Shiller P

Post on: 23 Сентябрь, 2016 No Comment

- Page Title:

- Page URL:

This page has been successfully added into your Bookmark.

Bookmark of this page has been deleted.

Market Overvalued, How to Invest?

Shiller P/E: 27 ( %)

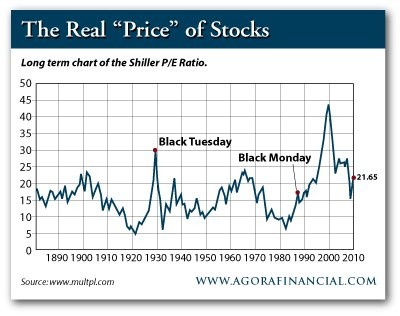

Shiller P/E is 62.7% higher than the historical mean of 16.6

Implied future annual return: -0.3%

Historical low: 4.8

Historical high: 44.2

S&P 500:

Regular P/E: 19 (historical mean: )

Prof. Robert Shiller of Yale University invented the Schiller P/E to measure the market’s valuation. The Schiller P/E is a more reasonable market valuation indicator than the P/E ratio because it eliminates fluctuation of the ratio caused by the variation of profit margins during business cycles. This is similar to market valuation based on the ratio of total market cap over GDP. where the variation of profit margins does not play a role either.

GuruFocus calculates the Shiller P/E ratio of individual stocks and different sectors. Here you can see the Sector Shiller PE. it shows you which sectors are the cheapest. Here you can see Shiller P/E of individual stocks.

How Is the Shiller P/E Calculated?

- Use the annual earnings of the S&P 500 companies over the past 10 years.

- Adjust the past earnings for inflation using CPI; past earnings are adjusted to today’s dollars.

- Average the adjusted values for E10.

- The Shiller P/E equals the ratio of the price of the S&P 500 index over E10.

Why Is the Regular P/E Ratio Deceiving?

The regular P/E uses the ratio of the S&P 500 index over the trailing-12-month earnings of S&P 500 companies. During economic expansions, companies have high profit margins and earnings. The P/E ratio then becomes artificially low due to higher earnings. During recessions, profit margins are low and earnings are low. Then the regular P/E ratio becomes higher. It is most obvious in the chart below:

The highest peak for the regular P/E was 123 in the first quarter of 2009. By then the S&P 500 had crashed more than 50% from its peak in 2007. The P/E was high because earnings were depressed. With the P/E at 123 in the first quarter of 2009, much higher than the historical mean of 15, it was the best time in recent history to buy stocks. On the other hand, the Shiller P/E was at 13.3, its lowest level in decades, correctly indicating a better time to buy stocks.

Shiller P/E Implied Market Return

If we assume that over the long term, the Shiller P/E of the market will reverse to its historical mean of $mean, the future market return will come from three parts:

- Contraction or expansion of the Schiller P/E to the historical mean

- Dividends

- Business growth

The investment return is thus equal to:

Investment Return (%) = Dividend Yield (%) + Business Growth(%) + (Mean_Shiller_PE/Current_Shiller_PE) (1/T) -1

From this we will estimate that at the Shiller P/E’s current level, the future market return will be around -0.3% a year. This is the historical implied return, actual return and long term interest. Interest rate does have an impact on the market returns. Click on the legend of the chart below to show/hide chart series.

In reality, it will never be the case that Shiller P/E will reverse exactly to the mean after 8 years. Table below give us a better idea on the range of the future returns will be if the market are within 50% to 150% of the mean.