Market return (Business) Definition Online Encyclopedia

Post on: 16 Март, 2015 No Comment

The total return of an ETF based on its market price at the beginning and end of the holding period .

This may be different from the ETF’s NAV return.

Market return

Market risk

Risk that cannot be diversified away. Related: Systematic risk.

Stock market return s that have been lower than assumed in the plan designs and which are now assumed to remain lower.

RMarket is the market return for a given month (YCharts uses the S&P 500 Total Returns Index SPXTR)

When calculating, we use the maximum of 60 months of historical returns data or the full life of returns data of the stock. There must be at least 36 months of data for us to run this calculation.

Starting some time period before the takeover (often five days before the first announced bid, but sometimes a longer period), the researchers calculate the actual daily stock returns for the target firm and subtract out the expected market return s (usually calculated using the.

The amount of money that a willing buyer pays to acquire something from a willing seller, when a buyer and seller are independent and when such an exchange is motivated by only commercial consideration.

Market return

Market risk.

In other words, an investor should not expect to earn an abnormal return (above the market return ) through either technical analysis or fundamental analysis.

For example, under usual conditions we might observe a certain level of correlation of market return s. A period of contagion would be associated with much higher than expected correlation.

A positive alpha is the extra return awarded to the investor for taking a risk, instead of accepting the market return. For example, an alpha of 0.4 means the fund outperformed the market-based return estimate by 0.4%. An alpha of -0.6 means a fund’s monthly return was 0.

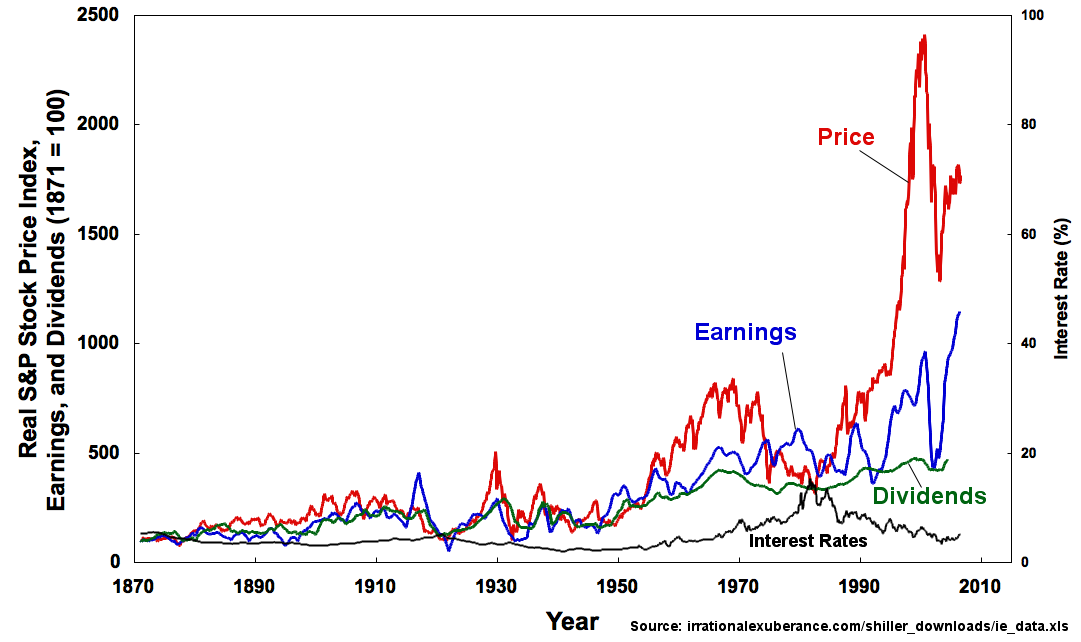

French mathematician Louis Bachelier performed the first rigorous analysis of stock market return s in his 1900 dissertation.

Alpha in a stock portfolio is the measure of a manager’s ability to select stocks that outperform the market return. often benchmarked by the S&P500, across a defined time period.

5 times the market return. [More precisely, that stock’s excess return (over and above a short-term money market rate) is expected to move 1.5 times the market excess return).] According to asset pricing theory, beta represents the type of risk, systematic risk. that cannot be diversified away.

We obtain the CAPM alpha if we consider excess market return s as the only factor. If we add in the Fama-French factors, we obtain the 3-factor alpha, and so on.

It took two years before the market return ed to pre-crash levels. The crash followed a 43% increase earlier that year. It was caused by a combination of factors. First traders were concerned about anti-takeover legislation moving through Congress.

The net broad market return would be -14 percent but, since they consistently outperform the market by 6 percent, their estimated return would be -8 percent. In this instance, the investors would like to cut their beta in half without necessarily cutting their alpha in half.

Stock market return s, for example, may fluctuate from year to year, but holding on for longer periods has historically provided less risk.

where covs,m is the covariance of the return of the security with the market return. and,

varm is the variance of the market return .

Market, strictly speaking, means a market portfolio. all of every available security. In practice an index is used rather than calculating this directly.

For measuring market return s, a proxy such as a broad-based index is used. Thus, if b exceeds 1, the security is more volatile than the market, and is termed an ‘Aggressive Security’. For example, a beta of 1.

measurement of returns from an investment apart from market return s. Represents the amount of return expected from fundamental causes such as the growth rate in earnings per share; contrast with beta. which is a measure of volatility.

Dictionary of Banking Terms

Alpha.

Arbitrage: Taking advantage of minor aberrations in the market to try to profit as the market return s to normal.

An 8 foot tall Probability Machine (named Sir Francis) comparing stock market return s to the randomness of the beans dropping through the quincunx pattern. from Index Funds Advisors IFA.com

Pуlya’s Random Walk Constants

Javascript builds a distribution from 50 step walks.

Still, the financial services industry is touting immediate annuities right and left as the answer to low bank interest rates and volatile stock market return s. Don’t fall for it. Think about your long-term needs — and the needs of your life insurance beneficiary.

It is considered to be one of the most important indicators of the strength of the US stock market. The Dow Jones Industrial Average (DJIA) has fluctuated between 3.2% (in high market return s in 1929) and 8% (during low market return s).

Underperform A security is said to underperform when its appreciations are slower compared to the overall market return s. Such a security often gets a weak hold or a moderate sell recommendation. Random Finance Terms for the Letter U Underfunded Pension [Read more. ].

Earnings response coefficient s (ERC) measure the extent of a securitys abnormal market return in response to the unexpected component of reported earnings of the firm issuing that security.

In the previous formulation Ri is the asset return; Rm is the market return and Rf is the free-risk rate.

Figure: graphic representation of the CAPM.

A model of security returns that acknowledges only one common factor. The single factor is usually the market return .

Spin-off

A company can create an independent company from an existing part of the company by selling or distributing new shares in the so-called spin-off.

plus a risk premium (the difference between the historic market return. based upon a well diversified index

such as the S&P500 and historic U.S. Treasury bond) multiplied by the assets beta.

Expected return on investment The return one can expect to earn on an investment. See: capital asset.

Sum of the differences between the expected return on a stock (systematic risk multiplied by the realized market return ) and the actual return often used to evaluate the impact of news ona stock price.

Characteristic Line The line of bet fit through a series of historical returns for the firm’s stock relative to the market return s. The slope of this line, called beta, represents the average movement of the firm’s stock returns in response to a change in the market’s returns.

Example: Suppose average market return to a stock was 10% for some calendar year. meaning stocks overall were 10% higher at the end of the year than at the beginning, and suppose that stock S had risen 12% in that period. Then stock S’s abnormal return was 2%.

Exploring The Exponentially Weighted Moving Average

Volatility’s Impact On Market Return s

The ABCs Of Option Volatility

An Option Strategy for Trading Market Bottoms.

Using the CAPM model and the following assumptions. we can compute the expected return of a stock: if the risk-free rate is 3%, the beta (risk measure) of the stock is 2 and the expected market return over the period is 10%, the stock is expected to return 17% (3%+2(10%-3%)).

Retrieved from .

Exchange rates and stock prices tend not to. Stock market return s, however, do tend to exhibit mean reversion. Exhibit 1 provides an intuitive illustration of the difference between mean reverting and non-mean reverting behavior.

A positive Alpha indicates the extra yield of the security or portfolio awarded to the investor for having taken a risk, rather than simply accepting the average market return. Thus, an alpha of 0.5 means that the security or portfolio has outperformed the estimated market-based return by 0.5%.

Definition: [crh] A model of security returns that acknowledges only one common factor. The single factor is usually the Definition: /?rd=market+returnmarket return. See: Factor model.

Returns come from two sources: market return s, or beta, and active manager returns, or alpha. Managers can use derivatives to eliminate mark. (Read more)

Alternative Investment

Investment in items other than stocks, bonds or other securities. Wine, art and antiques are examples. (Read more).

I’d like to take our time today to focus on another reader email that I think is closely connected to our topic from Monday. The issue raised is central to trading success, both in this difficult environment and in the future when the market return s to trading on pertinent fundamental and technical.

Market Research Quality Standards Association (UK)

Market Research Society of Australia

Market resources

Market return.

Since beta relates an asset’s return to the market, then the alpha distinguishes it from the market. Algebraically, this is presented by the expression for a straight line or excess return equals a (alpha) + b (beta)X (market return ).

For those who are laid off, starting a business is often an option and that can mean small-business loans. As investors get nervous with stock market return s during slow times, banks will often see flocks of skittish investors dumping money into FDIC-insured vehicles like CDs and savings account s.

Ordinarily this basic return would be determined by reference to the market return s achieved for similar types of transaction s by independent enterprises.

Back to top Underperform An analyst recommendation that means a stock is expected to do slightly worse than the market return. Back to top Undersubscribed A situation in which the demand for an initial public offering of securities is less than the number of shares issued.