ETFs Pros Cons and Misconceptions

Post on: 1 Апрель, 2015 No Comment

ETFs: Pros, Cons and Misconceptions

Jon Palfrey, CFA

Senior Vice President, Portfolio Manager

K arey Irwin, CFP

Vice President, Investment Funds

One significant change recently on the investing landscape has been the introduction and proliferation of Exchange Traded Funds (ETFs) also known as passive investing or index investing. An ETF (in its purest form) is a vehicle used to mirror a basket of securities in an index. In recent years, the nature and complexity of these products has changed, and the number of products available has skyrocketed – the number of ETFs available in the U.S. has increased by 350% in only four years! 1 This amount of new product growth is even more surprising when we consider that there are only a handful of EFT providers.

Some investors consider ETFs to be a good option as they perceive them as a less risky way to invest during periods of low returns, or high market volatility. Leith Wheeler is an active manager with the belief that we can add value to a client’s portfolio over time through security selection; however, we also recognize that ETFs can have a place in clients’ portfolios. Let’s explore some of the facts and myths of ETF investing.

Fact or Myth: ETFs are less volatile than the markets. Myth. ETFs by definition mirror the market, so they will not protect clients’ capital in declining markets. On a post fee basis (yes, ETFs do charge fees, albeit much lower fees than actively managed mutual funds) you will never be able to earn a higher return than an Index with a traditional ETF, but you won’t perform significantly worse than one either. There is no potential for downside protection during a negative market period with a plain vanilla ETF. Actively managed mutual funds do have the ability to perform better in both rising and falling markets, but also have the potential to do worse – that is where the quality of the investment manager comes in.

Fact or Myth: ETFs are less risky than actively managed mutual funds . Myth. Because ETFs are created to replicate a market or portion of the market, if you hold an ETF, you will have exposure to all securities in that market (both high and low quality). In contrast, active managers have the ability to invest in less volatile stocks and/or choose not to invest in lower quality (more risky) securities

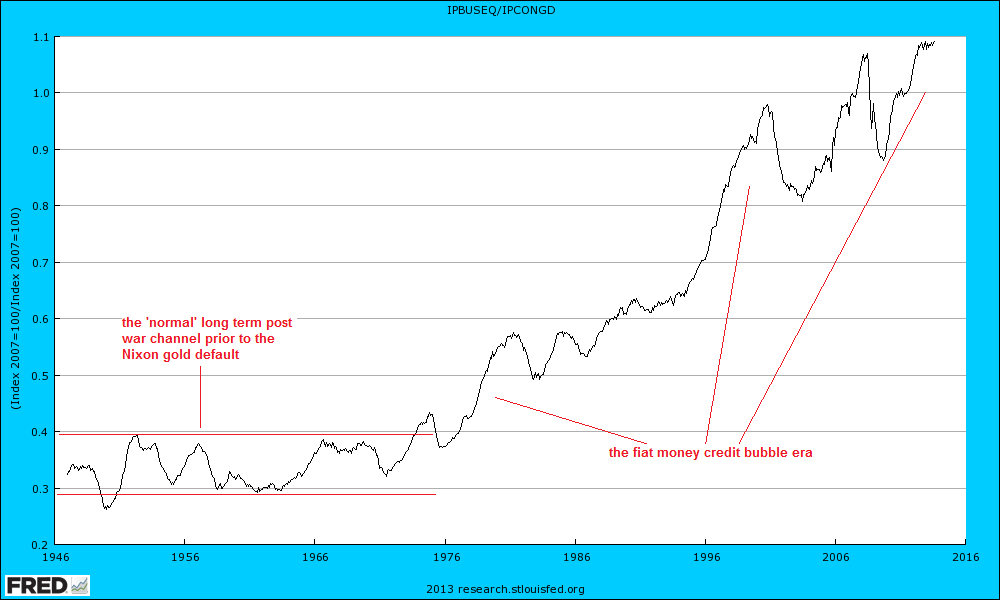

There is a significant difference between how ETFs and active mutual funds are structured. An ETF is typically ‘capitalization weighted’ which means the larger a company (its market cap), the larger their weight in the ETF. Actively managed portfolios tend to weight their holdings based on the investment merit of the security. Active portfolios often own fewer securities than an ETF and typically are more ‘equal weighted’ rather than cap weighted.

Fact or Myth: ETFs are less expensive to own. Fact . The true cost of owning an investment in Canada is somewhat misunderstood and quite poorly disclosed. Traditional ETFs are constructed to mirror an index, so fees are kept low since there are no research costs (as no research is provided) or Advisor or service costs (as there is no investment service provided). However, some of the more creative versions of ETFs are now charging much higher fees than plain vanilla ETFs. In addition to management fees, the following table compares and contrasts other costs of investing in an ETF versus an actively managed mutual fund. The bottom line for investors is you need to know how much you are paying in fees whether they are built in or on top of management fees.