Hedge funds_1

Post on: 6 Июль, 2016 No Comment

This is an advanced investing topic. Hedge funds are not recommended for retirement portfolios and should only be considered by experienced investors who are willing to accept a high level of risk (see below ). Please ask in the forum for advice.

A hedge fund is an investment fund that can undertake a wider range of investment and trading activities than other funds, but which is only open for investment from particular types of investors specified by regulators. These investors are typically institutions, such as pension funds, university endowments and foundations, or high net worth individuals. As a class, hedge funds invest in a diverse range of assets, but they most commonly trade liquid securities on public markets. They also employ a wide variety of investment strategies, and make use of techniques such as short selling and leverage. [1]

Like mutual funds. hedge funds pool investors’ money and invest those funds in financial instruments in an effort to make a positive return. Many hedge funds seek to profit in all kinds of markets by pursuing leveraging and other speculative investment practices that may increase the risk of investment loss. [2]

Unlike mutual funds, however, hedge funds are not required to register with the SEC. Hedge funds typically issue securities in “private offerings” that are not registered with the SEC under the Securities Act of 1933. In addition, hedge funds are not required to make periodic reports under the Securities Exchange Act of 1934. But hedge funds are subject to the same prohibitions against fraud as are other market participants, and their managers have the same fiduciary duties as other investment advisers. [2] (Superseded by the Dodd-Frank legislation, see below .)

Hedge fund investors do not receive all of the federal and state law protections that commonly apply to most registered investments. For example, you won’t get the same level of disclosures from a hedge fund that you’ll get from registered investments. Without the disclosures that the securities laws require for most registered investments, it can be quite difficult to verify representations you may receive from a hedge fund. You should also be aware that, while the SEC may conduct examinations of any hedge fund manager that is registered as an investment adviser under the Investment Advisers Act, the SEC and other securities regulators generally have limited ability to check routinely on hedge fund activities. [2]

Hedge funds are commonly classified as a unique asset class, much like commodities, private equity, and other “alternative” investments. Yet unlike other asset classes, hedge funds do not share unique structural characteristics (e.g. bonds represent a loan to a company or government agency, and stocks represent ownership in a corporation). Consequently, hedge funds should not be thought of as an alternative asset class per se. but rather as investment strategies that trade existing asset classes to generate returns. [3]

Contents

Strategies

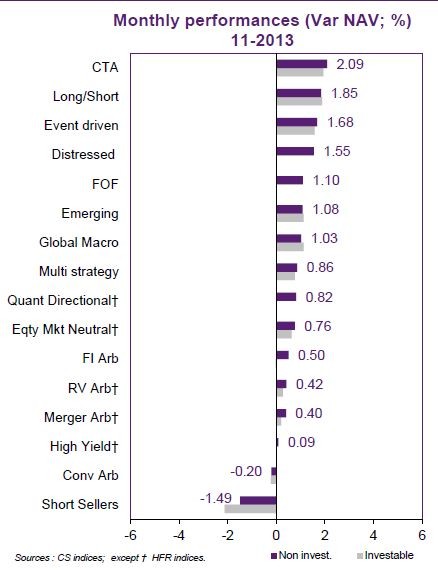

Hedge funds, in short, are largely unregulated, private pools of capital. Hedge fund managers can invest in a broad array of assets and pursue many investment strategies such as global macro. market neutral equity. [4] convertible arbitrage. or event-driven. [5]

These four categories are distinguished by investment style and have their own risk and return characteristics. Managed futures or multi-strategy funds may not fit into these categories, but are nonetheless popular strategies with investors. It is possible for hedge funds to commit to a certain strategy or employ multiple strategies to allow flexibility, for risk management purposes, or to achieve diversified returns. The hedge fund’s prospectus, also known as an offering memorandum, offers potential investors information about key aspects of the fund, including the fund’s investment strategy, investment type, and leverage limit. [1]

Although no two funds or strategies are exactly alike, many funds operate within a common framework, namely using offsetting positions to control one or more identified risk factors. In fact, Alfred Winslow Jones formed the first hedge fund in 1949 [6] — hedging long stock positions by shorting other positions — in order to mitigate the gyrations in the equity market. Jones’s model was based on the premise that performance depends more on stock selection than market direction. This practice of hedging market risk remains common in today’s hedge fund environment. [3]

Characteristics

While strategies and individual hedge funds are quite heterogeneous, it is useful to focus on four broad characteristics that distinguish them from other types of money management funds. [5]

First, hedge funds are not restricted by the type of trading strategies and financial instruments they may use. In particular, hedge funds can and do make use of short selling, derivatives, and options, all of which are complex and potentially nonlinear in payoffs. [5]

Second, hedge funds make liberal use of leverage, be it directly through the use of debt or indirectly through leverage embedded in derivatives. This freedom is possible because hedge funds in the United States largely fall outside of the regulatory umbrella by virtue of being open only to accredited investors and large institutions. [5]

Hedge fund investors and counterparties impose some discipline on the amount of leverage actually employed. This discipline, however, may be limited by the third key characteristic — opacity to outsiders — which again is in large part due to their unregulated nature. [5]

Finally, hedge fund managers are typically compensated based on both scale and absolute performance through a dual fee structure, e.g. the “2-and-20” set-up where managers retain 2% of the net asset value of the fund and 20% of returns in excess of some benchmark. [5]

Opacity

Opacity is not unique to hedge funds as financial institutions generally, and banks especially, are thought to be more opaque than firms in other industries. Financial firms, however, often have traded instruments such as equity shares or bonds outstanding, so they are subjected to further scrutiny by market participants. By contrast, hedge funds, due to their unregulated and private nature, are not subject to such wide scrutiny unless they chose to issue public securities. Moreover, the success of a hedge fund often depends on proprietary trading strategies which, if made public, can be used by others to trade against them. Investors know this and are thus willing to tolerate a degree of opacity not seen in the mutual fund industry in the hope of securing particularly rich returns. [5]

U. S. regulation

Effective July 21, 2011 for all registered advisers, the Dodd-Frank Wall Street Reform Act aims to increase regulation of financial companies, including hedge funds. The act requires advisers with private pools of capital exceeding $150 million or more in assets to register with the SEC as investment advisers and become subject to all rules which apply to registered advisers. Under Dodd-Frank, hedge fund managers who have less than $100 million in assets under management will be overseen by the state where the manager is domiciled and become subject to state regulation. This will significantly increase the number of hedge funds under state supervision, as the threshold for SEC regulation was previously $30 million. [1]

In response to Dodd-Frank, some of the larger hedge funds have gone entirely private; closing to outside investors and only trading their owner’s money. [7].

Compensation

The compensation structure of hedge funds differs markedly from other institutional investors such as mutual funds. In particular, hedge fund traders and managers tend to be compensated more on absolute return and scale, while their brethren in institutional investing typically have their compensation tied to performance relative to some benchmark such as the S&P500. In addition, hedge fund managers have added optionality in the form of hurdle rates (no incentive fee if returns are below the hurdle rate) and high water marks (incentive fee only on new profits, i.e. after past losses are made up), making payoffs potentially very convex and therefore asymmetric: gains and losses are treated differently. This convex payoff structure provides strong incentives for hedge fund managers to take on risk and leverage. Although incentive fees also play an important role in the mutual fund industry, they are required by law to be symmetric in the U.S. [5]

Investment risk

While in theory hedge funds enhance the risk-adjusted returns of traditional portfolios, they are also often acknowledged to be potentially risky investments. Because of their potential pitfalls, hedge funds should be viewed as long-term investments. [3]

Although hedging is actually the practice of attempting to reduce risk, the goal of most hedge funds is to maximize return on investment. Nowadays, hedge funds use dozens of different strategies, so it isn’t accurate to say that hedge funds just hedge risk. In fact, because hedge fund managers make speculative investments, these funds can carry more risk than the overall market. [8]

Further, there is a growing amount of literature which substantiates conclusions that hedge fund returns are predominately determined by exposure to common risk factors, not manager skill. Investors seeking higher returns should avoid hedge funds, and gain access to the risk factors they want in lower cost ways, such as index or other low-cost, passively managed funds. [9]