Saving and Investing The Difference Between Active and Passive Management

Post on: 12 Октябрь, 2015 No Comment

Published on April 19th, 2007

This is part fourteen in a series that will occupy the money hacks slot at Get Rich Slowly during April, which is National Financial Literacy Month .

First, Michael Fischer introduced us to mutual funds. Next, he described the various types. Today he looks at the difference between actively- and passively-managed funds.

What are active and passive management? (4:27)

In a way, passive management is like autopilot the fund manager feeds parameters into a computer, and the fund manages itself. Active management costs more, but in return theres an actual pilot at the helm of the craft, attempting to find the best route. (This metaphor is a simplification, but conveys the basic idea.)

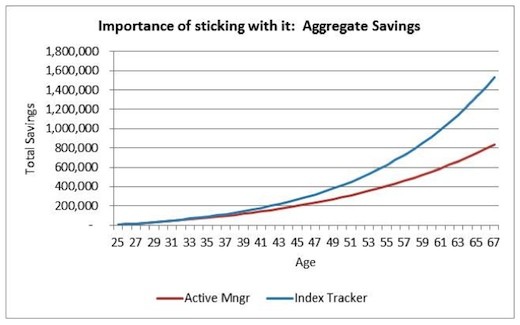

So which are best, passively-managed funds or actively-managed funds? One oft-cited statistic (for which I still have not found a source) is that funds with actively managed portfolios fail to beat the market 80% of the time. Thats why so many people preach the value of passively-managed index funds: youre not going to beat the market, but youre not going to underperform, either.

In his book Saving and Investing . Michael elaborates on the difference between actively managed fund and passively managed funds. In particular, active portfolio managers practice the following strategies in an attempt to beat the market:

- Market timing They try to buy low and sell high in order to maximize returns.

- Security selection Active managers over-weight certain stocks and bonds based on what they believe will happen. Other securities are under-weighted. For example, if I believe that Microsoft is likely to show increased earnings, I might make the portfolio Im managing extra heavy with Microsoft.

- Sector selection Rather than give added weight to individual stocks, a fund manager might give extra weight to an entire sector. A manager who over-weighted his fun in tech stocks in 1999 looked like a genius, but he looked like a fool if he was still in them two years later.

The trouble is that while active managers might be better than you or me at timing the market, or at picking a hot stock, theyre still no better than the market as a whole. Thats why so few actively managed funds are able to compete with index funds.

See also this recent USA Today article: Great minds dont think alike about index funds. Tomorrow we end our week with a crash-course in hedge funds, a subject about which I know nothing. (I dont even know what a hedge fund is!)

Michael Fischer spent nine years at Goldman Sachs, advising some of the largest private banks, mutual fund companies and hedge funds in the world on investment choices. Look for more episodes of Saving and Investing at Get Rich Slowly every weekday during the month of April. For more information, visit Michael’s site, Saving and Investing. or purchase his book .

GRS is committed to helping our readers save and achieve their financial goals. Savings interest rates may be low, but that is all the more reason to shop for the best rate. Find the highest savings interest rates and CD rates from Synchrony Bank. Ally Bank. GE Capital Bank. and more.