Multibagger Stocks HBJ Capital

Post on: 30 Июль, 2015 No Comment

An efficiently run Insurance franchisee with strong growth Opportunities going forward !

- Why is Bajaj Finserv the best way to the Multi-decade growth in the Indian Insurance industry. Is it a good stock to BUY in your portfolios at the current price !

We had sent the following Investment note on Bajaj Finserv a few months back to our Investment clients. The story still holds true and is in fact strengthened with the expected improvement in Financial savings in the country. With a positive equity market and better regulations, Indian insurance industry is well placed for strong growth. Bajaj Finserv might well be that stock that you are looking for in your Portfolio. Read the investment note for more,

Dear Investor,

Our interest in Bajaj Finserv emerges from the hugely undervalued Insurance Operations of the company. With over 70% of its profits and value coming from Insurance Operations, it is one of the few stocks to play for the growth in the Insurance Industry. At the current Market price, the Insurance operations of the company are available at a valuation of 6500 Crs after adjusting for the companys stake in Bajaj Finance (after 20% Holding Discount) and other Balance sheet items. This is extremely cheap for a 74% stake in two of the most efficient Insurance companies in India.

Conservative and Capital Efficient Underwriting Operations :-

Bajaj Allianz General Insurance Company (BAGIC)

Our Analysis clearly shows that BAGIC is by far the most Profitable and Shareholder friendly general insurance company in India. BAGIC scores well over all its peers and just look at its consistent performance across all key Parameters,

BAGIC has in fact stated generating underwriting Profits (last Quarter Underwriting Profit of 56 Cr) from this year. Its Combined ratios are well under 100% compared with the Industry average of around 110%, that shows the Quality of its operations. Underwriting Profits literally means that the company has a negative cost on the capital which are classified as liabilities and BAGIC is getting paid for using Customers money. The free Float generated from such Underwriting is helping the company achieve ROEs of over 26%. BAGIC also has the best Gross Written Premium/ Share Holders equity which is almost double the Industry average which points to the Capital efficiency of its operations and sustainability of such high ROEs.

Disciplined Underwriting and large Low Cost Floats :-

Bajaj Allianz Life Insurance Company (BALIC)

BALIC is by far the largest value creator for Bajaj Finserv. The Life Insurance subsidiary has till now received Shareholders Equity of just around 1211 Cr You can compare it with the last years profit of about 1000 Cr and the companys Net worth of 4400 Cr to understand the brilliant performance of the company since inception. Life Insurance business allows the company to receive Long Tail floats and when these can be generated at a low cost, there is huge profits available as shown in BALIC. Life Insurance companies will continue to have strong Cash Inflows when they grow, considering the back ended nature of outflow. With the huge growth opportunity in India expected to unfold over the next decade, BALIC can continue to add on its AUM from the existing 32000 Cr.

While BALIC may not generate underwriting Profit, its Average Claims ratio (78%), Expenses Ratio (19%), Investment Income and Employee productivity are among the best in the Industry. The best part about BALIC has been its conservative underwriting during phases of extreme competition. Despite this leading to erosion in Market Share and overall Fund size, BALIC has been able to focus on disciplined underwriting which will keep it in good stead going forward.

The entire Life Insurance industry has gone through significant stress over the last few years with huge shifts in Product Portfolios and other Regulatory changes. While the shift towards Traditional products will reduce Fee Income, in the long term they would be compensated by a steady float. We believe that the Industry would start growing from this year and should be able to clock over 15% CAGR for the next 3-5 years. BALIC with its Solvency ratios of around 710% against mandated 150% is well positioned to ride this growth. This huge CAR would be levered in the growth phase and thus can help the company to improve its ROEs significantly. BALIC can almost triple its underwriting without any new addition of Equity.

Highly Efficient Insurance Operations to provide Value and Growth :-

There are several global examples of Efficient and Disciplined Insurance companies which have had strong compounded growth for decades and created strong Value for its Shareholders. While Bajaj Finserv doesnt have a real competitive advantage like the Distribution network of Banks (or) an unique low cost model of GEICO, a disciplined Underwriting process and Cost conscious operations has helped it to compound its Book steadily.

In a Capital deficient country like India, Insurance companies which are able to generate large Capital at relatively lower cost should do extremely well. Bajaj Finserv between its Insurance operations manages about 37000 Cr of Capital which is generated at a cost lower than Banks, leading to strong Investment income. During the ensuing growth phase, company would continue to add more AUM and can generate very high returns on Incremental Equity.

Insurance continues to be an extremely under penetrated product in India and it would be one of the fastest growing Financial product going forward. While the Life Insurance industry has gone through a turmoil, we believe that the recent changes have set up a strong base for the Long Term growth. Efficient Private Insurers have been consistently increasing their Market shares against a bloated public sector. This trend can continue for many more years like in the Banking sector.

When we look at Bajajs Insurance operations from a Banking analogy, we are seeing a Bank with the lowest cost of funds, has an adequate provisioning and strong Risk underwriting which is leading to best in Industry NIMs and ROAs. All these makes us believe that, Bajajs Insurance division can effectively double its Book every 4 years and can continue its compounding for many more years.

Value can be Suppressed for an extended Time period :

An elongated period of Suppressed value is the biggest risk to the stock that holds back several Investors. With the management not keen on unlocking value through Dividends (or) listings, only a consistently strong performance will help re-rate the stock. While the company is just a holding company for the groups Financial divisions, its still being viewed by Investors like its peer Bajaj Holdings & Investment which is a diversified Holding and investment company of the promoters.

Almost every Financial company with a wide range of Assets is a holding company in that sense, from Sundaram Finance, Reliance Capital, Birla Nuvo to Max India. There is no Insurance company in India which is not present within a Holding company structure, including that of the Insurance companies promoted by banks. Nevertheless this continues to be a significant risk and Managements thoughts on this needs to be ascertained using better.

There are very few Analysts tracking the company and there has been severe neglect of the stock among Investors. While the current depressed environment in the Insurance sector has largely led to the neglect of this stock once the Insurance industry comes into focus with a few Listings, the company would be re-rated substantially. It is this neglect that is allowing Investors to buy the Shares at such cheap valuations.

Managements quality of execution can be seen in all its business divisions, from the rapid scale up the operations of its Consumer Finance subsidiary to the Efficient underwriting at its Insurance subsidiaries. We believe that the current valuations discounts a large part of the Uncertainties and the risks involved, thereby providing significant upsides in case of positive surprises.

The stock currently quotes at a Price/ Earnings of less than 6X and a Price to Book of less than 1.3X, for a company which can consistently generate ROEs of over 20%. The Book itself is substantially undervalued in our view and to buy the stock near its Book value is a good bargain.

We are clearly not expecting a sharp Re-rating or a rapid close in the Price-Value gap, as we understand the inherent limitations of its Holding structure. But even if the share price follows its earnings growth we should be able to get a 20% compounded returns over the next 3-5 years. Any other form of value unlocking (Bank License, Insurance subsidiary listing etc) or Market recognition that would lead to a reduction in the Price Value gap would be an added bonus.

August Multibagger Idea. A High Quality niche FMCG company at very attractive Valuations !

- A Company in a supply constrained business that consistently helps it earn strong ROEs is available at less than 15X earnings.

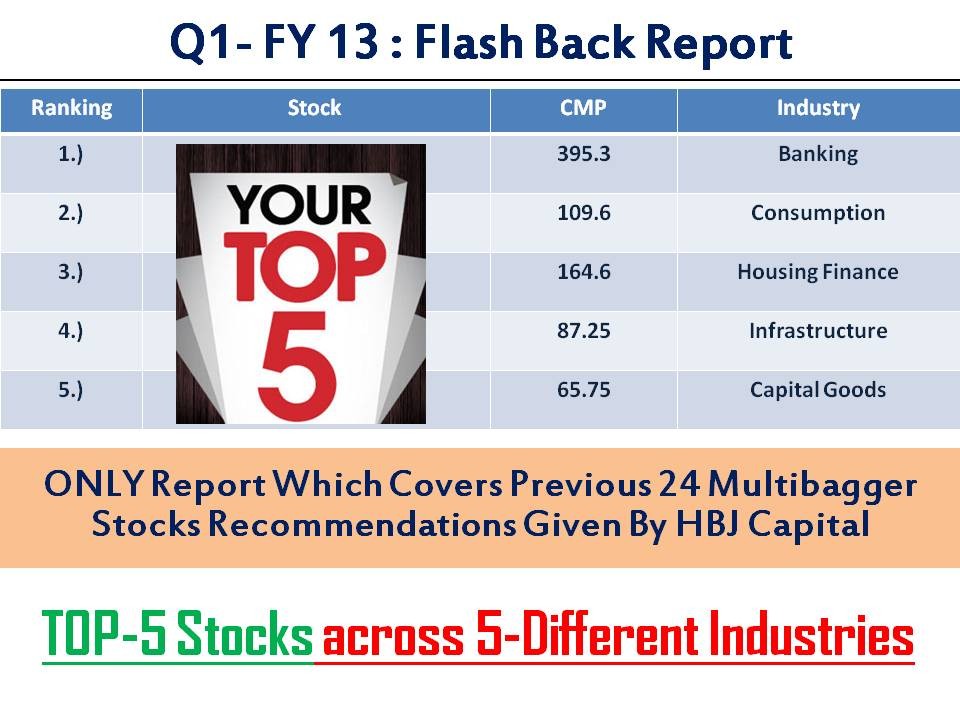

We at HBJ Capital have been consistently ahead of the street in identifying stocks with Multibagger potential. Our track record over the past few years is a clear indication of our superior investment research process that helps us to spot opportunities on a consistent basis. We believe that there are few stocks that can offer the Investment metrics that this stock can offer to Investors.

We strongly believe that Investors cant make huge profits by buying quality Businesses at 40X earnings. even if they are high quality and have a strong growth runway ahead of them. We believe that BIG profits can occur only when an Investor is buying stocks that are transitioning from average businesses to Great businesses. When this re-rating in quality of business is combined with earnings growth and Management quality, we are setting ourselves for BIG Multibagger returns.

Our clients would recieve a detailed Research report on the stock which explains them the Investment thesis in a easy -to-understand manner. As with most of our Multibagger ideas, this company is rarely covered with the frontline Brokerages/ Investment research companies. despite the company posting strong results over the last many quarters. We believe that the company has all the ingredients to become a Multibagger Idea,

- Less Crowded Trade.

- Strong Scalable Business.

- Strong Demand Environment.

- Healthy Delta in ROEs, Earnings, Cash Flows etc.

- Strong Industry Tailwinds.

We also believe that the stock can be a good Bull Market stock, considering a few parameters related to the companys Management team. To know more about the stock, you can fill the form below