Market losses highlight pros cons of target funds

Post on: 19 Декабрь, 2016 No Comment

Mutual funds aimed at retirees haven’t been immune from the credit crisis.

At the end of September, the 2005 target-date funds were down nearly 15 percent for the previous 12 months, according to Morningstar Inc. The 2010 category was down nearly 14 percent.

For September alone, while the Standard & Poor’s 500 fell 9 percent, the retirement category was down only slightly less at about a 7 percent loss, Morningstar said.

That includes managed payout funds from Fidelity, Vanguard and Schwab, which all introduced the payout funds in August 2007.

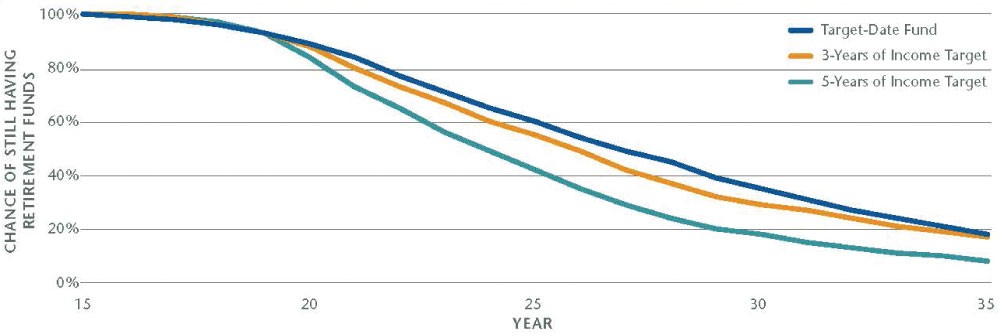

The drops shouldn’t come as a surprise. Financial firms have been singing a constant chorus about how retirees need to keep stocks in their portfolios later into retirement to generate enough growth to outlast increasing life expectancies.

And target-date mutual funds typically keep 40 percent to 50 percent of their portfolios in stocks for those at or near retirement.

The issue for investors is to consider what type of alternatives they would have chosen if the target-date and managed payout funds hadn’t been around.

Variable annuities are subject to market risk, fixed annuities carry issuer risk and cash investments carry inflation risk.

A hodgepodge of stocks and bonds that wasn’t rebalanced regularly could have plunged much further than the target funds.

Still, the losses will make many retirees think differently about how much risk they can tolerate, so it’s a good time to remember the strengths and the limitations of these investments.

Not a substitute

Some industry players have feared that consumers would confuse the retirement funds with annuities, which typically come with some type of guarantee.

If a payout fund estimates ranges of income, for example, keep in mind it’s an estimate, not a promise.

One size fits most

The target funds aren’t factoring in the desire to travel the world in the first year of retirement, said Anne Lester, senior portfolio manager for JPMorgan’s SmartRetirement funds.

Big early withdrawals from a stock-heavy nest egg can be devastating, particularly in a year when stocks fall hard, Lester said. Her firm has kept equity stakes at the lower end of the target-date spectrum because of that risk, she said.

Look under the hood

Be sure you understand how your retirement fund is run, experts said. A fund’s prospectus explains a fund’s asset allocation and how stocks and bonds will be chosen in the fund.

Typically, the funds are a collection of other funds within one institution. Vanguard, for example, relies on its low-cost index funds for its retirement-fund portfolios. Others use more actively managed funds that, in theory, have more flexibility in tough markets.

Putting it on autopilot

Whether stock selection is done by an index or a portfolio manager, target funds do the dirty work of rebalancing among asset classes. Just make sure you have the stomach for it, experts said.

If people come to the realization that they took on too much risk and want out, fine. But no fair turning it back up when the Dow is at 14,000, said Jeff Mortimer, chief investment officer for Schwab Funds.

Anecdotally, portfolio managers said investors have been slower to pull out of retirement-oriented funds in the downturn than those in broad-based stock funds.

This is the advantage of the target-date structure — being there when an individual might not be inclined to rebalance, said Ned Notzen, chair of the T. Rowe Price asset allocation committee.

Taking a hit

15%

Amount 2005 target-date funds were down at the end of September for the previous 12 months

14%

Amount the 2010 category was down

Retirement questions?

Write to yourmoney@tribune.com, or via mail at Your Money, Chicago Tribune, Room 400, 435 N. Michigan Ave. Chicago, IL 60611. If your letter is selected, we may include you and your question in a future column.