Hussman Funds Weekly Market Comment Impulse Response September 13 2010

Post on: 31 Июль, 2015 No Comment

Impulse Response

John P. Hussman, Ph.D.

All rights reserved and actively enforced.

Except for a burst of census hiring that briefly pushed payroll growth above trend during the second quarter of this year, job growth has been perpetually below trend over the past two years. During the post-war period, the civilian labor force has historically grown at about 0.15% each month, which currently implies that normal trend job growth should be about 225,000 jobs per month.

While last month’s labor report was favorably received by Wall Street, that reception was based strictly on the fact that job losses were not as bad as anticipated, given concerns about a double dip in the economy. The problem with this celebration, however, is that analysts continue to overlook the typical lags between deterioration in leading indicators and deterioration in coincident measures, much less lagging ones. As I’ve noted frequently in recent commentaries, the typical lag between deterioration in say, the ECRI Weekly Leading Index and the ISM Purchasing Managers Index is about 13 weeks, and sometimes longer. The typical lag with respect to new claims for unemployment is about 23-26 weeks (which puts the likely window of deterioration at about the October — November time frame), and the typical lag with respect to the payroll unemployment report is, not surprisingly, about 4 weeks beyond that. The critical risk area here extends for several months, not a few weeks.

The labor reports of the past three months cannot possibly be considered to be favorable from a macroeconomic perspective. The reason for this is that these reports were each more than 500,000 jobs short of what should have been expected.

To provide some perspective on this, below is a simple estimate of what economists call an impulse response profile for the U.S. labor market. When we deal with economic variables — such as employment — that are subject to positive or negative shocks, it is often helpful to estimate how those shocks tend to propagate over time. For employment, a 1% shock in job creation or destruction (versus trend growth) tends to be followed over the following year by an additional 1% movement in jobs in the same direction. After that, the impulse gradually attenuates over a larger period of years, as the initial positive or negative burst is followed by a trajectory back toward trend growth. In effect, positive and negative shocks to job creation have very strong tendency to cluster, propagating in the same direction for a period of about 12 months, and then gradually attenuating toward the long-term trend.

Note that the cumulative impulse response curve shifts direction after the first year. Evidently, both when hiring workers and when laying them off, businesses tend to shoot first and ask questions later. In economic recoveries, large initial bursts of hiring tend to propagate for a year, and then the new hiring is rationalized. Similarly, large bursts of layoffs in a recession tend to propagate and then reverse.

We can apply this impulse response to prior economic shocks to get an idea of what the economic headwinds or tailwinds would be for the job market in a normal cycle. I stress the word normal here because in our view, the current economic picture is well outside of postwar norms, and is much better characterized by previous periods of credit crisis. This can be seen most clearly in sluggish final sales, and in the failure of income, less government transfer payments, to show any normal sign of meaningful growth.

With respect to the employment situation, given the massive job losses we observed in 2008 and 2009, we are already past the point where the impulse response curve should propagate additional job losses. Rather, in a normal post-war recovery, the normal impulse response profile suggests that we ought to be observing rapid employment gains on the order of 460,000 to 500,000 jobs a month.

Based on typical impulse response, very robust job growth would normally have been expected following the massive job losses of 2008 and 2009. From this perspective, the past three employment reports have not simply been bad — they have been among the worst job creation shortfalls on record. While not every shortfall results in a fresh wave of propagating job losses, we are observing this shortfall in the context of leading economic indicators that have already turned down clearly.

So what is the most likely outcome of this situation? In my view, the next three months represent the most serious window for the U.S. economy and labor market. The typical 23-26 week lag between leading indicator deterioration and new unemployment claims deterioration suggests that we may observe upward pressure on new claims for unemployment beginning about mid-October. As I noted last week, however, these lags can be somewhat variable, and the leading indicators tend to have a better correlation with price fluctuations in the securities market. By the time the coincident economic evidence is clear, securities markets have often completed a large portion of their adjustment.

On the positive side, while the next few months may provoke some further job losses, I suspect that the U.S. economy is already running fairly lean from an employment standpoint. The better leading indicators of economic activity do suggest a further round of cuts, but there is not nearly as much room for this as employers had going into the recent credit crisis. Employment losses have already been so profound that the typical impulse response actually creates something of a tailwind for the labor market, which hopefully will hold additional job losses to a tolerable level. That said, we shouldn’t rely on anything close to the typical impulse response, because generally speaking, past tailwinds for job growth after a recession have been heavily reliant on the fresh expansion in debt-financed, large-ticket spending. This includes fixed investment, autos, durable goods, and residential investment.

Overall then, we are facing the likelihood a fresh near-term deterioration in U.S. economic activity, as part of a longer multi-year adjustment, which is typical post-credit crisis behavior. My impression is that Wall Street is eager to treat the present cycle as a V-shaped recovery. We see little evidence to support that view, and the best evidence we do observe is more consistent with a double-dip (if not a continuation of a single ongoing recession).

The most serious risk

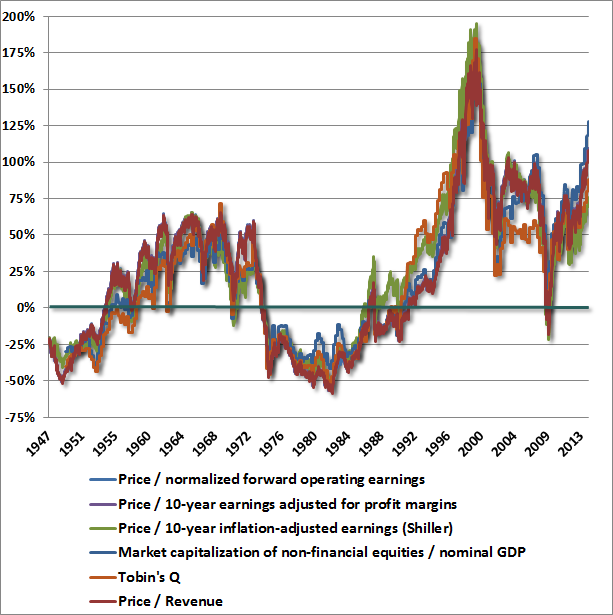

Yet even the near-term risks to employment and the economy are not the greatest risks that investors face. Rather, the most serious risk for investors here is the persistent and misguided eagerness of Wall Street to value long-term assets based on short-term earnings results. Investors have priced the S&P 500 in a manner that is far too dependent on the achievement and maintenance of profit margins about 50% above historical norms. This is a mistake. Profit margins normalize over time, and on the basis of normalized earnings, the S&P 500 is about 40% above robust historical valuation norms (and even further above valuation levels that have represented generational buying opportunities such as 1974 and 1982, when well-covered corporate dividend yields averaged about 6.7%, versus the current 2%).

Yes, bond yields are low here, but 10-year bonds are a 7-year duration instrument while U.S. stocks are roughly 50-year duration instruments at present. Wall Street analysts appear very comfortable advising their clients to lock-in prospective long-term equity returns for the next 50 years at yields that are dramatically below the norm, simply because 10-year Treasury yields are depressed. But where will the 10-year Treasury yield be in 5 years, in 10, in 15, in 20, in 25, in 30 years? Whatever the yield is today will be a distant memory then, but will the return that investors locked in for stocks still look like a value?

Meanwhile, much of the earnings recovery we’ve observed over the past year has been driven by financial companies writing up their assets because the FASB decided in 2009 that it was better to create an opaque monolith out of our entire financial system than to allow the bondholders of banks or other overleveraged financial institutions to lose a penny. A great deal of what represents paper wealth, created out of nothing but a sharpened pencil, will be wiped away in the coming years, because there are not sufficient cash flows behind those asset valuations.

As I’ve said before, a security is nothing more than a stream of cash flows that will actually be delivered to investors over time. When the cash flows are not sufficient to actually repay the face value of the securities; when the cash flows are used to repurchase stock in order to offset the dilution created by grants of stock to corporate insiders; when transitory peaks in those cash flows are used to value securities, rather than considering the entire stream — when these things happen, investors will predictably lose over time.

For our part, we remain focused on identifying companies with stable revenues, stable profit margins, and a record of distributing cash flows or reinvesting them for growth. We are enormously skeptical of share repurchases and takeovers, which are weak uses of cash with little historical evidence of effective return. If share repurchases were highly counter-cyclical, so that companies massively repurchased stock at depressed valuations and not at elevated ones, we might have more confidence. But that’s not what we observe. We prefer companies with stable, predictable cash flows, at reasonable valuations, that earn a consistent return on assets and invested capital, and that don’t show earnings with one hand and quietly rob investors of them with the other. These opportunities always exist. In an economy that appears likely to remain difficult, we refuse to value stocks in a way that relies on a resumption of normal economic growth and assumes profit margins 50% above the norm.

Market Climate

As of last week, the Market Climate for stocks remained characterized by unfavorable valuations, mixed market action, and unfavorable economic pressures. The stock market is clearly overbought on a short-term basis. Day-to-day fluctuations continue to be dominated by attention to various widely-followed technical support and resistance levels. An easing of economic concerns would make us somewhat more constructive in response to periodic improvements in market action, but our latitude for doing so is constrained by valuations. More reasonable valuations, coupled with an easing of economic concerns, would be ideal of course, and would provide us much greater latitude to respond to changes in the quality of market action. Meanwhile, we’ll take our market evidence as it comes, and remain focused on individual stock selection and portfolio construction. Both the Strategic Growth Fund and the Strategic International Equity Fund remain fully hedged at present.

In bonds, the Market Climate remained characterized by moderately unfavorable yield levels and favorable yield pressures. Bonds have pulled back from their recent highs on hopes of averting further economic weakness. Though investors have clearly taken a breath of relief on the basis of narrow surprises (note for example that last week’s new unemployment claims report was coupled with upward revisions for the prior two weeks), it’s not at all clear that investors understand the typical lags between leading indicators, coincident indicators, and lagging indicators. For our part, the prospect of further economic risk, and therefore the prospect of Fed action on quantitative easing, and in turn, bond price strength and U.S. dollar weakness, is still very much on the table.

Prospectuses for the Hussman Strategic Growth Fund, the Hussman Strategic International Equity Fund, and the Hussman Strategic Total Return Fund, as well as Fund reports and other information, are available by clicking The Funds menu button from any page of this website.