Butterfly Course Part 1 The Basics

Post on: 31 Август, 2015 No Comment

Welcome to Part 1 of the Options Trading IQ Butterfly Course. Today well be introducing the butterfly and discussing some of the basics.

Butterflies are a well know option strategy, but they are commonly misunderstood and often traded poorly by novices. After doing some research I realized there isnt a great deal of information around regarding butterflies. It’s not one of those really popular strategies like iron condors or covered calls where there is almost an overabundance of information. The information available is spotty and very disjointed. With this course I want to create the ultimate, one-stop shop guide to the butterfly strategy. So, are you ready to come along for the ride?

A butterfly is a neutral (generally), income oriented strategy. It is a limited risk and limited profit trade, but on a typical butterfly trade, the profit potential is higher than the potential loss. Butterfly spreads involve 3 different option strike prices, all within the same expiration date, and can be created using either calls or puts. A typical butterfly would be constructed as follows:

Buy 1 in-the-money call

Sell 2 at-the-money calls

Buy 1 out-of-the-money call

The in-the-money and out-of-the-money calls are placed at an equal distance from the short strike. A butterfly trade is entered for a net debit which means money will be deducted from your account once the trade is placed. This is the maximum amount that you can lose from the trade. The maximum profit is calculated as the difference between the short and long calls less the premium that you paid for the spread. For example if you had the following butterfly spread:

Long 1 June $95 call @ $5.00

Short 2 June $100 calls @ $2.50

Long 1 June $105 call @ $1.00

The total net debit to enter this trade is $1 which means the maximum profit is $4. This is calculated as the difference in the strike prices from the short to long strikes ($5) less the premium paid ($1). The potential return on investment is 400% and this would occur if the stock closed exactly at $100 at expiration. You should be aware the achieving the full 400% return is extremely unlikely, but more on that later.

The breakeven points for a butterfly are calculated as follows:

Downside breakeven = lower call PLUS premium paid ($95 + $1) = $96

Upside breakeven = higher call LESS premium paid ($105 $1) = $104

In this example, the maximum loss will be incurred if the stock closes at $96 or below and at $104 or above. You can see this on the diagram below.

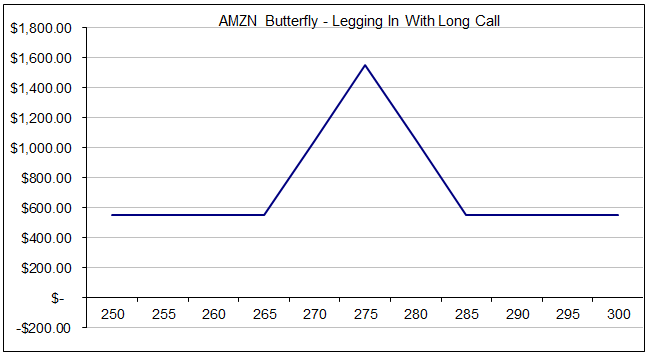

The Butterfly Payoff Diagram

As you can see above the butterfly payoff diagram or expiration graph has a tent like shape with the potential for very large profits around the short strike. Its important to keep in mind that its very unlikely that you would ever achieve the maximum profit. In fact, some traders say, that you should basically ignore the top one-third of the butterfly expiration graph as it unlikely and unrealistic that your trade will finish in that area. The other problem with the top third of the butterfly graph is that profits will fluctuate wildly even with only small movements in the underlying due to the high level or short gamma. The closer you get to expiry, the higher the gamma will become, and the more your profits will fluctuate.

A good aim for a butterfly trade is to make a 15-20% return on capital at risk.

Should You Use Calls or Puts?

Butterflies can be traded with either calls or puts, it doesnt really matter. You can also trade an iron butterfly which uses BOTH calls and puts. An iron butterfly is basically a combination of a bear call spread and a bull puts spread. Generally speaking, traders will use calls for neutral and bullish butterflies and puts for bearish butterflies but there is no real hard and fast rule. Iron condor traders may prefer to trade iron butterflies. Advanced traders might look at the relative skews of calls to puts. If puts are much more expensive due to significantly higher levels of implied volatility, they may prefer to use puts, but generally speaking the payoff is going to be very similar whether you use calls, puts or both.

Some Things to Keep In Mind When Trading Butterflies

Butterflies are a commission intensive strategy as you are trading 4 contracts each time you enter a trade, and 4 contracts when you exit a trade. As most brokers charge transactions fees on a per contract basis, this can soon add up and should be taken into account when evaluating whether butterfly spreads are right for you.

The greeks will be discussed in detail shortly, but basically butterflies are short volatility, short gamma and long theta. Gamma is a very important aspect to be aware of when trading butterflies, particularly as you get closer to expiry.

When trading multi-legged options strategies as one order, the bid-ask spreads can be significant and therefore make it difficult to initiate a trade for a decent price. If you choose to enter the 3 legs individually you run the risk of the market moving against you before having the entire position opened.

You can move the center strike of a butterfly slightly in-the-money or out-of-the-money to reduce the cost, however this gives the trade a directional bias. Sometimes this can be a good thing and we will discuss directional butterflies in detail shortly.

Why Trade Butterflies?

Unlike other options strategies such as iron condors and credit spreads, butterflies are very dynamic and can be traded for a variety of different reasons with different goals in mind. Some reasons to trade butterflies include:

* Income Butterflies are a great way to generate income from stocks you think are going nowhere in the short term. This can contribute to overall portfolio returns in flat markets.

* Non-Directional In their simplest form, butterflies are delta neutral or non-directional trades. Trying to pick the direction of stocks or the overall market can be stressful and expensive. Delta neutral butterflies can be set up with strict rules to take the guesswork out of trading.

* Hedging Market makers and advanced traders often use directional butterflies as a short term hedge on positions that are moving against them. Centering the profit tent of a butterfly around a strike that is under pressure in another trade (such as a credit spread) can be a great way to control risk and allow you to keep the original position open for a few more days. Sometimes that is all you need for a trade to move back in your favor. At that point you can then remove the butterfly hedge and stick with your original trade. Long term out-of-the-money put butterflies can also be a much cheaper method of portfolio protection than pure long puts.

* Low Maintenance Butterflies are sometimes called vacation trades due to their low risk and need for only very infrequent monitoring. Butterfly trades are generally very slow moving early on in the trade. They can get a little exciting and volatile as they approach expiry and are within the profit tent though.

Thats it for today, some fairly basic stuff covered but in the next session we will get in to some of the meaty details when we look at how to enter trades in your brokerage account, how to set profit targets and stop losses and how to choose strike widths.