How to Calculate a Portfolio Performance

Post on: 30 Июнь, 2015 No Comment

Instructions

Calculate the portfolio’s aggregate rate of return. Take the portfolios year-end value, subtract the beginning annual balance, and divide by the year-end value. This will provide a basic annual growth percentage.

Gather each stocks beta. Most stocks have a beta that is available from finance websites. Investors can visit these sites and gather the latest beta for each security in their investment portfolio.

Tips & Warnings

References

More Like This

How to Calculate a Portfolio Percentage

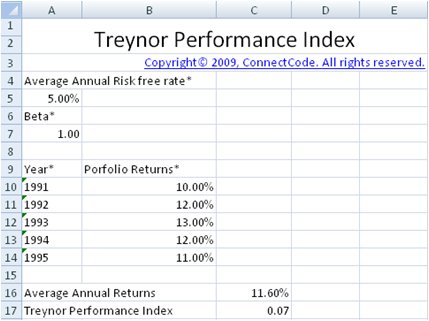

How to Calculate Treynor Ratio

You May Also Like

How to Calculate Performance Attribution. How to Calculate Portfolio Turnover. Thoroughly research every investment before sinking money in it.

How to Calculate a Portfolio Performance. Portfolio analysis is a tool investors use to measure the performance of their investments.

The key to a successful investment portfolio is to place your assets where they will generate as much income as possible. This.

How to Calculate Fund Performance. Total return is a measure of performance used to evaluate investments or a pool of investments such.

Your portfolio consists of different investment activities you own, such as stocks and bonds. A good investor wants to know how well.

How to Calculate Risk & Return. splitting the amount of risk-free return from the risk-based returns in an. they can.

How to Use Excel To Calculate Investment Portfolio Returns; Comments. 1338366324 Nov 04, 2012. For example, the average grade in a.

. is an equation to calculate risk-adjusted performance of a stock portfolio. return from average portfolio return. For example: 2005: 3.2.

A benchmark is a standard used to measure the performance of a security. Fund or investment managers will often use a benchmark.

Performance. How to Calculate Stock Price Return. The rule of the stock market has always been buy low, sell high. If.

Review the portfolio. You should see your stocks, listed in alphabetical order (if you chose that option). When building a stock.

It is used by investment managers to calculate portfolio risk. The Sharpe ratio. Calculate Compounded Period. It can be 0.

How to Calculate Market Value of Equity. Balancing a Portfolio; Managing Your Money; More eHow. home; mom; style; food; tech; money;.

Read it as Risk divided by Return. 2. Risk Adjusted Returns Defined. risk and return. Risk is typically refereed to.

Calculating the performance of your stock investments is important for you to understand your overall financial health. How to Calculate a.

Diversified portfolios greatly reduce risk while smoothing investment returns by including many securities across a wide. Example of a Well Diversified.