop down to protect my profits was the right thing to do. The mistake I made was moving my stop too close for the type of stock I was trading.

I normally trade very-high volume stocks in the market. Moving a stop fairly close is almost never a problem when trading RIMM, EBAY, AMZN or APPL. But I was trading a lower-volume stock — and I forgot that important piece of information. And it cost me a bunch of money.

The stock had a hiccup — within literally five seconds, it traded up to hit my stop. Then kept going against me, giving me an extra 10 cents of slippage (slippage is the difference between where you wanted your trade executed and where it actually got executed) and knocking me out of my position with a minimal profit.

To add insult to injury, after this little five-second hiccup, the stock was back down and trading at its original pre-hiccup levels. Had I put my stop in a more rational place given the stock’s characteristics, I would have still been in a very profitable trade. As it stood, I made a few bucks, but gave away a bunch because of a mental error.

But now the real battle started. I’m talking about the emotional battle that takes place in a trader or investor’s head when he or she makes a mistake. I’ll describe the battle that took place in my head and then talk about our stock trading psychology that will show you how you can save yourself a bunch of money — or make a bunch more — by following a few simple guidelines.

Understanding Stock Trading Psychology: Emotions Are Good Company, But Poor Guides

I had just given away a good chunk of money. I was using good trading tactics, but I failed to properly take into account all of the conditions of my trade. To be honest, I was mad. I was mad at myself. I was mad at this stupid stock (which had been a brilliant stock just moments ago). I was mad at the nameless, faceless traders that bought this stock for a few moments when I wanted them to sell.

In my emotional state, I did something I almost never do. I jumped right back in the market and shorted the stock at its low.

Then a wonderful thing happened. This second mistake of the morning cleared my head. I had made this mistake before. Sirens were going off in my head. I was seeing red flags. My gut clenched up. And I did the exact right thing — I immediately got out of this ill-advised, emotional investment. No thought involved. No analysis to see if, in fact, the stock could drop further. Nothing but a click of the mouse and out for a scratched trade (or a breakeven trade).

So the story does have a bit of a happy ending. Within minutes, the stock moved strongly the other way and I was safely on the sidelines. And with my emotions now in check, I could go back and analyze this stock and the markets rationally. My strategy was done for the day on this stock. So there were no more signals to act on. Time to move on.

Invest Based On Your Plan Not Your Emotions

Speaking of the psychology of trading, I know of no trader or investor who makes better decisions when he or she is emotional. Not one. Let’s look at three steps to take that will ensure that you can make your trading and investing decisions based on proven strategy, and not your current emotional state.

1. To follow a strategy, you have to have a strategy. Why do you enter and exit your trades and investments? If your answer is anything other than, I base my entries and exits on a written strategy, then you have left yourself wide open to make emotion-driven trades. Every good trader and investor I know has a clearly defined strategy that guides all of their decisions. Strategies can include: written trading systems, computerized trading systems, following every pick from a newsletter, and many others. But you must know and apply your strategy to get consistent results.

2. If you know you are in an emotional state, don’t take any action. If you find yourself getting emotional, just walk away and come back later. This applies to traders who are in front of a computer screen or investors looking at the stock tables in the newspaper. When you are emotional, your decisions are compromised. This is true for any extreme emotional state. Euphoria can cause bad decisions, just like anger. So if your stock has just made a huge move and you are ecstatic, you may want to buy every other stock in the sector. Take a deep breath and a long break. Then come back and go over your decision when you’re in a less elated state. And most of all, make your decisions based on your strategy!

3. Learn to change your emotional state. When I made my second mistake this morning, I used a psychological tool that I learned from my good friend Dr. Van Tharp to immediately change my emotional state. There are some good resources for learning these valuable techniques, but Van’s home-study course is the best one I know. For more on this great tool, see the Tips and Tricks section below.

Emotions are a wonderful part of the human experience. But rarely do they help us make right decisions for trading and investing. Stick with your proven strategy, and leave your emotions for other areas of enjoyment.

Great trading,

D.R.

Today’s Trader’s U Tips & Tricks

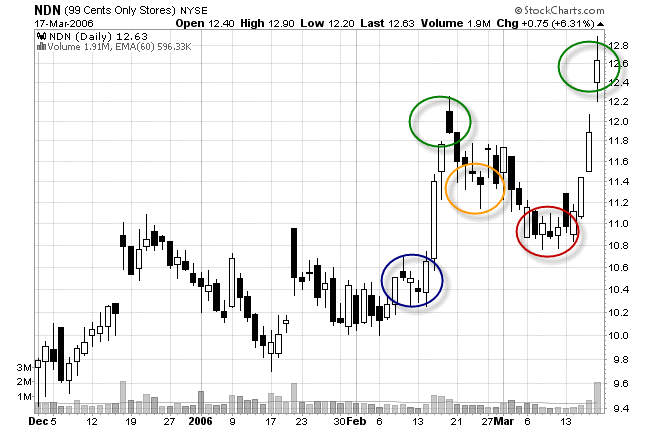

The Chart of the Week — Pat-On-the-Back Edition

On February 22, 2006, I issued a warning on the S&P 500 Index (^GSPC) saying that it was stretched too far to the upside with no momentum and no investor fear. I concluded that the market was going to head down with the most likely scenario being a prairie dog top. (A prairie dog top happens when the market pops its head up above old highs very briefly, just enough to entice the momentum players, and then falls from there). We got our prairie dog top on February 27, and the market has dropped more than 2% in just seven trading days since then. I hope our analysis helped in your trading and investing!

Special note: If you did benefit from our market warning, please send a note to me at drbarton @ www.investmentu.com. I’d love to hear from you!

Related Articles: