REIT ETFs for Income Investors

Post on: 17 Октябрь, 2015 No Comment

Feature Stories News:

In response to a changing market environment, investors can use alternative assets like real estate investment trusts and related exchange traded funds to diversify a traditional equities and fixed-income portfolio.

The real estate market has exhibited low correlations with stocks and bonds, suggesting it can offer good diversification benefits, writes Morningstar analyst Alex Bryan.

The FTSE NAREIT All Equity Index has shown a 0.78 correlation to the S&P 500 over the past decade a 1 reading reflects perfect correlation, whereas a 0 reading reveals no correlation.

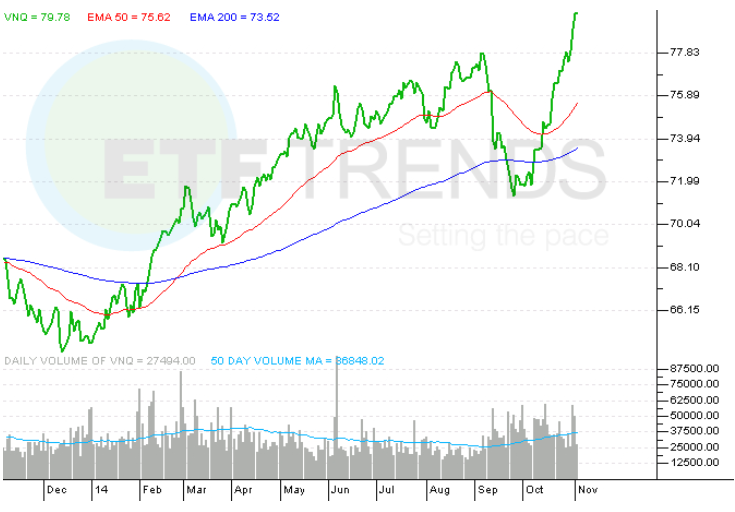

For those interested in broad REITs exposure, the Vanguard REIT ETF (NYSEArca: VNQ ) provides investors with a liquid investment vehicle to capture the real estate market as opposed to direct ownership of physical real estate properties.

Additionally, with a REITs ETF, investors can gain exposure to a wide range of commercial and retail real estate. Specifically, VNQ includes diversified REITs 10.6%, health care REITs 13.3%, hotel & resort REITs 8.0%, industrial REITs 4.5%, office REITs 13.3%, residential REITs 16.3%, retail REITs 25.9% and specialized REITs 8.1%.

REITs share similar attributes with stocks and bonds. Since REITs are required to distribute at least 90% of their income from rent payments to investors, these real estate investments can generate attractive yields. For example, VNQ has a 3.19% 12-month yield. However, the distributions are taxed as ordinary income and REITs can cut distributions. [Residential REITs: Renters Aren’t Buying ]

The real estate assets are similar to stocks in that they can also appreciate in value alongside the stock market. VNQ has increased 26.8% year-to-date.

However, since REITs are tied to the property value, these companies can benefit from a leveraging effect on appreciating properties, but they can also experience a significant drop off in the event prices fall.

Because REITs generally own properties that are largely financed with debt, they can experience large swings in value from small changes in property values, Bryan said.

Looking ahead, potential investors should keep in mind that REITs are not a good hedge against inflation and a rising rate environment will negatively impact the asset. Rising rates raise REITs debt financing costs. However, a flat interest rate outlook would benefit REITs in an expanding economic environment as rising rents and property prices would support the asset class. [Falling Rates Help Lift REIT ETFs ]

Bryan also warns that investors shouldnt get too trigger happy with REITs investments due to their high valuations VNQ shows a 33.8 price-to-earnings ratio and a 2.1 price-to-book.

High valuations and interest-rate risk are good reasons not to immediately overweight REITs, Bryan added. However, they can offer good diversification benefits over the long run. Rising interest rates could cause valuations to recede and offer investors an opportunity to reap these benefits more cheaply. If nothing else, REITs are worth watching.

Vanguard REIT ETF

For more information on real estate investment trusts, visit our REITs category .

Max Chen contributed to this article .

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.