Skip The Volatility Check Out This Emerging Market Bond ETF

Post on: 2 Октябрь, 2015 No Comment

This fund is not only a great way to get in on growing emerging markets, but to do it with an income kicker.

There’s an often-used term that market commentators employ to describe how equities behave. They’ll say that stocks are climbing a wall of worry, meaning that the market continues to go up in the face of a host of looming negatives.

I’ve seen this phenomenon take place countless times throughout my three-plus decades of market analysis. While there are definitely periods where worries abound, one truism in this business is that worry is always around the corner.

Certainly, there’s a host of things investors are worried about right now. The big one is the debt-ceiling deadline. But other concerns also are creating worry, such as the recent end of the Fed’s latest quantitative easing program (QE2), Greece’s debt issues, the housing market, negative investor sentiment, slow economic growth, and 9.2% unemployment, to name only a few.

Yet with all of the worry swirling around right now, consider this: stocks are not off all that much from their recent highs. And, if we consider that stocks underwent a protracted pullback from May through mid-June, the relatively low percentage off of the highs is even more impressive.

The moral of this story is that when there’s real cause for worry, the market will reflect it in terms of price. If stocks start collapsing, and if the major averages fall below their respective 200-day moving averages, then it will be time for legitimate worry. Until then, any worry over the aforementioned conditions in the market will remain just that, worry.

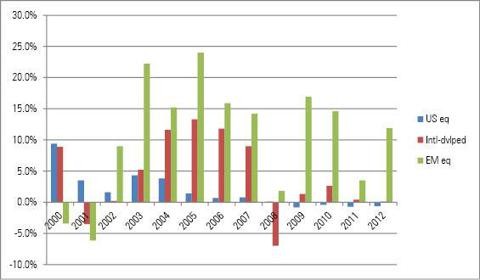

Beyond these borders, the International Monetary Fund (IMF ) forecast in June that GDP growth could hit 6.6% this year in developing economies-roughly three times the growth of advanced economies.

As tensions rise about what lawmakers should do about the US debt ceiling, and with projected economic growth for the United States at an anemic 2.5%, those looking to invest in bonds may want to consider emerging markets.

One way to invest in emerging markets is with the iShares JPMorgan USD Emerging Market Bond Fund (EMB ), a fixed-income fund that seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the JPMorgan EMBI Global Core Index.

The fund tracks the total return of actively traded external debt instruments in emerging market countries. Its top holdings are based in countries such as the Philippines, Turkey, Russia, and Brazil.

EMB has been on the increase, generally, since late February. This gain is fueled partly by $2.71 per share in dividend payments that have been dished out during that time.

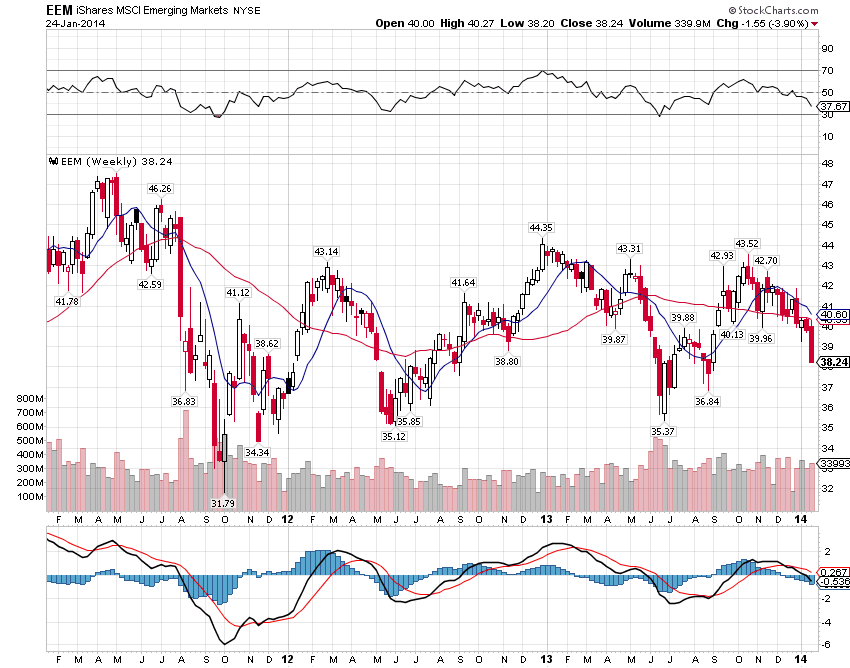

EMB also trades above its 50- and 200-day moving averages, indicating that EMB remains in a bullish trend.

Although the price of EMB has risen significantly since I recommended it, breaking the $109 mark again yesterday, there is still quite a way to go before it reaches its November 4 closing price of $114.13. As a result, there still could be significant room for gains.

As a bond ETF that pays a dividend every month, EMB is somewhat insulated from the volatility that afflicts other emerging-market funds. Special-situation ETFs such as this one give investors an opportunity to take advantage of emerging market growth, without the heightened risk that accompanies investing in equities.

Since bonds can be considered an income play, bond ETFs such as EMB offer up a great way to diversify your portfolio.

Editor’s Note: This article was written by Doug Fabian of the Money Making Alert.

Stay on top of the best financial news and commentary on Wall Street by following us @Minyanville .