Energy Transfer Partners Return To Distribution Growth Was Predictable Energy Transfer Partners

Post on: 20 Февраль, 2016 No Comment

Summary

- Valuentum predicted Energy Transfer Partners’ return to distribution expansion.

- We like units and hold them in the Dividend Growth portfolio.

- Let’s calculate an intrinsic value for the company and run shares through the Valuentum process.

Do you remember when Valuentum said that Energy Transfer Partners’ (NYSE:ETP ) distribution would return to growth in August 2012? No? Check out the piece here. The MLP announced in September 2013 that its distribution growth would resume (click here ). But what should investors expect from Energy Transfer Partners now? Let’s take a look at shares and run them through the Valuentum process.

For those that may not be familiar with our boutique research firm, we think a comprehensive analysis of a firm’s discounted cash flow valuation, relative valuation versus industry peers, as well as an assessment of technical and momentum indicators is the best way to identify the most attractive stocks at the best time to buy. We think stocks that are cheap (undervalued) and just starting to go up (momentum) are some of the best ones to evaluate for addition to the portfolios. These stocks have both strong valuation and pricing support. This process culminates in what we call our Valuentum Buying Index, which ranks stocks on a scale from 1 to 10, with 10 being the best.

Most stocks that are cheap and just starting to go up are also adored by value, growth, GARP, and momentum investors, all the same and across the board. Though we are purely fundamentally-based investors, we find that the stocks we like (underpriced stocks with strong momentum) are the ones that are soon to be liked by a large variety of money managers. We think this characteristic is partly responsible for the outperformance of our ideas — as they are soon to experience heavy buying interest. Regardless of a money manager’s focus, the Valuentum process covers the bases.

We liken stock selection to a modern-day beauty contest. In order to pick the winner of a beauty contest, one must know the preferences of the judges of a beauty contest. The contestant that is liked by the most judges will win, and in a similar respect, the stock that is liked by the most money managers will win. We may have our own views on which companies we like or which contestant we like, but it doesn’t matter much if the money managers or judges disagree. That’s why we focus on the DCF — that’s why we focus on relative value — and that’s why we use technical and momentum indicators. We think a comprehensive and systematic analysis applied across a coverage universe is the key to outperformance. We are tuned into what drives stocks higher and lower. Some investors know no other way to invest than the Valuentum process. They call this way of thinking common sense.

At the methodology’s core, if a company is undervalued both on a discounted cash flow basis and on a relative valuation basis, and is showing improvement in technical and momentum indicators, it scores high on our scale. Energy Transfer Partners posts a Valuentum Buying Index score of 7, reflecting our fairly valued DCF assessment of the firm, its attractive relative valuation versus peers, and bullish technicals. Energy Transfer Partners is a holding in the portfolio of the Dividend Growth Newsletter.

Energy Transfer Partner’s Investment Considerations

Investment Highlights

• Energy Transfer Partners is one of the largest and most diversified investment-grade master limited partnerships. The MLP boasts an attractive natural gas, crude oil, NGL and refined products logistics platform. A significant portion of the entity’s operating income is derived from fee-based sources with long-term contracts from creditworthy customers. We like its toll-road-like business model, which offsets many of the MLP’s more risky characteristics, not the least of which is significant dependence on the health of the capital markets.

• For MLPs, our valuation considers only maintenance capex (as opposed to total capex) in the derivation of enterprise free cash flow, consistent with the definition of ‘distributable cash flow’. This peculiarity results in MLPs’ fair value estimates receiving a boost for future operating cash flow growth without organically subtracting the growth capital associated with driving such expansion. This is a valuation imbalance that exists as a result of the inherent structure of an MLP (for MLPs, growth is typically funded via new capital as opposed to organically). Investors should be aware that, under a scenario in which all capex is deducted, our fair value estimate would be considerably lower.

• Energy Transfer Partners boasts a large annualized distribution yield. Since the second quarter of 2005, its annualized distribution has advanced from $1.85/unit to $3.74/unit. The MLP’s distribution has also recently returned to growth.

• On the basis of the MLP’s Valuentum Dividend Cushion score, we expect continued distribution expansion. If you’re not familiar with the Dividend Cushion, please evaluate its track record here. Though we emphasize that Energy Transfer Partners’ distribution expansion is based on continued access to the capital markets, the MLP’s Dividend Cushion ratio is 2.4.

Business Quality

Economic Profit Analysis

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Energy Transfer Partners’ 3-year historical return on invested capital (without goodwill) is 6.9%, which is below the estimate of its cost of capital of 10%. As such, we assign the firm a ValueCreation™ rating of POOR. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate.

Cash Flow Analysis

Firms that generate a free cash flow margin (free cash flow divided by total revenue) above 5% are usually considered cash cows. Energy Transfer Partners’ free cash flow margin has averaged about 9.4% during the past 3 years. As such, we think the firm’s cash flow generation is relatively STRONG. The free cash flow measure shown above is derived by taking cash flow from operations less capital expenditures and differs from enterprise free cash flow (FCFF), which we use in deriving our fair value estimate for the company. For more information on the differences between these two measures, please visit our website at Valuentum.com. At Energy Transfer Partners, cash flow from operations increased about 74% from levels registered two years ago, while capital expenditures expanded about 82% over the same time period.

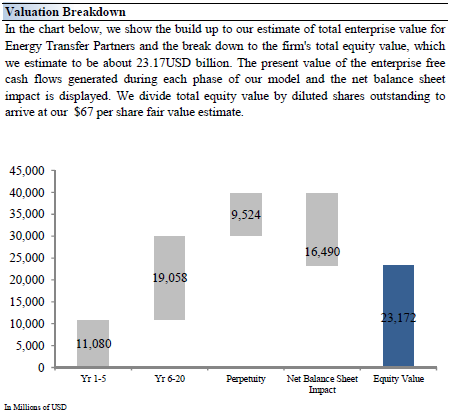

Valuation Analysis

Our discounted cash flow model indicates that Energy Transfer Partners’ shares are worth between $54-$80 each. Shares are trading at the low end of this fair value range. The margin of safety around our fair value estimate is driven by the firm’s LOW ValueRisk™ rating, which is derived from the historical volatility of key valuation drivers. Though even a LOW ValueRisk rating has a seemlingly wide range of fair value outcomes, the very real situation of Boardwalk (NYSE:BWP ), which slashed its distribution considerably despite an investment-grade sponsor, cannot be ignored.

The estimated fair value of $67 per share represents a price-to-earnings (P/E) ratio of about 54.4 times last year’s earnings and an implied EV/EBITDA multiple of about 12.5 times last year’s EBITDA. Our model reflects a compound annual revenue growth rate of 5.5% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 98.9%. Our model reflects a 5-year projected average operating margin of 5%, which is below Energy Transfer Partners’ trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 0.8% for the next 15 years and 3% in perpetuity. For Energy Transfer Partners, we use a 10% weighted average cost of capital to discount future free cash flows.

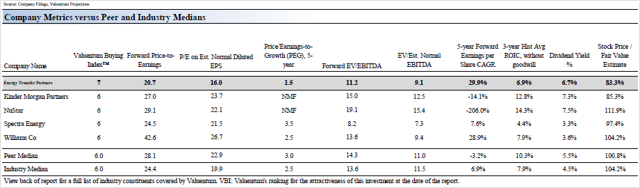

We understand the critical importance of assessing firms on a relative value basis, versus both their industry and peers. Many institutional money managers — those that drive stock prices — pay attention to a company’s price-to-earnings ratio and price-earnings-to-growth ratio in making buy/sell decisions. With this in mind, we have included a forward-looking relative value assessment in our process to further augment our rigorous discounted cash flow process. If a company is undervalued on both a price-to-earnings ratio and a price-earnings-to-growth ratio versus industry peers, we would consider the firm to be attractive from a relative value standpoint. For relative valuation purposes, we compare Energy Transfer Partners to peers Kinder Morgan Partners (NYSE:KMP ) and NuStar (NYSE:NS ).

Margin of Safety Analysis

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate the firm’s fair value at about $67 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future was known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values. Our ValueRisk™ rating sets the margin of safety or the fair value range we assign to each stock. In the graph below, we show this probable range of fair values for Energy Transfer Partners. We think the firm is attractive below $54 per share (the green line), but quite expensive above $80 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Future Path of Fair Value

We estimate Energy Transfer Partners’ fair value at this point in time to be about $67 per share. As time passes, however, companies generate cash flow and pay out cash to shareholders in the form of dividends. The chart below compares the firm’s current share price with the path of Energy Transfer Partners’ expected equity value per share over the next three years, assuming our long-term projections prove accurate. The range between the resulting downside fair value and upside fair value in Year 3 represents our best estimate of the value of the firm’s shares three years hence. This range of potential outcomes is also subject to change over time, should our views on the firm’s future cash flow potential change. The expected fair value of $76 per share in Year 3 represents our existing fair value per share of $67 increased at an annual rate of the firm’s cost of equity less its dividend yield. The upside and downside ranges are derived in the same way, but from the upper and lower bounds of our fair value estimate range.

Pro Forma Financial Statements

In the spirit of transparency, we show how the performance of the Valuentum Buying Index has stacked up per underlying score as it relates to firms in the Best Ideas portfolio. Past results are not a guarantee of future performance.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: ETP and KMP and included in the Dividend Growth portfolio.