Portfolio Theory Explained

Post on: 14 Октябрь, 2015 No Comment

Assumptions

MPT assumes that investors will act rationally, that they will aim to maximize returns while limiting risk. It also assumes they are receiving all information pertaining to their investments in a timely way. The theory claims that trying to beat the market through fundamentals and individual stock selection is futile.

Risk vs. Return

MPT compiles data on all asset classes and securities, such as stocks, bonds, currencies and real estate. It then calculates historical average returns. Risk is defined as deviation away from the mean historical returns during a particular time period. For example, U.S. stocks may average 11 percent returns over time. However, they may see a 33 percent gain one year and an 11 percent loss another year to arrive at that average.

Optimal Portfolio

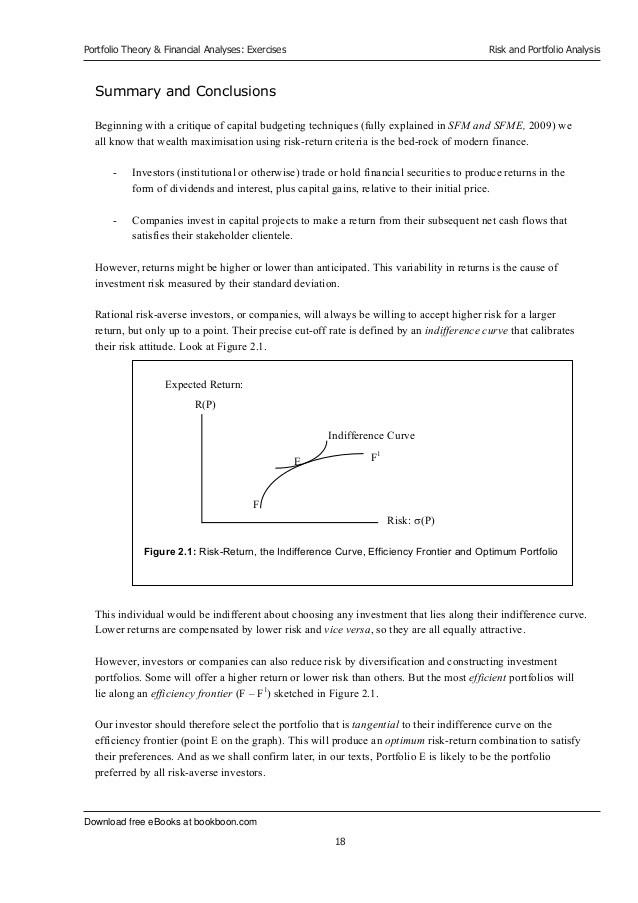

According to MPT, the optimal portfolio takes into account probabilities, average returns and differences in competing asset classes. Generally, it claims that the greater the risk, the greater the potential returns.

Controversy

References

More Like This

Portfolio Theory

CAPM Strengths and Weaknesses

You May Also Like

Harry Markowitz was the creator of modern portfolio theory. Published under the title Portfolio Selection in the 1952 Journal of Finance, Markowitz.

Modern portfolio theory (MPT) is a framework that combines logical assumptions and statistical data, to help investors create portfolios. Modern portfolio theory.

Stock market analysts agree that Warren Buffett is a skillful investor. His Berkshire Hathaway portfolio of stocks has netted substantial earnings for.

String theory has been around a long time in economics and the stock market. Essentially it states that the more severe a.

Successful investing is one of the fastest and most efficient ways of increasing your wealth. Unfortunately, since investing requires risk, it is.

Light is the manifestation of waves of electromagnetic radiation that varies based on wave intensity, frequency and polarization. The radiation is manifested.

There isn't a magic formula for managing your portfolio, but there are a few guidelines that can help point you in the.

Balanced portfolio theory, sometimes called modern portfolio theory, seeks to maximize returns while minimizing risk through the creation of portfolios that include.

Today's business industries are constantly changing, expanding, improving and modernizing. Thanks to modern technological advances, people can globalize their.