Debating CAPE a 10Year Prism for Valuing Stocks

Post on: 1 Май, 2015 No Comment

AFTER the tech crash a decade ago, investors started giving closer attention to the prices they pay for stocks.

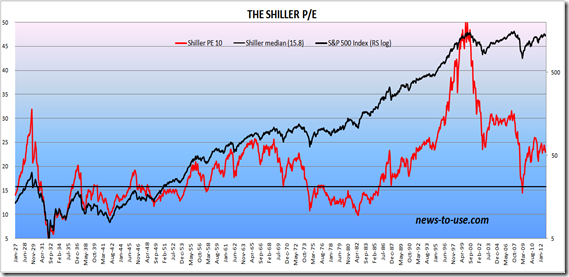

Some have turned to a tool known as the cyclically adjusted price-to-earnings ratio, or CAPE, to determine whether stocks are cheap or expensive. Yet while this version of the P/E ratio, popularized by the Yale economist Robert J. Shiller. correctly signaled frothy markets in 1929, 1999 and 2008, some strategists argue that it may not be as accurate in gauging valuations today as it was in the past.

“There are distortions in this period of time that make it a less useful tool,” says Jeremy Siegel, a finance professor at the Wharton School of the University of Pennsylvania and author of “Stocks for the Long Run.”

Traditional P/E ratios compare stock prices with one year’s worth of historical or projected earnings. CAPE, on the other hand, looks at 10 years of averaged, or “normalized,” profits. Because this method tends to smooth out earnings anomalies that arise at the peak of a profit cycle or the depths of a recession, CAPE is considered a more conservative gauge.

Photo

Jeremy Siegel sees problems with basing stock values today on 10 years of earnings, given the recent decades events. Credit Matt Rourke/Associated Press

Sometimes, the differences between traditional and normalized P/E’s can lead investors to drastically different conclusions.

Based on the past 12 months of earnings, for example, the Standard & Poor’s 500-stock index has a trailing P/E of around 15, which would make the market attractively priced based on historical levels, according to market strategists.

By contrast, the market’s CAPE reading is nearly 22. Although that’s not as elevated as in 1929 or ’99, it is significantly higher than the market’s long-run average of around 16.

“The basic idea of smoothing out earnings over time is excellent,” Mr. Siegel says. But he points out that the current CAPE for domestic stocks includes a 90 percent annual earnings decline in the first quarter of 2009. “You’re averaging in an unbelievable hole in profits,” he says.

JAMES STACK, president of InvesTech Research. adds that the current 10-year look back is unusual because it includes not just one but two of the worst profit recessions in history. In addition to the earnings decline stemming from the global financial crisis in 2008 and 2009, the bursting of the tech bubble weighed down corporate profits from 2000 through early 2003.

“Normalized earnings are fine to use if the periods you’re looking at are going to be more normal,” Mr. Stack says. “But anyone looking at 10-year P/E’s today has to realize that the past decade has been anything but normal.”

Based on CAPE, domestic stocks today “look ultraexpensive,” Mr. Stack says. Yet he notes that the true valuation picture may have been distorted, as corporations used the past decade’s recessions “as an opportunity to cleanse their balance sheets by writing off all nonperforming parts of their businesses.”

Mr. Shiller, who is widely credited with having warned investors about the tech crash and the more recent housing bubble, concedes that “corporate earnings have been unusually volatile in the past decade.”

But he argues that this is more reason — not less — to use normalized earnings in calculating the market’s P/E. “What alternatives do people have?” he asked in an interview. For instance, he says, if volatile swings in profits affect 10-year averages, surely they would distort P/E’s based on 12 months of profits even more. (Mr. Shiller is a regular contributor to the Economic View column in Sunday Business.)

Robert D. Arnott, chairman of Research Affiliates. agrees. He notes that based on the last 12 months of profits, the Russell 1000 index — which, like the S.& P. 500, tracks blue-chip domestic stocks — was trading at a modest P/E ratio of around 16. “But those were peak earnings,” he said. adding that his firm prefers to use CAPE to remove the effects of earnings peaks and troughs.

What about the fact that the past 10 years include two major earnings anomalies that skew the market’s CAPE?

“I’m grateful that there are people who believe that, who can be on the other side of my trades,” Mr. Arnott says.

He points out that the past decade has also been witness to much monetary easing by the Federal Reserve, artificially bolstering corporate profits. Moreover, he says, “corporate earnings are the largest share of gross domestic product since 1929, while wages are the smallest share of G.D.P. since 1937.” Those trends are unlikely to continue forever, he says, adding that profit margins will eventually come down as the economy improves and companies start hiring more aggressively.

This isn’t to say that CAPE is telling investors that it’s necessarily time to sell domestic stocks. To be sure, the CAPE of the S.& P. 500 is high by historical standards. But if one’s choice is between investing in domestic stocks or in 10-year Treasury notes. the equities probably still seem the better bet, Mr. Arnott says.

Mr. Shiller adds that based on more than 140 years of history, the market’s CAPE would indicate that investors should expect annualized gains of just under 4 percent a year, accounting for the effects of inflation. That’s worse than the long-run average of real annual returns of more than 6 percent for blue-chip stocks.

“But it’s not extremely low, either,” he says.

FOR his part, Mr. Siegel has a more bullish outlook. He argues that the market is attractively priced, considering how low interest rates are. And he says he thinks that investors will soon be willing to pay more for each dollar of corporate earnings than they are right now. Given that, he adds, domestic stocks could return 10 to 12 percent a year over the next several years — especially if the economy begins to pick up speed.

Mr. Siegel and Mr. Shiller are old friends who have periodically disagreed about market valuations. “Again, let me just say how much I respect my good friend Robert Shiller,” Mr. Siegel said. “His basic idea is excellent, but you have to consider today’s circumstances.”

Paul J. Lim is a senior editor at Money magazine. E-mail: fund@nytimes.com.

A version of this article appears in print on October 14, 2012, on page BU6 of the New York edition with the headline: Dueling Prisms For Valuing Stocks. Order Reprints | Today’s Paper | Subscribe