ETF v Fund

Post on: 20 Октябрь, 2015 No Comment

When approaching investing your savings the options available to you can be pretty overwhelming, especially with some investment products appearing to be the same. Exchange Traded Funds (ETF) and Mutual Funds are very similar investment products, but with some key differences that can have an impact on your taxes and your ability to buy and sell funds. This article will help you understand the similarities and differences between the two when you are looking at the ETF vs. Mutual Fund investment decision.

Pricing

Mutual fund prices do not vary during the trading day, rather they are priced at the end of the day once the closing price of all the underlying assets has been established. When a purchase or sale of mutual funds take place it is priced at the closing value of the mutual fund units once the day the order is made is closed. When ordering mutual funds you order by value (say an order of $10,000) and receive the number of units that amounts to (down to several decimal points) when the day closes and the final unit price is settled.

ETF’s on the other hand are traded similarly to stocks, with the price changing during the day as investor actively buy and sell units in the ETF. Each ETF will have a bid and an ask price, with the bid being the price you can sell your ETF units at, and the ask being the price you can purchase units at. There is typically a small (several cents) spread between the prices and the price may vary slightly between when you place an order and when the transaction is settled. When ordering ETF’s you order how many units you want to buy (or sell), and when the order clears the final cash amount will be processed.

Tax

ETF’s are far more tax effective than mutual funds in that the purchase and sale of underlying assets by the fund will not generate immediate tax consequences for unit holders. The actual tax impact will be generated when you sell your ETF units, and generate a capital gain or loss. Mutual funds on the other hand will generate tax consequences, and a cash cost to you, even if you haven’t sold the units. The underlying sale and purchase of assets (and the subsequent capital gains and losses of the fund) are passed on during the tax year.

Management Fees

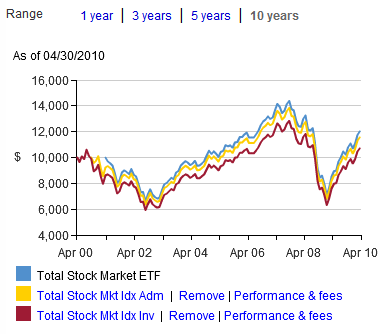

Another difference between ETF’s and mutual funds is that ETF’s typically have far lower management expense ratios that mutual funds. ETF’s typically experience management expenses in the 0.1% to 1.25%, whereas mutual funds can range from 0.01% to 10%. This is always important to consider as regardless of the performance of your portfolio this expense will be incurred, and can turn a flat or low portfolio return into a negative one. There is some overlap, however, so it’s always important to review the details of any fund you’re considering investing in.

So What Should I Choose?

ETF’s are relatively new to the market place and their lower expense charges and favorable tax implications have led to widespread success for these investment tools. That said, there is some caution that being a newer product and with many new entrants there is a risk that some fund companies could struggle to complete, and the liquidation of assets that results would generate significant negative tax implications for those holding units when the fund closes. As such it’s recommended that when considering the ETF vs. Mutual fund investment option should you choose to go with an ETF ensure that it is managed by a firmly established company.