Call Options and How to Benefit From Them

Post on: 7 Сентябрь, 2015 No Comment

A call option gives the holder the right to buy 100 shares of underlying stock at exercise or strike price until the date of expiration. Using the previously mentioned Exxon example we can observe how buying an call option can be so benefiting for the investor.

In exchange of paying the $300 Premium ($3 Premium price per share x 100) Investor A has the right to buy Exxon shares at $35 per share at any time until expiration date of the option. What would be bad is not to be able to carry out the option, loosing the investor the amount of $300 for the value of the option contract plus a commission.

When the investor buys a call option it adds a fraction of the cost of the stock in order to participate in the appreciation of stock in case that it moves above the $35 strike price per share. Instead of putting the $3800 to buy 100 shares from Exxon stock when the market price is $38 per share the investor invests $300 in case the option raises above $38, the investor will be able to carry out the option and buy the stock at $35 strike price per share.

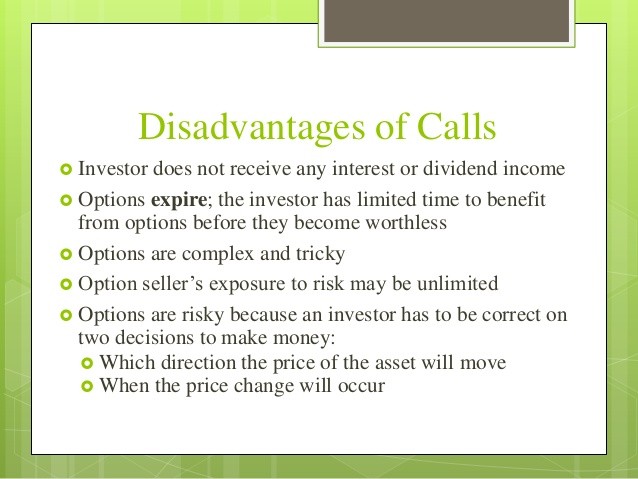

The basic problem would be that stock would have to move above strike price before the option expires because the option is not worth anything after expiration date. It is an asset liability. There is a time value for the options price. While longer the time before the options expiration date greater is the option’s value of time. Equally, when closer the option to maturity date lower will the option’s value of time.

The bond to the value of time are the underlying stock price and the call option’s strike price. This relation affects the intrinsic value of the option. The intrinsic value is the difference that exists between the market price of the stock and the strike price. When the market price is higher than the strike price, it is said that the call option is in the money. In Exxon?s example, if the market price of the stocks raise up to $37 per share, the intrinsic value of the call option is of $2 per share and the option holder can buy the Exxon stock at a lower price than the one fixed by the market at that time.

The value of a call option is higher when it is in the money. One says a call option is out of the money when the market price of the stock is lower than the strike price. At the money is when the market price is equal to the strike price:

Intrinsic value of call option = (market price of the stock – stock price)

- = ($37 — $35) = $2 per share

Time till expiration of the option has a direct effect in the valuing of the option. While longer the time left to expiration date, higher the opportunities that the option is in the money. Therefore, an option with a longer term till expiration is negotiated at a higher Premium than the options, getting near expiration.

Option’s Premium price fluctuates depending of two factors:

- The underlying price of the stock The time that is left for the option to expire.

If Exxon stocks raise to $40 per share, the intrinsic value of the option raises a dollar per share. This increase in the price of the stock makes the option be negotiated at much more than $3 Premium price with which the option was originally sold.

An course of action for call buyers is selling the option for a benefit instead of carrying it out. Benefits that can be obtained explain why so many investors prefer this course of action.

When buying or selling an option one not only greater returns to his investment but also requires less capital risk. When buying a call option instead of stocks the investor is only investing a small fraction of the cost of the stock.

If the price of the stock raises significantly above the strike price within the period before expiration date, the investor then could sell the stock and keep it for a long-term capital appreciation. The most that an investor can lose when buying a call option is the cost of the option. That is why negative risks are limited, as opposite to the potential loss in case of buying stocks.

There are many examples of high-flying stock that have raised their prices at abnormally high prices to later fall again in forgetfulness, resulting in huge losses for those investors that invested when stocks were being negotiated at excessively high prices.