Noload mutual fund (Stock market) Definition Online Encyclopedia

Post on: 23 Октябрь, 2015 No Comment

No-load mutual fund

No-Load Mutual Fund

No-load mutual fund

A no-load mutual fund that is allowed to use fund assets to pay for its distribution costs. The 12B-1 plan mutual fund is an alternative to paying the sales fees encountered in loaded funds.

In my no-load mutual fund practice I use specific recommendations, even for my free newsletter subscribers. They are first based on my trend tracking indicator giving us the green light and secondarily on the selection of mutual fund s based on momentum analysis.

Most of the no-load mutual fund s are also larger funds. This means that there will be a lower chance of making a lot of money off the fund — but overall, these funds are generally a bit safer.

The Lowdown On No-Load Mutual Fund s

These funds let you cut out the middleman — and the fees.

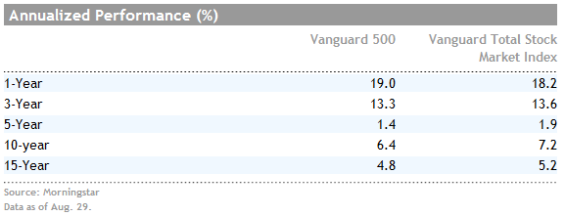

Technically, SPY is a no-load mutual fund that trades on the stock exchange like a stock. Investing in this stock is somewhat like buying the Vanguard 500 Index fund. but it is better for the purpose. Vanguard discourages people from buying and selling their fund like a stock.

No-load mutual fund s will not charge you to invest in fund shares. Load fund s offer ed by an investment advisor take a commission charge off the top of every investment you make. The costs and fees of stock direct purchase plans vary from company to company.

No-load mutual fund s can be purchased directly from mutual fund companies, so unless you’re a mutual-fund trading addict, the availability of thousands of mutual fund s in one location probably shouldn’t affect which broker you choose.

Why You Should Always Buy No-Load Mutual Fund s

Pay Attention to the Expense Ratio — It Can Make or Break You!

Look for an Experienced, Disciplined Management Team

Find a Philosophy that Agrees with Your Own when Selecting a Mutual Fund.

A no-load mutual fund will not have any fee attached such as a brokerage fee. For selling buying trading. or servicing the fund. A no-load fund is the opposite of a load fund.

In a nutshell, an ETF is a specific kind of no-load mutual fund that you might consider to be a basket of stocks. ETFs are diversified like mutual fund s, only they trade like stocks. They are cheap to trade (as low as $8.00) and don’t hit you with any short-term redemption fee s.

option — a contract that gives the holder the right but not the obligation to buy or sell a specified quantity of a security at a specified price within a specified time.

No-load mutual fund s often reinvest dividends promptly and without transaction costs. (Source: Vanessa O’Connell, ‘Spiders ‘ Offer Another Way to Scale S&P 500’s Heights, Wall Street Journal, 3/11/95.) SPINs Standard & Poor’s 500 Index Notes (q.v.).