FOREIGN DIRECT INVESTMENT POLICY AND TRENDS IN UZBEKISTAN

Post on: 16 Март, 2015 No Comment

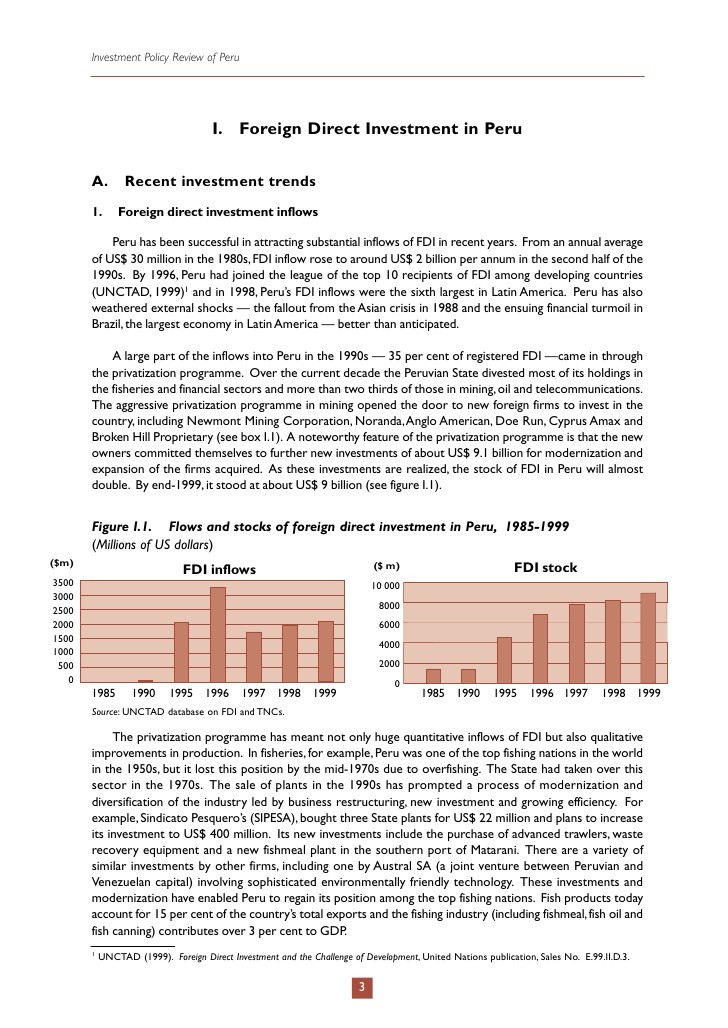

Institute of Forecasting and Macroeconomic Research

under the Cabinet of Ministers of the Republic of Uzbekistan,

Tashkent, Uzbekistan

Foreign direct investment (FDI) has become a key source of growth in many countries with transition economies. In this regard, one of the objectives of the investment policy of many developing countries is to attract FDI into the national economy. It is assumed that FDI have a positive impact on economic development and will bring new technology, open up new markets and improve management practices and business activities. FDI help recipient countries to cover a significant part of the capital needed for investment due to the inflow of capital from abroad.

FDI is an investment made to acquire a lasting management interest (normally 10% of voting stock) in a business enterprise operating in a country other than that of the investor defined according to residency [13].

A number of researchers have studied FDI impact on economic growth. Findlay (1978) postulates that FDI increases the rate of technical progress in the host country through a contagion effect from the more advanced technology, management practices, used by foreign firms [12].

Another economist Dees (1998) finds the FDI as an important factor in explaining Chinas economic growth [9] and according to De Mello (1997) it has a positive correlation for selected Latin American countries [11]. A study by Borensztein et al. (1998) tested the effect of FDI on economic growth in a cross-country regression framework. The authors found some evidence of a crowding-in effect, i.e. that FDI is complementary to domestic investment. A one dollar increase in FDI inflows is associated with an increase in total investment in the host economy of more than one dollar. This implies that FDI exerts a positive effect on domestic investment, ranging from 1.5 to 2.3, probably due to the attraction of complementary activities that dominate the displacement of domestic competitors [14]. Borensztein et al. (1998) also sees FDI as an important vehicle for the transfer of technology, contributing to growth in larger measure than domestic investment.

Inflows of foreign capital are assumed to boost investment levels letting FDI contribute to economic growth via technology transfer. Blomstrom, Konan and Lipsey (2000) TNCs through FDI flows can transfer technology either directly (internally) to their foreign owned enterprises or indirectly (externally) to domestically owned and controlled firms in the host country [1].

According to De Gregorio (2003), FDI may allow a country to bring in technologies and knowledge that are not readily available to domestic investors, and by this way increases productivity growth in the economy. FDI may also bring in expertise that the country does not possess and foreign investors may have access to global markets. In fact, he found that increasing aggregate investment by 1 percentage point of GDP increased economic growth of Latin American countries by 0.1% to 0.2% a year, but increasing FDI by the same amount increased growth by approximately 0.6% a year during the period 19501985, thus indicating that FDI is three times more efficient than domestic investment [10].

We should also mention paper by Tochitskaya and Kolesnikova (2008), where the authors analyzed the impact of FDI on the economys productivity and export platform creation. The research showed that even though the enterprises with the foreign assets are more technologically developed and productive, they have no influence on the local companies.

Legal framework and regulation of attracting foreign investment in the Republic of Uzbekistan base on the acts like law On Foreign Investments (1998)[2], law On investment activity (1998)[4], law On guarantees and measures of protection of the rights of foreign investors [3], decree of the president №-3594 On additional measures of stimulation of private foreign direct investments attraction (2005) [5], decree of the president №-4434 On additional measures of stimulation of foreign direct investments attraction (2012) [6] and others.

According to the legislation of the Republic of Uzbekistan foreign investors grant conditions no less favorable than the corresponding conditions for investments by individuals and legal entities of the Republic of Uzbekistan.State guarantees and protects the rights of foreign investors carrying out investment activities on the territory of the Republic of Uzbekistan. Along with the general guarantees and measures of protection in some cases, foreign investors may be granted additional opportunities when they invest in priority sectors and projects to ensure sustainable economic growth, progressive structural changes in the economy and to ensure the strengthening and expansion of the export potential of the country and its integration into the world economy. There are also preferences in projects of small business, the implementation of which is aimed at processing of raw materials, production of consumer goods and services. An investment agreement is concluded between the Government of the Republic of Uzbekistan and foreign investor, through the Ministry of Foreign Economic Relations, Investments and Trade.

In order to provide all kinds of information and support to foreign investors it was created the Uzinfoinvest Agency for the Information Support and Foreign Investments Promotion [16]. The main tasks of the agency are to create awareness about the economic and resource potential of the Republic of Uzbekistan, to provide them with information about future projects, the legal basis of investment activities, to organize meetings and negotiations between foreign investors and domestic entrepreneurs to implement mutually beneficial long-term investment projects. Moreover it maintains a high international image of Uzbekistan through abroad promotional events and actions like exhibitions, forums, presentations, conferences and seminars, publishes specialized literature, booklets and creates a system of specialized information Internet web site.

The first free economic zone Navoi Free Industrial Economic Zone (FIEZ) was created by the Presidential Decree in 2008 on the territory of Navoi region [17]. It was decided to create a Special Industrial Zone (SIZ) Angren for the development of the productive capacity of Tashkent region in 2012 [7], and a Special Industrial Zone Jizzak [8] for the development of Jizzak and partially Syrdarya regions in April 2013. These reforms helped the country to stimulate the attraction of FDI into the economy.

In the early 2000s FDI inflows into the economy of Uzbekistan was low, and their accumulated volume in 2004 did not exceed US $1 billion. Share of FDI in overall investment reached almost 10%, and they had no significant effect on the process of structural transformation of the economy, development of industrial production and foreign trade increase [18]. However, because of the investment policy reforms the annual volume of foreign investment in Uzbekistan increased from US $0.7 billion in 2000 to more than US $2.5 billion in 2012. The share of direct investment in them has increased from 14.4% in 2000 to more than 79% in 2012, amounting to about US $ 2 billion. Noteworthy is the fact that while in the past 10 years the volume of investment in the economy as a whole increased by 3.2 times, the volume of foreign direct investment has increased over this period more than 20 times.

Financial and economic crisis significantly changing the amount, direction and structure of global investment flows had some influence on foreign investment attraction and development in Uzbekistan. Analysis of foreign investment into the country in the pre-crisis and post-crisis period (2005-2012 years) says about the results of the measures taken by the government on leveling the crisis effects and trends of recent years. (Figure 1.)

Figure 1. Inward foreign direct investment trends in the economy of Uzbekistan

Source: State committee on statistics of the Republic of Uzbekistan.

Because of the measures, US $11.7 billion investment was attracted into Uzbekistan in 2012 and 22% of them, or more than US $2.5 billion was foreign investment, of which 79% was direct investment. There was an increase in the share of FDI in total investment and in fact it accounted for more than 17.2% in 2012 comparing 14.9% in 2005 [15]. It occurred as a result of the improvement of business environment, a broad system of legal guarantees and privileges for foreign investors, holistic system of measures to encourage activities of enterprises with foreign investment. Share of FDI in the structure of investments increased by 2.3 percentage points compared with 2005, while the volume of FDI inflows increased by 3.9 times. The share of total foreign investment increased by 10.8 percentage points from 68.5 % in 2005 to 79.3% in 2012 [14].

There were significant structural changes in distribution of foreign investment among regions as well. During the years of 2007-2012 the shares of Bukhara, Kashkadarya and Navoi regions in total volume of foreign investments have decreased slightly — from 30.7 %, 17.9% and 9% in 2007 to 25.5%, 15.1% and 8.7% in 2012 respectively. It provided an increase in territorial balance in the distribution of foreign investment. (Figure 2.)

Figure 2. Regional distribution of foreign investment in the economy of Uzbekistan

When it comes to sector breakdown of foreign investment in the country in 2012 the largest part of them was directed to the industry (45.9%), transport (28.4%) and communication (10.9%) sectors. Comparing to 2004 shares of industry and transport in foreign investment increased (7 and 4.3 percentage point) while the share of communication decreased (3.5percentage point). (Figure 3.)

Figure 3. Foreign investment distribution among the sectors of the economy of Uzbekistan

However, despite significant progress in attracting foreign investment in the country, there are still significant shortcomings in this area. According to UNCTAD ratio of FDI to GDP of Uzbekistan remains fairly low — 3.1 % on average in 2007-2011, with an average level of the countries with economies in transition — 4.1% and the CIS countries — 4.2%. Besides a comparative analysis of FDI inflows to the CIS countries shows that Uzbekistan is significantly behind the rest of the commonwealth countries regarding foreign direct investment per capita. For example, in 2011 in Uzbekistan FDI per capita was US $50.5, while the average value for the CIS amounted to US $307.4 per capita. In Kazakhstan, the FDI per capita was US $796.6 while in Russian Federation the value was US $370.2 [18].

All this points to the need to further improve conditions for foreign investors. Economic reality concludes that FDI flows are oriented towards countries which practically demonstrate the following elements:

- selective sectoral investment policy or a focus on more technology-intensive activities;

- political and macroeconomic stability and liberalized markets;

- stable social order, especially attitude towards foreigners, access to social amenities and facilities for expatriate and their families, conflicts settlement;

- a limited role of state in economy, a favorable business climate (openness to trade and a free commercial regime, transparent and automatic incentives, a payment system at international standards, a free currency system, financial and fiscal facilities, a small tax on profit and agreements for avoiding double taxation),

- better endowment of human capital(work force initiative and qualification, good connection between education and labor market requests, local managerial abilities, good quality of research and development personnel);

- industrial and intellectual property rights guarantees, successful FDI projects history, foreign investors views about investment climate and others.

1. Blomstrom, M. D. Konan and R.E. Lipsey. 2000. FDI in the Restructuring of the Japanese economy. The European Institute of Japanese Studies (EIJS), Working Paper No 91. Stockholm.

2. Bulletin of Oliy Majlis of the Republic of Uzbekistan, 1998, №5-6, article 91. (Ozbekiston Respublikasi Oliy Majlisining Axborotnomasi, 1998 y. 5-6-son, 91-modda.)

3. Bulletin of Oliy Majlis of the Republic of Uzbekistan, 1998, №5-6, article 93. (Ozbekiston Respublikasi Oliy Majlisining Axborotnomasi, 1998 y. 5-6-son, 93-modda).

4. Bulletin of Oliy Majlis of the Republic of Uzbekistan, 1999, №1, article 10. (Ozbekiston Respublikasi Oliy Majlisining Axborotnomasi, 1999 y. 1-son, 10-modda).

5. Bulletin of Oliy Majlis of the Republic of Uzbekistan, 2005, №15-16, article 109. (Ozbekiston Respublikasi Oliy Majlisining Axborotnomasi, 2005 y. 15-16-son, 109-modda.).

6. Bulletin of Oliy Majlis of the Republic of Uzbekistan, 2012, №15, article 167. (Ozbekiston Respublikasi Oliy Majlisining Axborotnomasi, 2012 y. 15-son, 167-modda).

7. Bulletin of Oliy Majlis of the Republic of Uzbekistan, 2012, №16, article 177. Decree of the President of the Republic of Uzbekistan On establishment of a special industrial zone Angren.

8. Bulletin of Oliy Majlis of the Republic of Uzbekistan, 2013, №12, article 151. Decree of the President of the Republic of Uzbekistan On establishment of a special industrial zone Jizzak.

9. Dees, S. 1998. Foreign direct investment in China: Determinants and effects. Economics of Planning, 31: 17594.

10. De Gregorio, Jose. 2003. The role of foreign direct investment and natural resources in economic development. Working Paper No 196. Central Bank of Chile, Santiago.

11. De Mello, L. R. 1997. Foreign Direct Investment in developing countries and growth: A selective survey. Journal of Development Studies, 34(1):1-34.

12. Findlay, R. 1978. Relative backwardness, direct foreign investment and the transfer of technology:A simple dynamic model. Quarterly Journal of Economics, 92: 116.

13. Foreign direct investment statistics: how countries measure FDI 2001 Washington, D.C. International Monetary Fund. OECD, 2003, P.23

14. Glass, A.J. and K. Saggi. 1998. FDI policies under shared markets. Journal of International Economics, 49: 30932.

15. State committee on statistics of the Republic of Uzbekistan.