Record Low Interest Rates Could Support REIT ETFs

Post on: 16 Октябрь, 2015 No Comment

Feature Stories News:

Real estate investment trust, or REIT, exchange traded funds may continue to generate higher profits as interest rates remain suppressed. Even if rates do rise, REITs could follow higher growth as the assets move less like equities and more like real estate.

According to a Paragon Report, REITs are taking advantage of the low interest rates to boost earnings and raise dividends for investors. For instance, mortgage REITs are dependent on interest rate spreads higher rates makes it less profitable for REITs to borrow. [Real Estate: List of REIT ETFs ]

Federal Reserve Chairman Ben Bernanke has stated his intent to keep interest rates low until 2014 and even suppress borrowing costs if the economy is in need.

REITs are securities that trade like stocks but are required to pay out 90% of their taxable income to share holders as dividends.

JP Morgan Asset Management projects U.S. REIT dividends may grow 6% on average per year over the next five years and produce total returns of up to 10% if dividend yields are 4%, reports Michael Aneiro for Forbes. [ETF Chart of the Day: REITs ]

JPM real estate strategist Michael Hudgins believes a 5% to 6% growth seems reasonable, considering the pullback during the recession and dividend cuts.

U.S. REITs do not currently offer value versus equities, and have been trading in a range that goes from slightly expensive to slightly discounted relative to the value of their underlying portfolios, Hudgins said in the article. Having said that, the dividend growth described above combined with measured but improving strength in the U.S. economy and U.S. commercial real estate market (i.e. improving occupancy and rent growth) should support positive returns, even while U.S. REITs underperform the broader equity market and, perhaps, international REITs.

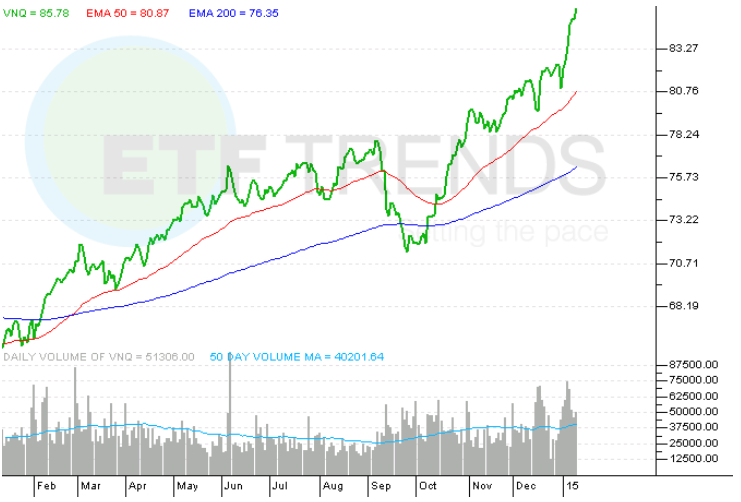

- Vanguard REIT Sector ETF (NYSEArca: VNQ )

- SPDR Dow Jones REIT ETF (NYSEArca: RWR )

- First Trust S&P REIT Index Fund ETF (NYSEArca: FRI )

- Schwab U.S. REIT ETF (NYSEArca: SCHH )

Vanguard REIT Sector ETF

Max Chen contributed to this article .

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.