Leveraging Leverage For Bigger Profits

Post on: 21 Октябрь, 2015 No Comment

Leverage is like fire. It can warm your house but it can also burn it down if it gets out of control. The key is to manage it. One way to do this is to stay fully invested in the market while managing leverage and getting the highest benefit from it. Knowledge of this strategy can help you opportunistically use leverage to grow a portfolio at a faster clip while still managing risk.

Stay Fully Invested

Market timing is a subject of much debate. Many studies have tried to debunk it in the short term. At the same time, when the time horizon is elongated, it appears hard to argue against it. Due to the long-term nature of such periods, it appears that this long-term market timing may be a little understudied and thus present some positive opportunity to those who understand it. You don’t have to be a staunch advocate of market timing to play into some of its merits. A good common ground is to stay fully invested but use leverage to opportunistically add to portfolio returns. (Learn more about market timing in Buy-And Hold Investing Vs. Market Timing . )

Conventional market timing is typically played out in the form of switching into stocks when the stock market looks cheap relative to T-bills and, when it looks overvalued. doing the opposite. The strategy we are discussing incorporates leverage into the equation rather then buying T-bills, which provides great expected returns. However, we suggest mitigating risk by playing percentages and only using leverage up to a certain degree so that catastrophic risk of bankruptcy is avoided.

The Strategy

In this strategy, we stay fully invested in stocks all the time, but use a very diversified ETF as a broad equity proxy. Quite simply, the chance that every stock in the ETF’s corresponding index will go bankrupt is next to impossible. If your investment in such a diversified vehicle goes to zero, you have bigger problems along the lines of economic Armageddon!

Once you have your investment vehicle in place, you can opportunistically add to it when valuations present themselves. The amount of leverage to use is based on the relationship between the valuations of the investment vehicle relative to the underlying economic underpinnings upon which its valuation is based. One measure is the S&P 500 relative to the U.S. GDP. However, a more global measure may be a total world index relative to a global output measure.

When the equity measure appears to be at a peak, the suggested leverage capacity to be used would be zero. Similarly, when the valuation measure is near the bottom, a higher leverage capacity may be used.

Leverage Capacity

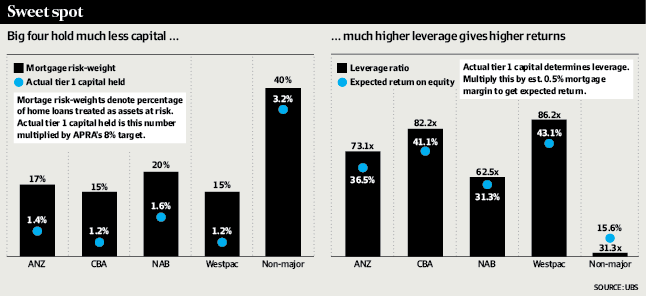

To be safe, the only debt that should be used in this strategy is home equity debt. If you are carrying other high-interest debt (such as credit cards), you should not be investing in the market; saving on interest expense is a better risk-adjusted investment than what can be expected in equity investing.

If mortgage debt is your only debt, your financial condition is probably pretty healthy. Moreover, homes hold their appreciation value better than most investments and are hard for banks to take away due to foreclosure laws. Conversely, margin debt can be called any time you fall below the high margin levels dictated by brokerage companies. Long story short, you have time for irrational pricing to correct without finding your debt a burden. (For related reading, see Borrowing Smart In A Debt-Filled World .)