How to Find the Best Roth IRA Rates

Post on: 5 Май, 2016 No Comment

August 31, 2010

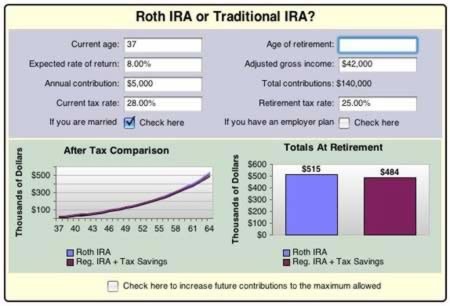

One of the most common Google searches you will find in regards to Roth IRAs (or really any investment account) will be how to find the best rates of return for that account. What the people running a search with these terms are looking for is not how to do the math to calculate the return. Instead they are looking for an easy way to get a high return in their retirement account, and want to know the best place that offers an account with a high rate. Unfortunately for them it simply isn’t that easy. The return of your Roth IRA isn’t something that is set by the firm or bank where you open the account. It is determined by the return of the investments inside the account.

Lesson One: Roth IRAs, Traditional IRAs, and 401ks are all accounts .

They don’t, by themselves, have a return. I like to think of my Roth IRA as a box. An investment box that I put money into. If I left that money sitting in the Roth IRA and I didn’t put it into an investment vehicle (like a CD, a mutual fund, or individual stocks) it would earn $0 for me. It would just hold the money and do nothing. That would be bad — inflation would slowly eat away at the spending power of that money and by the time I got to retirement it would be worth a lot less than what I put in the account to begin with.

Lesson Two: You Must Pick Investments Inside Your Retirement Account

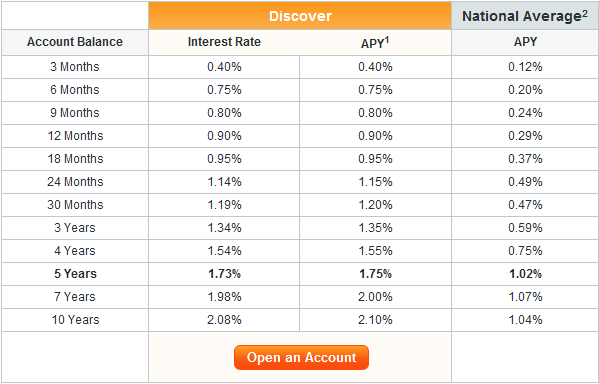

Sticking with the box example: you put money in the box. It sits there until you put it into an investment vehicle. Let’s say you max out you Roth IRA this year and deposit $5,500 into the account. You could split up that $5,500 investment by putting $1,500 into a 3-year CD. $2,000 into a bond index mutual fund, and $2,000 into a stock index mutual fund. Each of those investments would be envelopes in that box.

Lesson Three: Best Roth IRA Rates are Determined by Investments

Let’s assume you invested that $5,000 and split up the money into envelopes at the beginning of the year rather than throughout the year with monthly deductions from your accounts. At the end of the year you decide to peek into the box to see how much money you have. You’re hoping it’s gone up or at least stayed at $5,500. When you peek into the box your three envelopes are gone. But don’t be distressed — the provider that holds your Roth IRA has simply taken the money in the envelopes and now holds them at their financial institution. Instead you find a couple of pieces of paper in place of the original envelopes. This is the summary of your account and it shows how much money you deposited throughout the year, and what the overall return was. That all important number reads a +5.88% return for the year. Is this a best rate for your Roth IRA? That’s hard to tell as it depends on what you were invested in and what happened in the markets throughout the year. But whatever return you received, like it or not, could have been improved or made worse by making different investment choices and not by picking a different firm to hold your Roth IRA.

This article is by staff writer Kevin Mulligan.