Record Inflows Favor Emerging Market Bond ETFs

Post on: 2 Октябрь, 2015 No Comment

Record Inflows Favor Emerging Market Bond ETFs

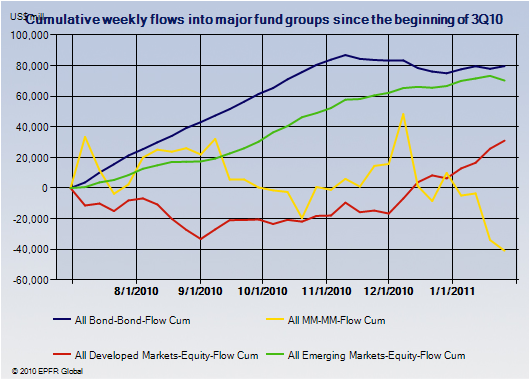

Ive written a number of features on money flow in the recent past, incorporating daily data at the Wall Street Journal and/or weekly directionality reported by the research firm EPFR Global . In fact, one month ago, I identified the enormous amount of money that was flowing into emerging market equities and emerging market bonds .

Four weeks has since elapsed. And, in spite of the psychological Dow 10,000 victory, EPFR Global reports that net assets have actually been leaving U.S. equities. Meanwhile, money market funds have not been the beneficiaries of the reported outflow.

Since the money has to flow somewhere, where have the dollars/yen/euros presumably gone? Yep still heading into the hot emerging market stocks and equally desirable emerging market bonds.

Half of net inflows are accounted for in emerging market equities. Yet its still probable that a developed market sell-off would adversely affect emergers in the near-term; moreover, precious metals may be a preferred method for how a portoflio may maintain its purchasing power .

This leads me to the most critical stat in the fund flow data; emerging market bonds raked in nearly $1 billion in a single week the largest weekly haul on EPFRs record books.

So far, ETF investors have limited choices in emerging market bond investing. Here are 3 of the most popular trade-able funds:

1. PowerShares Emerging Market Sovereign Debt (PCY). Ever since its inception, its been one of my favorite diversifers. (Review my 11/2007 feature on why PCY may be the perfect hedge .)

Other than the worldwide liquidation of all asset classes in the credit collapse 9/08-11/08, PCY has delivered the goods. Year-to-date, PCY is up a startling 31% and remains comfortably above short- and long-term trendlines.

2. iShares JPMorgan USD Emerging Markets Bond Fund (EMB). The coupon yield here is close to 7%, while the SEC 30-day yield is 5.5%. Some folks might think it may not be the best yield for a weighted average maturity of 12 years when you have heavy exposure to Russian and Latin American debt. On the flip side, EMB continues to demonstrate demand via 11% YTD gains and a current price above its 200-day trendline.

3. Templeton Emerging Markets Income (TEI). For starters, TEI is not a traditional ETF, but rather, a closed-end fund that trades on an exchange. Prospective investors want to consider the pros and cons of CEFs versus ETFs.

Still, TEI is not a dollar-denominated fund like the 2 mentioned earlier. This means TEI can take advantage of dollar weakness or at least act as a hedge against the falling dollar. It currently yields 7%, and has a bit lower average credit quality than PCY or EMB.

If you’d like to learn more about ETF investing… then tune into “In the Money With Gary Gordon.” You can listen to the show “LIVE”, via podcast or on your iPod.

Disclosure Statement: ETF Expert is a web log (blog”) that makes the world of ETFs easier to understand. The content does not represent investment advice, nor are the securities discussed suitable for every investor. Pacific Park Financial, Inc.. a Registered Investment Adviser with the SEC, may hold positions in the ETFs, mutual funds and/or index funds mentioned above. Investors who are interested in money management services may visit the Pacific Park Financial, Inc. web site.