How to Create Your Own Vanguard Balanced ETF Portfolio

Post on: 31 Март, 2015 No Comment

Discover the reasons why a Vanguard Balanced ETF portfolio may be right for you

The popular Vanguard Balanced Index Fund is made up of two indexes; 60% is invested in a sampling of the CRSP U.S. Total Stock Market Index and 40% is invested in the Barclay’s U.S. Aggregate Float Adjusted Bond Index.

I am going to show you how to use a two-part Vanguard ETF portfolio, that uses these same indexes, to make a more powerful and flexible Vanguard Balanced ETF portfolio.

First, it is important to understand how diversified each of these indexes can be. The CRSP U.S. Total Stock Market Index has 3,775 stocks which covers 100% of the U.S. stock market. The Barclay’s U.S. Aggregate Float Adjusted Index has a staggering 8,958 bonds.

The Vanguard Balanced Index Fund is a great investment. With just one holding, you can cover a vast majority of the US stock and bond market, but by using a combination of the Vanguard Total Stock Market ETF (VTI) and the Vanguard Total Bond Market ETF (BND) you can achieve several significant advantages.

Here are six advantages to using these two ETFs instead of just one Index Fund.

Vanguard Balanced ETF Portfolio Advantage #1

Pay less tax

ETFs are like a cross between an individual stock and an index fund. They track an index just like an index fund but they trade throughout the day just like a stock.

All of the owners of an index fund are put into one pool and when one group of owners sells shares, the index fund manager has to sell fund holdings and possibly pass along capital gains to all of the other owners of the index fund.

Due to the unique structure of ETFs, other owners do not affect your taxes, which makes them more tax efficient. To see more tips on how to save taxes see: The Power of Tax-Efficient Investments .

Vanguard Balanced ETF Portfolio Advantage #2

More flexibility

The biggest disadvantage of the Vanguard Balanced Index Fund is the lack of flexibility. The percentage of stock and bond is locked at 60% stock and 40% bond. When you combine the Vanguard Total Stock Market ETF (VTI) with the Vanguard Total Bond Market ETF (BND) you have the flexibility to determine how much stock and how much bond you want to have. More importantly, you can make adjustments to that mixture in the future.

Here is a chart that shows the return of four different mixtures. The first number is the stock portion and second number is the bond portion. For example, the 80/20 Vanguard ETF Portfolio is 80% stock and 20% bond. As you can see from this chart, the more money invested in stocks the more you would have made.

Click to Zoom In Source: Zephyr StyleADVISORTM

Here are some examples of how you can use this flexibility.

This first chart shows an example of changing the stock and bond allocation over a persons lifetime. This more than anything demonstrates the flexibility of using this two-part Vanguard ETF portfolio instead of just one Vanguard Balanced Index Fund. This flexibility allows you to start with one mixture, and as you get older, reduce the risk in your portfolio. This is only an example and not a recommendation, as your situation may differ, but it does demonstrate the flexibility of this concept.

Another example would be saving for college. This next chart shows an example of changing the stock and bond allocation of a college savings program as the child gets closer to college.

Vanguard Balanced ETF Portfolio Advantage #3

Easier to mange your risk

The key difference between using just the Vanguard balanced index fund and this two-part Vanguard ETF portfolio is the ability to customize the portfolio to fit your personal risk tolerance.

This next chart shows all of the down market drawdowns that have transpired since May of 2007. Predictably you can see the more money that is added to the stock portion, the more it fell during the bigger downturns. Using two Vanguard ETFs instead of one Vanguard Index Fund allows you to customize the portfolio to meet your needs. You can decide which portfolio you feel you could live with.

Perhaps you would like to take more risk than the Vanguard balanced fund, or perhaps you would like to take less risk, but at least you have control over the risk that you’re taking. To fully understand how to evaluate the risks of your portfolio see: Best Method to Evaluate Investment Risk .

Click to Zoom In Source: Zephyr StyleADVISORTM

Vanguard Balanced ETF Portfolio Advantage #4

Better for rebalancing

One of the other advantages to having two pieces instead of one is that you can rebalance those two pieces on an annual basis and sometimes get a higher rate of return. This next chart shows what would happen if you replicated the Vanguard Balanced Stock Index by placing 60% into the Vanguard Total Stock Market Index ETF (VTI) and 40% into the Vanguard Total Bond Market ETF (BND), and did not rebalance or rebalanced once a year versus just buying the Vanguard Balanced Index Fund.

You can see from this chart that rebalancing these two ETFs once per year back to their original 60/40 mixture actually achieves a .33% (6.72% versus 6.39%) higher rate of return per year, which may not seem like much but adds up to a fairly significant amount over time. For example, $100,000 invested at the 6.72% versus 6.39% for 10 years would net you $6,144 more.

This is especially useful if you are able to accomplish this rebalancing without any trading cost, which is what youd be able to do if you held these ETFs in a Vanguard Brokerage Account because Vanguard allows you to trade these ETFs with on commission. You can make even more money by using Opportunistic Rebalancing, see — Rebalance Portfolio: How to Do It. When to Do It. for more information on this exciting concept.

Click to Zoom In Source: Zephyr StyleADVISORTM

Vanguard Balanced ETF Portfolio Advantage #5

Less expensive

Another advantage of using this two-part Vanguard ETF portfolio is that it is actually cheaper than buying the Vanguard Balanced Index Fund. The table shows the expense ratio for the index fund for both the Vanguard Balanced Index Fund Admiral Shares and the Investor Shares versus the cost for all of the mixtures that are listed in the charts above.

As you can see from the table, every mixture of the two-part Vanguard ETF portfolio is cheaper than either of the Vanguard Balanced Index Funds. Investment cost is critical to your long-term success. See Best Low Cost Index Funds for Highest Portfolio Returns for more information on how you can lower your investment costs.

Source: Morningstar

Another key advantage is that this plan is so simple and so easy to execute that you do not need to pay an advisor, which could save you considerable money over the long-term. You can set up your own retirement plan or college savings plan without paying the significant cost of the advisor.

Vanguard Balanced ETF Portfolio Advantage #6

Easier to buy

Purchasing this two-part Vanguard ETF portfolio is actually quite easy. You can buy an ETF any place that you can buy a stock. Not all index funds are available on every trading platform, but you should be able to find these two ETFs everywhere.

Also, the minimum purchase is lower. The Vanguard Balanced Index Fund Investor Shares (VBINX) has a $3,000 minimum purchase and the Vanguard Balanced Index Fund Admiral Shares (VBIAX) has a $10,000 minimum purchase. With an ETF you can buy as little as one share, which is just over $100 for the Vanguard Total Stock Market ETF (VTI), and just under $100 for the Vanguard Total Bond Market ETF (BND). If you are just starting out you can buy these two ETFs with less money, although in order to execute an adequate rebalance program you will eventually need more money.

My recommendation would be to establish a Vanguard Brokerage Account and purchase these two ETFs inside of that account. Vanguard does not charge any commissions to buy or sell their own ETFs.

Conclusion

I highly recommend that you consider using this two-part Vanguard ETF portfolio to create your own Vanguard Balanced ETF Portfolio instead of using the Vanguard Balanced Index Fund.

You will find that using these two ETFs will be tax efficient, create more flexibility both now and into the future, allowing you to create a customized portfolio that perfectly fits your personal risk tolerance. It is also less expensive than using the index fund and may potentially provide a higher rate of return by rebalancing once per year. With just a little bit of effort you will find that setting up this portfolio is quite easy and definitely worthwhile.

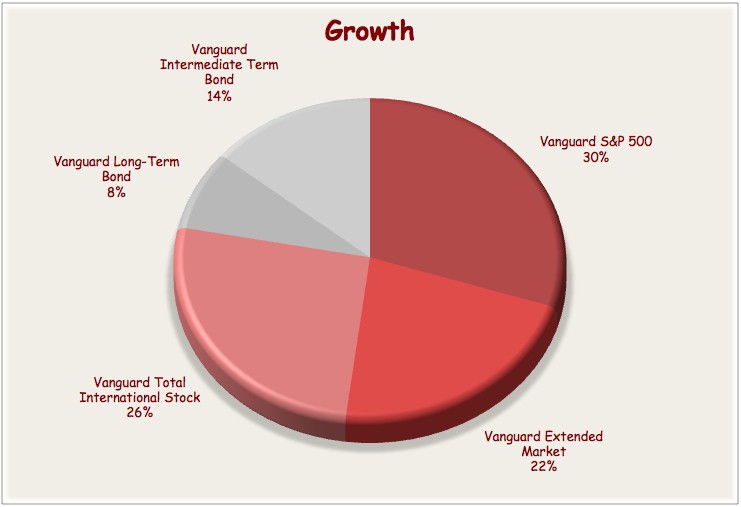

To take it to the next level and see what you can do with a four, five or six holding Vanguard ETF portfolio, read my 50-page Vanguard free report .

This report is full of critical information for the Vanguard investor. I disclose my Retirement Income Builder Program and I share my six risk-calibrated, easy-to-copy Vanguard ETF Portfolios.

Click on the link below and I will email the report to you. You will also have the option of receiving my free email newsletter where you can see my best articles, delivered to your inbox, before anyone else.

Would you like a happy retirement? Download our FREE report Retirement Income Builder: 6 Easy to copy Vanguard Global Portfolios with time-tested retirement planning advice for every investor. Learn more.

Remonsy ETF Network exists to enhance your life-long investing success by providing independent and authoritative investment advice you can trust. Landmark academic financial studies, proprietary in-depth research and over a quarter century of real world financial advisory experience during good times and bad provide the foundation for our time-tested, proven investing guidance. And most important, we work only for you: We dont hold or manage your money. We dont earn trading commissions. And we dont take money from investment companies.