Call Ratio Backspreads Profit off of Rising Prices

Post on: 2 Сентябрь, 2015 No Comment

What is a Call Ratio Backspread?

A call ratio backspread is a good strategy if you have a strong conviction that the security you are buying options on will have a strong upside move. Basically, the call ratio backspread is inverse to the call ratio spread in that you ar

What is a Call Ratio Backspread?

A call ratio backspread is a good strategy if you have a strong conviction that the security you are buying options on will have a strong upside move. Basically, the call ratio backspread is inverse to the call ratio spread in that you are shorting ITM call/s and buying OTM calls. This options strategy calls for a greater number of OTM calls than ITM calls, all of the same expiration month and underlying security. This strategy is a low risk, unlimited reward strategy that has the expectation of strong upside movement before options expiration. The goal when initiating this position is to create it with a small debit, or even a credit if possible.

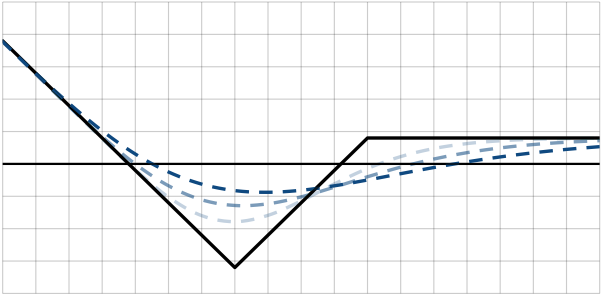

Call Backspread Risk Characteristics

As you can see, once the call ratio spread breaks above the breakeven point (b2*), the profits become unlimited. Conversely, a move below the short call strike will limit your losses to the net debit paid to put the transaction on. If a net credit was received to put the transaction on, a move in the underlying below (b1*) will lock in a gain.

Breakevens & Profit Potential

It is sometimes hard to wrap your head around the breakeven and profit potential calculations. Let’s think of it as two separate components: intrinsic value of options at expiration & transaction costs.

Transaction Cost = (# of Short Call Contracts * Price Received) — (# of Long Call Contracts * Price Paid)

As discussed, there are two breakeven points with the backspread. Let’s review the calculations for both of them:

b1* (if transaction cost is < 0, or a Net Credit) = Short Call Strike Price + Transaction Cost

b1* (if transaction cost is > 0, or a Net Debit) = A debit Transaction has no lower breakeven price. It will be locked into a loss until the underlying moves above b2*

b2* = Long Call Strike + (# of Short Call Contracts * (Long Call Strike — Short Call Strike) / (# of Long Call Contracts — # of Short Call Contracts)) — Transaction Cost

What are we really doing with this breakeven calculation? Well, we know that we want to understand at what point the combination of long and short calls will become profitable. We know that if the underlying is at the long call strike, the long calls will be worthless and the short calls will each have an intrinsic value which equals the difference between the two strike prices of our options. Therefore, we also can conclude that we need the additional long calls to appreciate enough to offset the losses from the short calls. This is the premise of the strategy, the higher the underlying moves, the greater the profit from the net long calls.

Use the following spreadsheet to make your life easier when you are trying to calculate your breakeven points. Remember, only change the values in the highlighted cells.

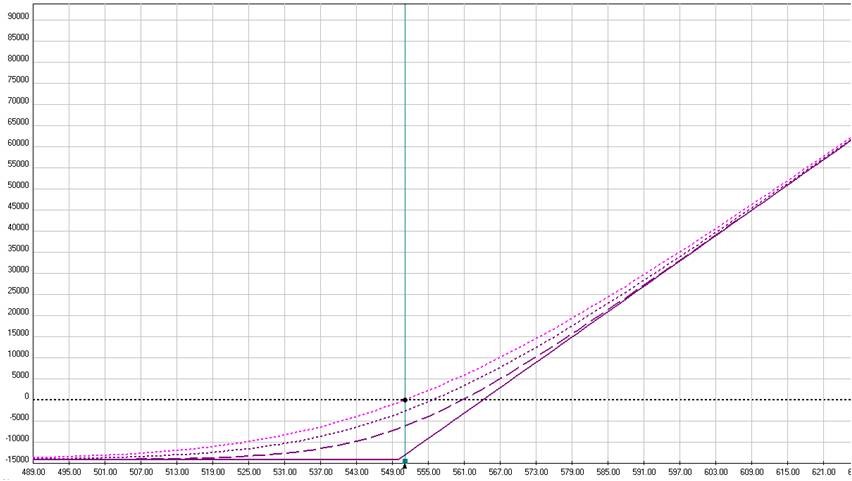

Call Ratio Backspread Example

We will use the UYG proshares to show you a nice example of a call ratio backspread. We are going to keep it simple and initiate a 2 by 1 spread using the 22 calls and the 19 calls. Long 2 contracts of the 22 and short 1 contract of the 19.

The expectation here is that the UYG will climb substantially between now (August 17th 2008) and expiration in September 2008. As you can see in our spreadsheet above, the trade was put on as a small net debit which will limit the losses to $.30 if the stock goes the opposite way and moves below the lower strike at expiration.

Again, based on our spreadsheet the breakeven on this strategy is $25.30. The stock must hit this number or higher at expiration to avoid taking a loss. The strategy will profit dollar for dollar above the breakeven on the net number of long contracts, which in this case is 1 ( 2 — 1).

Conclusion

In conclusion, the call ratio backspread is a great strategy for those of you who believe the stock will run strongly by expiration. You want to be careful in selecting stocks that have high beta’s so that your price projections may be achielved. While it is not necessary to do this, it puts the odds more strongly in your favor. Always try to keep the net debit small, if you cannot achieve a net credit.