Investing In Africa With ETFs

Post on: 30 Апрель, 2015 No Comment

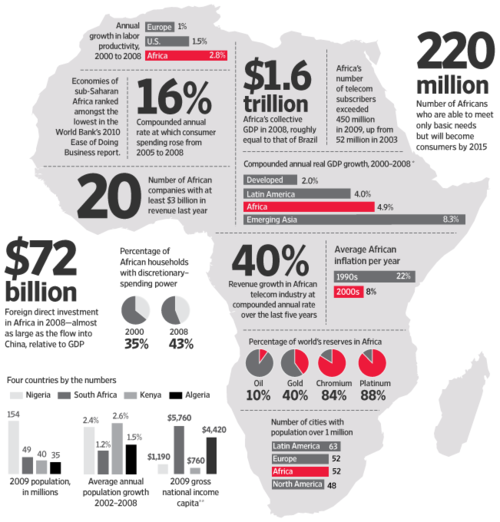

Summary

- ETFs have penetrated niche asset classes, such as frontier markets equity. This includes Africa, with EZA, AFK, and NGE.

- In illiquid, under-researched markets, ETFs don’t offer the same diversification and market return matching as in the US.

- Particularly in Africa, ETFs may not be adequate as a replacement for individual securities but can serve to gain additional diversification. Case in point: the Nigeria focused ETF NGE.

Is there an app for that? A few years ago that was a fun and only slightly rhetorical question, as we traded in our flip phones for smart phones and our PCs were catching flak from the tablet takeover. Today no one asks, because he answer is unequivocally yes.

In similar fashion, a present day investor might ask: is there an ETF for that? Increasingly, that is a rhetorical question as well. Mostly, that is a good thing. Exchange Traded Funds (ETFs) have leveled the playing field by democratizing access to asset classes and markets traditionally only accessible to sophisticated investors such as endowments and pension funds.

But if ETFs sometimes sound too good to be true, it is because they are. Where they excel is in traditional asset classes where a passive, low-cost basket of stocks is generally a better alternative to an actively managed, less transparent, less tax efficient portfolio. The risk lies in the fact that ETFs are not a cure for illiquidity, market inefficiency, and increased correlation between asset classes.

As investors in Africa we at Africa Capital Group have looked at several ETFs including iShares MSCI South Africa (NYSEARCA:EZA ), Market Vectors Africa (NYSEARCA:AFK ), and Global X MSCI Nigeria (NYSEARCA:NGE ). I wanted to focus particular attention on NGE, because investors are well served to take a careful look under the hood. If investing in Nigeria were as simple as equating high GDP growth rates and favorable demographics to a rising tide that lifts all stocks, than NGE would be your fund. The reality however, is more complex:

1) NGE is not that diversified. The top holding, Nigerian Breweries, comprises nearly 20% of the fund and the top 10 names comprise nearly 75%.

2) Almost 50% of the fund is invested in banks. Granted, the financial sector plays an outsized role in the economy relative to developed market, but still, 50% is a lot.

3) Illiquidity + Illiquidity ≠ Liquidity. Just by wrapping Nigerian stocks in a crisp US-traded ETF you have not solved the illiquidity problem of the underlying securities. As long as demand and supply for the ETF shares is relatively balanced, the ETF’s share price should be able to stay close to its NAV. However, that does not mean that the NAV can’t be dragged down by investors outside of the ETF demanding liquidity in the market place during a downturn. Furthermore, if US investors on their own decide to dump NGE in some sort of a risk-off frenzy, than the ETF might be forced to sell shares of the underlying securities, thus demanding liquidity in the Nigerian market, which will come at a cost.

4) My last point, and the one I feel strongest about, is that sub-Saharan Africa might actually be one of the few places on Earth where active, bottom-up investing still makes sense. You cannot sit in an office in New York with a Bloomberg terminal and know everything you need to know about Africa. It takes traveling there, to appreciate that Africa is not a uniform place of war, poverty, and disease. Information flow is light, research is scarce, and liquidity is low in all but the biggest names. In other words: ideal circumstances for boots on the ground and active management. An ETF approach to these markets will not capitalize on the advantage that can be had by discriminating between stocks with good prospects and those without.

In summary, I am a believer in ETFs, but I am less convinced that they can be used as a one-stop-shop to gain access to African stocks. Perhaps they can be added to a portfolio of individual stocks for further diversification, but, in my view, they do not suffice as a standalone solution.

Disclosure: The author is long EZA. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.