How ETFs Alter the Dynamics of Gold

Post on: 10 Октябрь, 2015 No Comment

Related Content

The forecast for gold prices has recently been in flux, with 2014 appearing more positive than 2013 — even before the military standoff in Ukraine’s Crimea region. throwing geopolitics into the mix. Various factors tend to affect gold prices, including global security, currencies, interest rates and macroeconomic outlooks. But forecasters have recently incorporated a new variable into the equation: retail investors.

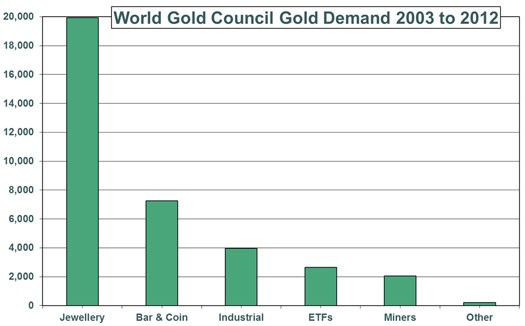

Retail gold buyers have for years been associated with jewelry buyers rather than people seeking bullion as a store of value, a diversification strategy or an investment tactic. But small-scale investors have enjoyed unprecedented access to gold in the past decade because of exchange-traded funds backed by the metal itself, rather than by gold-mining companies or futures. As a result, more motivations to buy have emerged. “The gold ETFs are a fairly big game changer for the gold industry, with both good and bad consequences,” says Sam Sivarajan, head of investments at Manulife Private Wealth in Toronto, part of Manulife Financial Corp. “They have democratized gold buying.”

Similar metals-based ETFs have also affected commodities markets such as those for silver and platinum. But the SPDR Gold Shares ETF (GLD), which debuted on the New York Stock Exchange in November 2004 and has traded on NYSE Arca since December 2007, has received the most attention. GLD, the world’s largest physically backed gold ETF, has captured roughly 70 percent to 80 percent of the gold ETF market, says Sivarajan. Last year was the first annual decline in the gold price since the ETF’s inception. This slump underscored the power of retail investors over gold prices. Small-scale holders joined with hedge funds. which divested about a third of the value of the gold ETF. That pushed 881 metric tons of the metal onto global markets, depressing prices.

The ETF fund is marketed by Boston’s State Street Global Markets, an affiliate of State Street Global Advisors. The fund eliminates logistical hurdles, such as costs of trading, storing and insuring gold bars, for retail investors to trade in gold. The price of a share of GLD has ranged from $127.60 to just under $130 in NYSE Arca trading March 1–10 and represents the value of one tenth of an ounce of gold. Storage and trading expenses run about 0.4 percent.

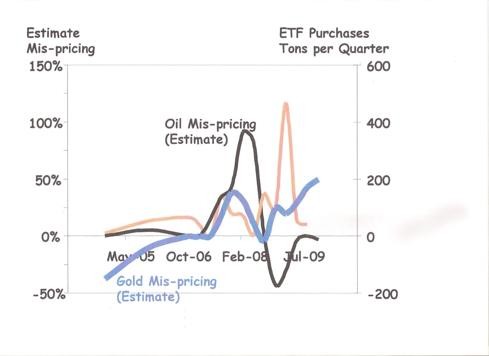

In 2013 the interplay between investors and gold made it difficult to tell whether ETF sales were a reaction to gold prices or vice versa. Analysts did not see a single cause for gold sales last year among those using the metal as a store of value or a hedge against other portfolio risks. But once a combination of factors triggered large sales, low prices may have been a reason for the increased demand by jewelry buyers, says Martin Murenbeeld, chief economist for Canadian investment bank Dundee Capital Markets in Vancouver. Either way, the result was a buying spree elsewhere. Last year China surpassed India as the world’s largest buyer of gold jewelry, according to Sivarajan. If demand stays high, however, prices could jump. “If demand in China and elsewhere remains near record levels but ETFs stop their selling, the market will be extremely short of supply,” says market research from Germiston, South Africa–based Rand Refinery, the largest integrated single-site precious metals refining and smelting complex in the world.

“These trades are in the real economy, which is different than on-paper trades, like futures contracts,” says Francisco Blanch, head of commodities and derivatives research at Bank of America Merrill Lynch in New York. “For every long in a futures contract, there’s a short, but an ETF backed by the metal alters the specific supply-and-demand balances.”

Also thanks to ETF buyers, demand rose in 2013 for platinum, a metal for which a supply shortage could pose other economic questions. Platinum is an integral commodity for carmakers, who use it in catalytic converters. That is why, some five years ago, the auto industry lobbied against the creation of platinum-backed ETFs out of concern that putting the industry in competition with investors for output could boost car prices.

Retail investors have yet to cause a severe supply drop, but they are likely to keep buying. The ETFs are increasingly a staple in portfolios as a means of diversification and are used by portfolio managers to meet the demands of their customers. “With gold and resources morphing into their own investment asset class, we expect over time to see a greater commitment to this,” says Murenbeeld. A parallel can be found in securitized real estate assets, which despite a degree of infamy gained in the financial crisis have also proved themselves to be a way to diversify a basic portfolio dominated by stocks and bonds.

Follow Matt Mossman on Twitter at @mamossman .